[ad_1]

Morningstar blames “mistimed purchases and gross sales;” Carl Richards calls it the “Habits Hole.” Vanguard’s Fran Kinnery describes the treatment as “Advisors Alpha.” Whichever phrase you like, the persistent hole between traders’ efficiency and their very own belongings (!) is a considerable drag on returns.

I point out this in case you missed this Morningstar report “Thoughts the Hole: A report on investor returns within the U.S.” on the subject; it snuck by throughout the canine days of summer time. I solely seen it as a result of Robin Wigglesworth highlighted it final week.1

The Govt Abstract offers you the flavour of the timing concern:

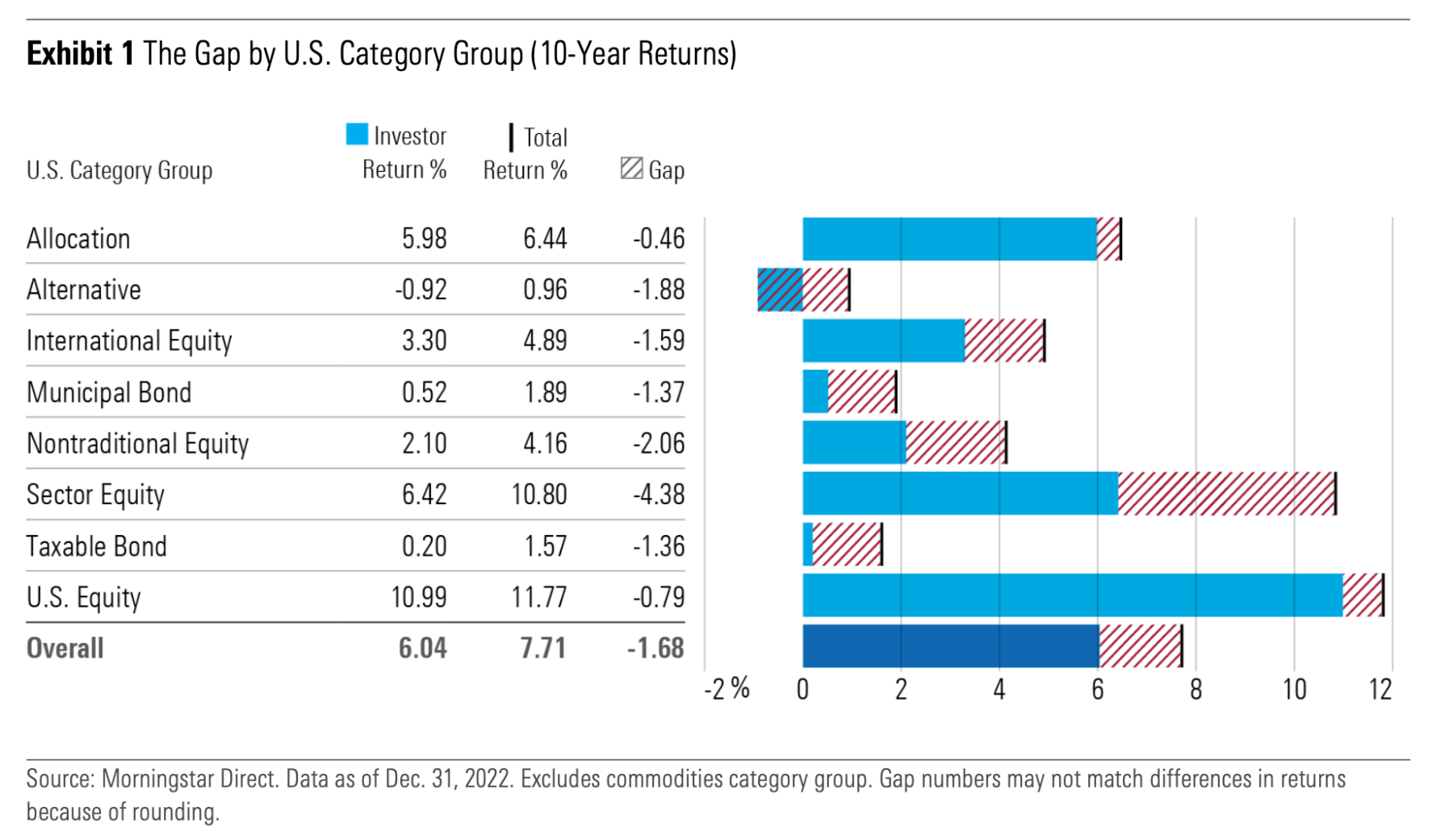

“The persistent hole between the returns traders truly expertise and reported whole returns makes money movement timing probably the most important elements—together with funding prices and tax effectivity—that may affect an investor’s finish outcomes.

