[ad_1]

March 2024 was only a continuation of the bull pattern that began all the best way again in November 2023. This has acquired to be one of many longer bull stretches that I can recall. It’s definitely the longest bull run that I can keep in mind with none significant pullbacks. Any slight dip was met with patrons and it simply appeared like there was no stopping it.

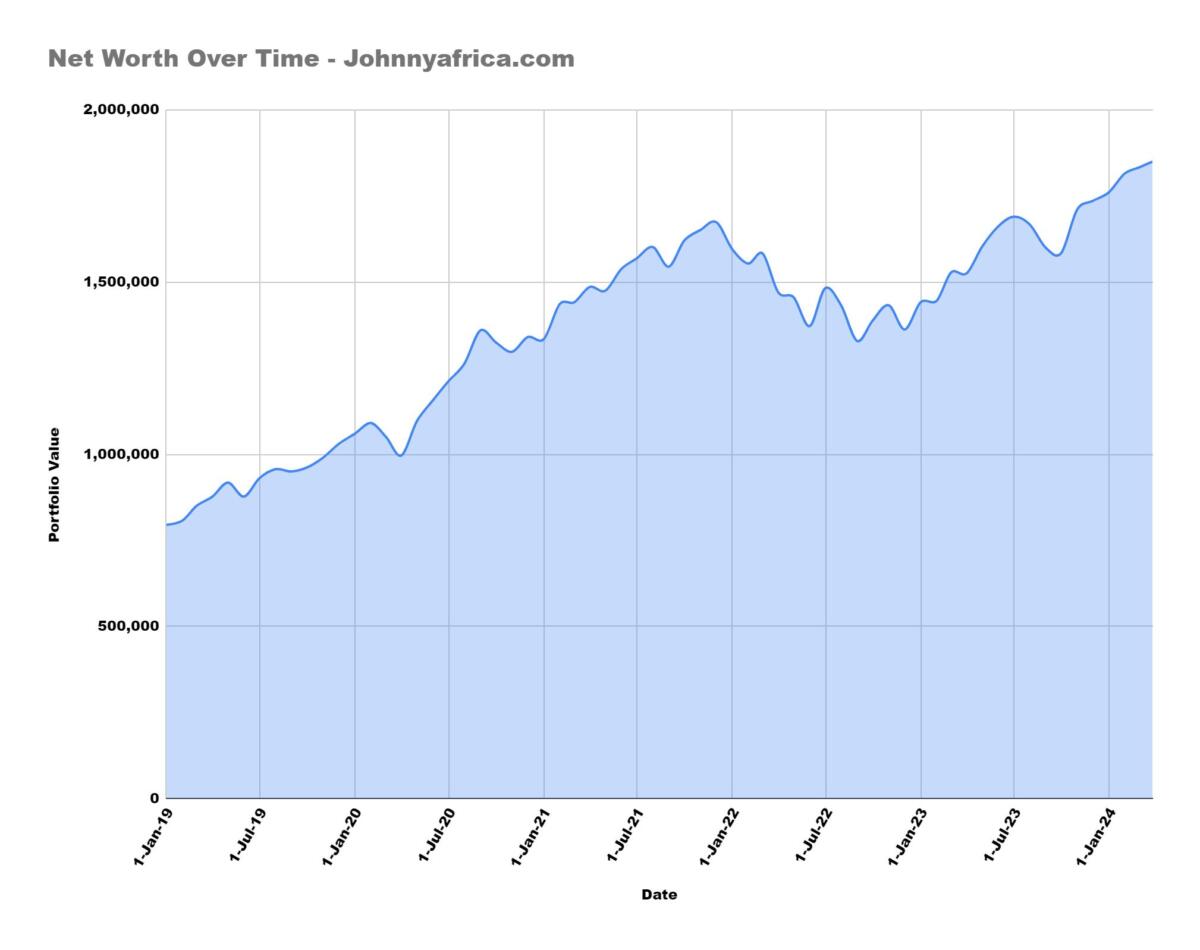

If you happen to haven’t already learn my posts earlier than, I achieved Monetary independence again in late 2020 early 2021 with a portfolio of roughly $1.3m invested in primarily ETFs. This ballooned to $1.7m throughout the peak of the markets in early 2022 earlier than coming again all the way down to Earth later in 2022.

