[ad_1]

Residing requirements fell once more in the beginning of the 12 months, marking 4 consecutive quarters of declining disposable incomes for the primary time since data started.

Hovering costs decreased the spending energy of British households by 0.2 per cent on common between January and March, official figures present.

The Workplace for Nationwide Statistics reported that inflation was 1.7 per cent through the quarter, outpacing revenue development by 1.5 per cent.

New information confirmed earlier estimates exhibiting that financial development slowed markedly within the first three months of the 12 months.

Gross home product (GDP) – a measure of the dimensions of the financial system – elevated 0.8 per cent, down from 1.3 per cent within the earlier quarter. GDP was 0.7 per cent larger than within the closing quarter of 2019, earlier than the pandemic started.

Concerningly for chancellor Rishi Sunak, enterprise funding fell 0.6 per cent and stays languishing 9.2 per cent under its pre-pandemic peak. Lack of funding suggests low ocnfidence within the financial system’s future and will hamper any restoration.

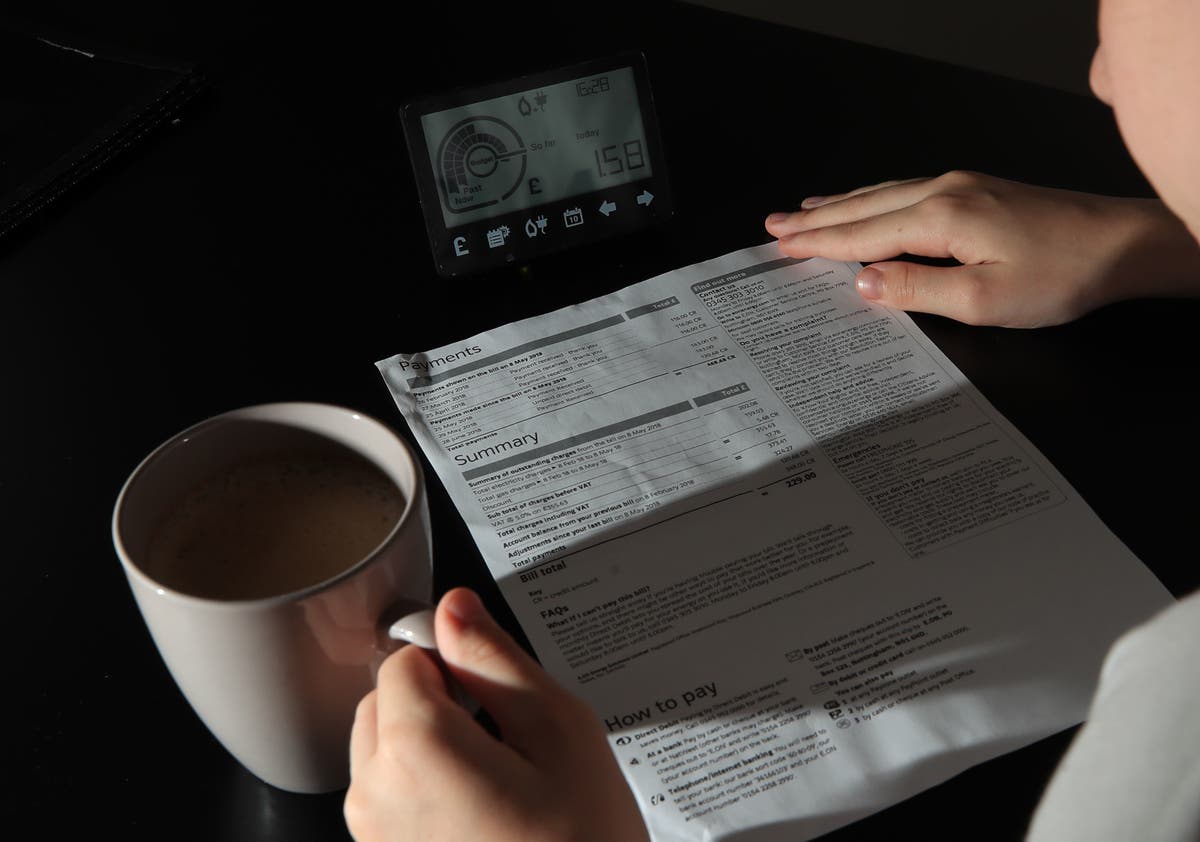

The figures don’t have in mind the final three months throughout which rising costs for necessities have developed right into a disaster, pushing vitality payments to round £2,000 for the typical family.

Inflation is at its highest in 4 many years and the Financial institution of England Governor warned on Thursday of worse to return.

Andrew Bailey stated worth rises will hit Britain more durable than another main financial system and that output is prone to weaken earlier and be extra intense.

Martin Beck, on the EY Merchandise Membership, stated: “The squeeze on family spending energy has additional to run, with the second quarter having seen each the vitality worth cap enhance by greater than 50 per cent and an increase in private taxation, whereas an extra massive rise within the vitality worth cap wanting probably in October.

“So, with financial savings charges already under ‘regular’ ranges, hopes of avoiding a client recession relaxation on households who collected ‘extra’ financial savings through the pandemic spending a very good quantity of these funds.”

ONS information additionally out on Thursday confirmed Britain’s present account deficit – the distinction between the worth of the products and companies the UK imports and the products and companies it exports – widened to a file £51.7bn, or 8.3 per cent of gross home product.

This was the most important shortfall since data started in 1955, in accordance with the ONS.

But it surely issued a warning over the figures, saying there was an impression of adjustments in post-Brexit information assortment on commerce in items imports and international direct funding, which it’s investigating.

[ad_2]

Source link