On this report, we dig into these nuances and discover how variations within the timing of money flows, sequence of returns, and asset dimension can affect this hole. As well as, our analysis imparts a couple of classes on how traders can keep away from these gaps and seize extra of their fund holdings’ whole returns.”

Morningstar’s key statement: Over the latest 10-year interval (2013-22), fund traders lagged the very funds they owned by 1.7% yearly. Contemplating these funds averaged a 7.7% annual return, that could be a 22% annual shortfall.

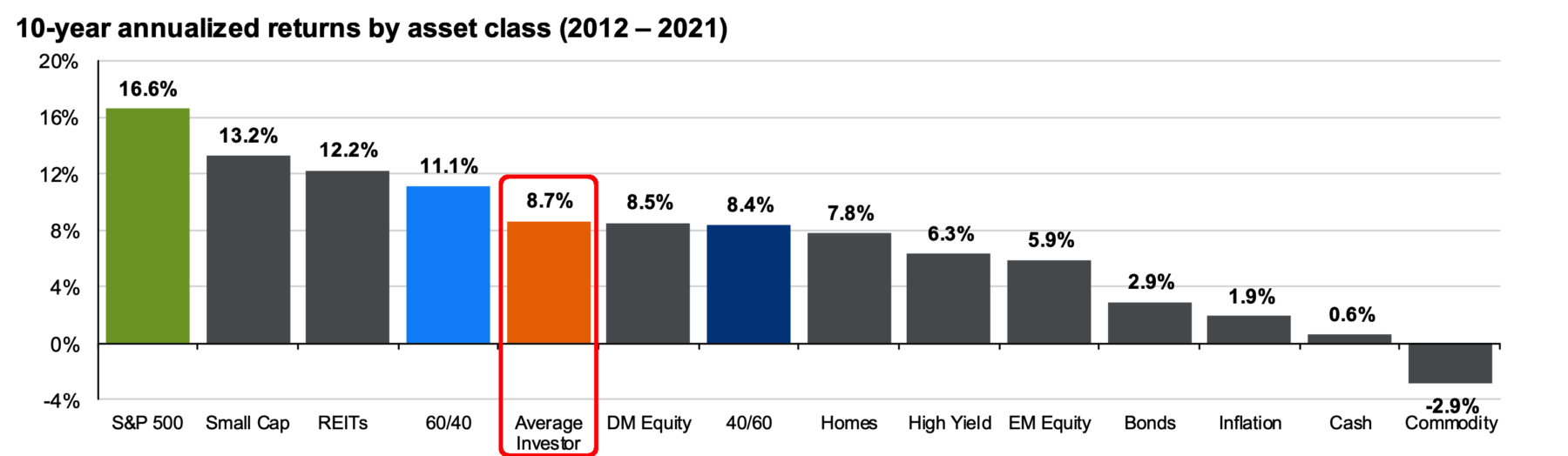

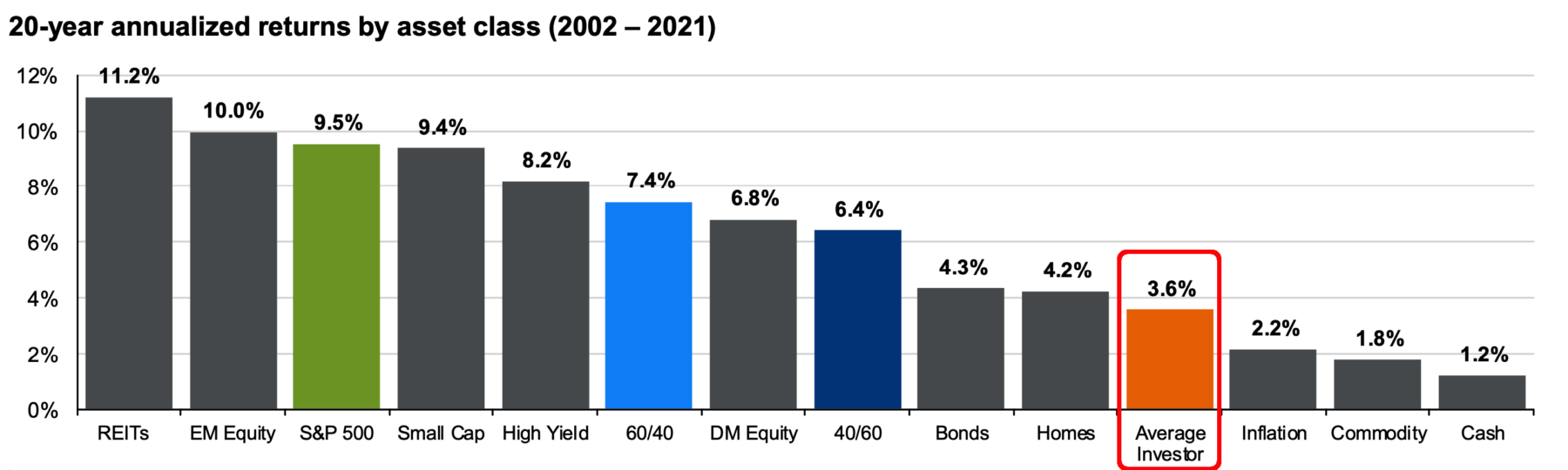

Worse nonetheless, this lag compounds over time. Think about the charts under (by way of J.P. Morgan’s Quarterly Information to the Markets); the affect over 10 or 20 years is substantial, and the longer the time interval examined, the better the hole turns into.2

Completely different research blame totally different sources for the lag; Morningstar factors to poor timing; Vanguard suggests it’s a lack {of professional} planning; Carl Richards says it’s all habits. Neurologist and investor Invoice Bernstein goes even additional, discovering an evolutionary cognitive concern in our limbic methods:

“To the extent that you just reach finance, you reach finance to the extent you could suppress the limbic system, your system one, which is the very fast-paced emotional system that we’ve got. In the event you can’t suppress that, you’re in all probability going to die poor…”

Like a lot in life, the extra satisfying reply is that the causes are nuanced and complicated, with quite a few interrelated elements mixed to result in an undesirable end result.