This submit might be a part of a month-to-month collection of portfolio updates that summarizes how my portfolio carried out, what trades I executed, what my month-to-month bills had been, and my normal outlook on the economic system/markets. That is by no means monetary recommendation so don’t look have a look at me for sage recommendation. I make silly trades and make even worse losses fairly steadily.

That is merely the efficiency of my portfolio and the way it has carried out on a month to month foundation.

Month-to-month Highlights – March 2024

- Internet value is close to $1.86m as of March 2023 Month finish

- +$50k for the month

- Went again to Sri Lanka and Bali throughout the month of March.

What’s in my portfolio?

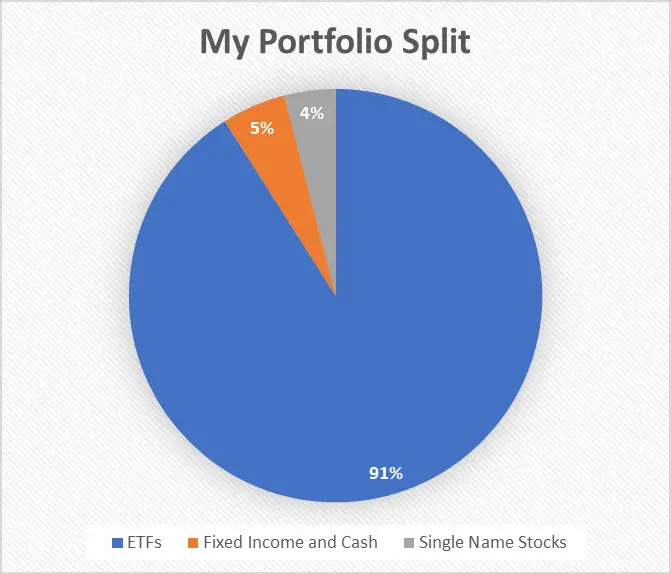

My portfolio is kind of easy and straight ahead. I’ve my holdings primarily unfold out between just a few ETFs, fastened earnings, and numerous single identify shares.

Fastened Revenue

On account of rising charges, I’ve additionally allotted a small a part of my portfolio (<5%) to fastened earnings merchandise. I’ve been buying 5.5% yielding treasury payments with a 3-6 month expiry. I presently have about ~$60k invested in a 3-mo T-Invoice that can expire in March 2024. As they expired in mid March, I purchased one other 3 month t-bill expiring in mid June yielding an analogous 5.4-5.5%. I think by the point June comes round, these yields will begin taking place since that’s when the FED is predicted to start out chopping charges.

That is assured cash with zero danger which I made a decision to make the most of whereas ready for higher entry factors. Nonetheless, it looks as if this cash most likely would have been higher used simply shopping for the market however that is alternative price I’m keen to sacrifice.

I additionally bought I-Bonds in 2022 on the peak of inflation peak when I-Bonds had been paying 9.5%. The charges have come down considerably since then as inflation itself has come down. The optimum time for me to promote these bonds had been on Dec 1, 2023 as that will have been the final month I used to be eligible for the upper charge of 6.4% (nonetheless greater than what treasuries paid). As it’s essential to forfeit three months of curiosity upon withdrawal earlier than 5 years, in complete my blended charge of return was round 8% for 15 months which is unquestionably one thing I can reside with.

ETFs

Once more, my major holdings are in just a few ETFs. My major holdings are in VTI, VGT, and VCR. I’ve at all times been a giant proponent of huge tech and have been closely invested within the Nasdaq for over a decade. This has paid off very effectively for me given the large bull market of the 2010s and is basically what allowed me to FIRE so shortly.

I used to carry extra dividend producing shares as I used to be actually into any such investing at a time period. I presently wouldn’t have many dividend particular ETFs as I desire progress greater than earnings. This sort of goes in opposition to the ethos of economic independence however I have the funds for coming in from different sources that I don’t have to focus a lot on earnings.

I added to my ETF positions in March 2024 however not a lot as I sometimes don’t like shopping for extra shares in any respect time highs. Usually occasions this isn’t good market recommendation because the prevailing sentiment has at all times been “time within the markets trumps timing the markets”. Nonetheless, I wish to suppose I do know a factor or two extra.

Single identify shares

A number of the single identify shares I personal are the next

- Tesla

- BRK.B

- Netflix

- RITM

- ASML

- ANET

These single identify shares make up lower than 10% of my complete portfolio. I are likely to not purchase a lot single identify shares anymore as there’s no level to tackle pointless dangers once I’m already so diversified with my ETFs.

Actual Property

I presently personal no actual property. I used to personal property within the US however have offered it in 2022 earlier than charges began rising. I’m not a giant fan of actual property. Whereas it positively is usually a good funding, I don’t suppose it beats investing within the markets. As well as, actual property is extremely illiquid with excessive transaction prices that few folks contemplate.

Lastly, as somebody that travels world wide and doesn’t wish to be tied down to 1 location, actual property doesn’t make sense as managing it from afar creates a bunch of complications. I a lot desire to have my cash liquid and within the inventory market.

March 2024 was one other month for the ages. The bull pattern that began in November 2023 has not proven any indicators of stopping. It’s actually been a straight shot as much as new all time highs and past on the again of strong earnings progress and expectations of the FED chopping.

As you possibly can see from the chart beneath, the Nasdaq has been on this good upward channel because the Oct 2023 lows with even the slightest dip being met with patrons.

In March, markets rallied to all time highs as soon as once more with Nasdaq up almost 15% YTD at its March peak. March additionally noticed a whole lot of juicy information releases that confirmed inflation being cussed staying above the FED stage however markets didn’t appear to care. It looks as if there’s nothing that may have an effect on the market which is additional supported by a VIX that hovered within the 13-15 vary this whole yr.

Whereas I do suspect small pullbacks to happen, it positive looks as if the markets are doing all the things to buck the pattern of the “wholesome pullback”. Usually throughout election years, volatility is usually greater than regular however this hasn’t materialized but. I think the low VIX is only a ticking time bomb for motion to comply with. What drives that motion continues to be TBD because it looks as if the market can do no improper.

Market Worth of Portfolio

Here’s a historical past of my portfolio worth. As you possibly can see, it’s moved consistent with the markets as must be the case since most of my holdings are in ETFs that monitor the S&P 500 and the Nasdaq.

| Ticker | Amount | Market Worth |

| VGT | 1450 | $760,293 |

| VTI | 2080 | $540,592 |

| VCR | 400 | $127,092 |

| VDC | 300 | $61,242 |

| TSLA | 100 | $17,579 |

| TQQQ | 1000 | $61,560 |

| FBGRX | 400 | $80,548 |

| VHT | 250 | $67,630 |

| RITM | 2500 | $27,900 |

| ANET | 35 | $10,149 |

| ASML | 50 | $48,524 |

| Complete Shares | $1,803,109 |

In complete, my portfolio is sitting someplace round $1.86m which additionally consists of money and glued earnings positions. This most likely be over $1.9m if it weren’t for my lined name MTM losses.

Trades executed for the month of March 2024

March was a really quiet month for my buying and selling regime. I offered lined calls on my holdings of VGT, VCR, and VTI in December which was already rolling the strike of a earlier name I had offered because the epic inventory market rally meant all my all calls had been within the cash. March is when these lined calls expired and as they had been nonetheless very a lot within the cash, I needed to roll them once more.

My earlier VGT calls had a strike of $480 which I rolled to $510 with a maturity in August 2024. That is nonetheless within the cash since VGT is presently sitting round $525-530. Nonetheless, I don’t foresee the market rally persevering with its identical blistering tempo and I hope that I can simply roll this contract another time and at last be out of the cash. This was a painful lesson in my lined name promoting as I’ll have misplaced out on any premiums for nearly 1 yr.

The theta on my new lined name contract is lengthy dated however that’s what occurs when your current contracts are greater than 10% within the cash. You might want to roll out your choices later and later.

Throughout the month of March, I additionally bought just a few AI associated performs which I nonetheless suppose have a bit extra room to run. I missed out on the vast majority of the AI run by not shopping for NVDA or AMD outright. Fortunately, VGT has a 5% stake in NVDA which has now turn out to be 10% pushed by its insane rally.