Give this a while over the lengthy weekend to learn. Your portfolio will thanks…

Supply:

Thoughts the Hole: A report on investor returns within the U.S.

Jeffrey Ptak, Amy C. Arnott

Morningstar, July 31, 2023

See additionally:

Timing is tough

by Robin Wigglesworth

FT Alphaville, August 25, 2023

Beforehand:

Investing is the Examine of Human Choice Making (August 23, 2023)

Underperforming Your Personal Property (July 24, 2023)

Easy, However Arduous (January 30, 2023)

Investing is a Drawback-Fixing Train (January 31, 2022)

____________

1. As famous in July in Underperforming Your Personal Property, that is the candy spot of my very own affirmation bias.

2. I do know, it’s not an actual apples-to-apples comparability; there are different elements contributing to the hole, similar to lively vs. passive underperformance. Even nonetheless, it exhibits the affect of the compounded efficiency hole (no matter trigger) over longer holding durations…

JPM charts from my July 24, 2023 publish, Underperforming Your Personal Property:

Over 10 years, (2012-2021) the SPX generated 16.6% annual returns, however the common investor solely gained 8.7% per yr. Over that interval, the standard investor garnered about half of what the markets generated:

The place issues actually went off the rails have been the 20-year returns,w which included many of the dot com implosion, and the entire Nice Monetary Disaster. Over that unstable period, the SPX returned 9.5% yearly whereas traders garnered about 3.6% per yr — barely a 3rd of the index.

[ad_2]

Source link