Abstract of inventory and ETF purchases

| Ticker | Purchase/Promote | Amount |

| VGT | Purchase | 5 |

| VTI | Purchase | 5 |

Portfolio withdrawals and bills

Withdrawals from my portfolio is a vital a part of the monetary independence ethos. The 4% withdrawal charge rule is without doubt one of the essential ideas of the FIRE motion which I attempt to adhere to. Usually, I desire to promote from my portfolio when markets are close to or in any respect time highs to seize, and solely once I really need the money.

For the month of March 2023, I traveled by way of Sri Lanka which was nice to lastly verify off nation #93. I actually appreciated Sri Lanka for its stunning pure landscapes and delightful seaside vibes particularly alongside the southern coast.

I made no withdrawals from the portfolio as I had sufficient money coming in from my weblog in addition to leftover money from different sources. My weblog generates cash each month to the tune of $3-4k and I cowl precisely how I earn cash from running a blog in different posts.

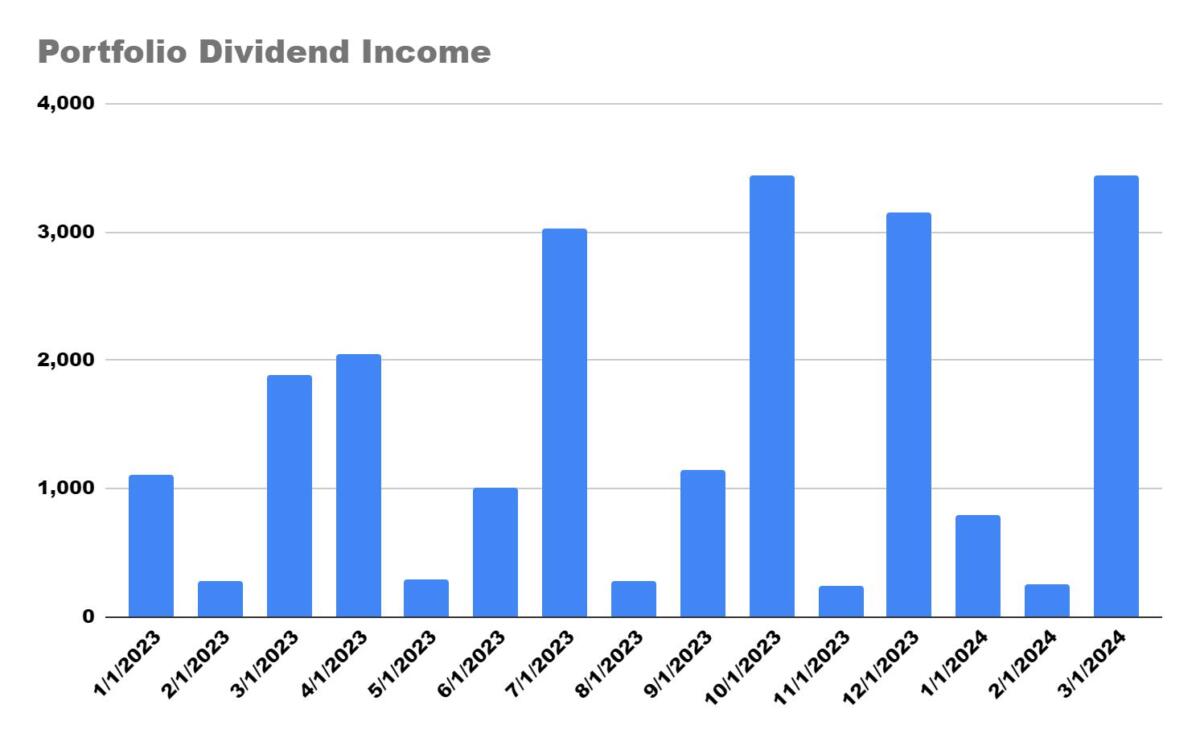

Dividend Revenue

For March, I collected a complete of $3.2k in dividends. I sometimes reinvest my dividends which has served me effectively throughout the market downturn of the final yr or two. I believe I’ll most likely cease reinvesting dividends within the close to time period as I wish to maintain a money pile whereas shares are in any respect time highs to reinvest when markets finally dip.

[ad_2]

Source link