[ad_1]

Help really

unbiased journalism

Our mission is to ship unbiased, fact-based reporting that holds energy to account and exposes the reality.

Whether or not $5 or $50, each contribution counts.

Help us to ship journalism with out an agenda.

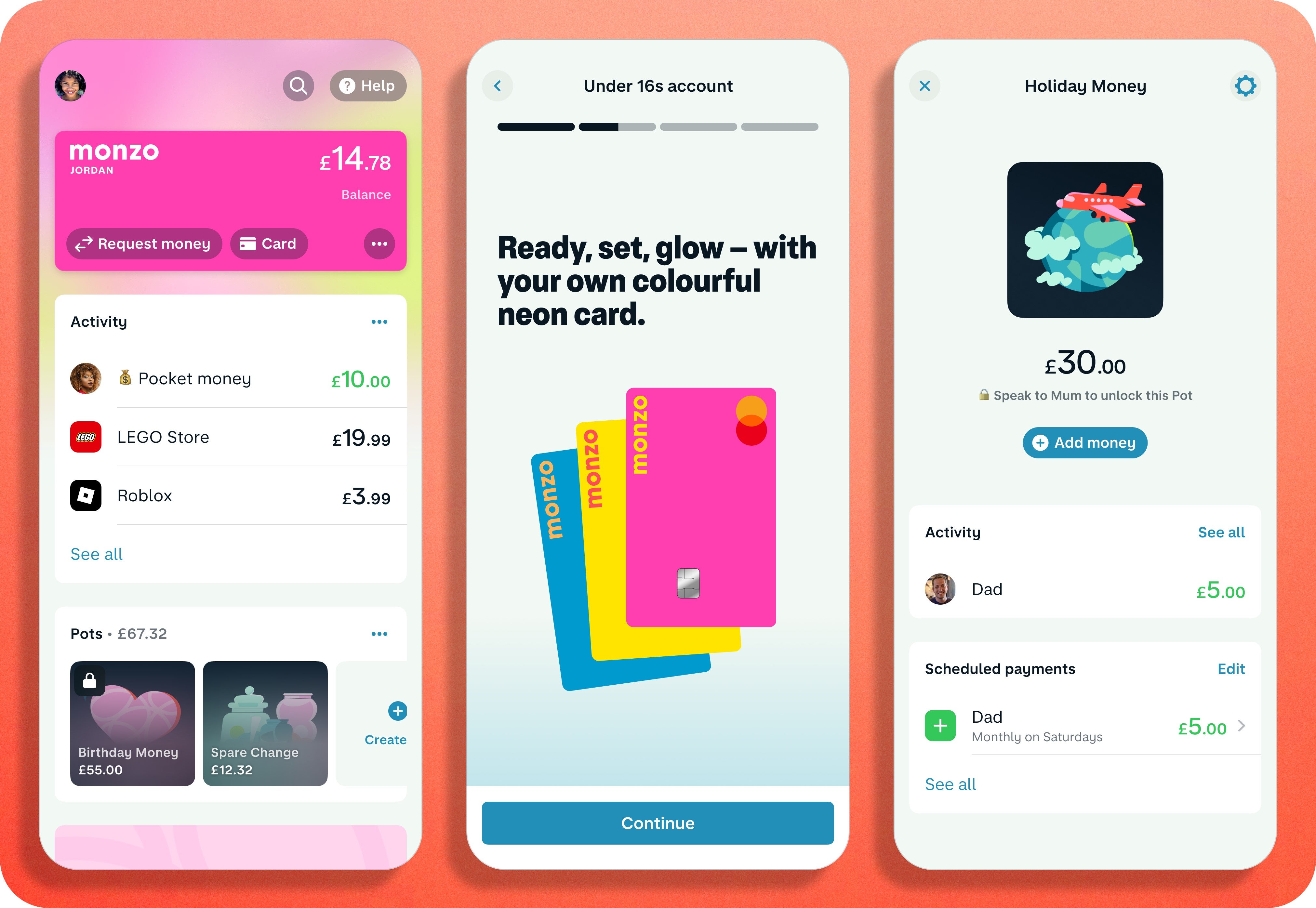

Digital financial institution Monzo has unveiled plans to launch a brand new account for kids aged beneath 16, which can let children set financial savings targets and organise cash with “pots”.

The account, which can include a brightly-coloured Monzo card in pink, yellow or blue, will embrace in-app steering for kids on cash matters.

The account, which has no charges for signing up, topping up, subscriptions or spending overseas, may be held by youngsters aged six to fifteen years outdated.

TS Anil, chief government of the financial institution, stated some “Monzo favourites” are included with the account, with instruments for kids to customize their app and playing cards to select from.

It can give youngsters their first style of saving and budgeting, in addition to receiving scheduled pocket cash funds and utilizing a card to pay in a store, whereas giving dad and mom or guardians management and visibility to make sure youngsters are managing their cash safely, the financial institution stated.

Dad and mom may have the kid’s account linked to their very own, and might select to be notified when their youngster spends. Dad and mom can set spending limits and use controls to show money withdrawals and on-line funds on or off.

Kids can “graduate” to an account for 16 and 17-year-olds and once more to a full Monzo account after they turn into an grownup, the financial institution stated.

Dad and mom or guardians can be a part of a waitlist for the brand new account, with the primary prospects getting entry later this summer season and the product being rolled out over the months forward.

It’s understood that Monzo will probably be exploring potential choices for curiosity on financial savings because it expands and develops its under-16s account.

A OnePoll survey for Monzo amongst 2,000 dad and mom indicated that greater than seven in 10 want that that they had been taught about cash administration at a youthful age.

Of the dad and mom who focus on funds with their youngsters, half (50%) stated they need their youngsters to know learn how to save pocket cash, with simply over two-fifths (42%) saying they need their youngsters to know learn how to create a finances.

Rachel Springall, a finance knowledgeable at Moneyfactscompare.co.uk stated: “It’s nice to see extra competitors available in the market to encourage the financial savings behavior and for under-16s to learn to handle their very own cash.

“Budgeting and saving for a wet day is a life talent which could not come naturally to some or certainly handed down, so entering into such a routine may appear a problem.

“For this reason digital apps and accounts that present real-time balances and train cash administration abilities are an excellent asset to boost any monetary training.

“Parental entry can be important to make sure their youngsters are spending safely, and it’s good to see this Monzo account permits them to rapidly flip off money withdrawals or on-line funds.”

Ms Springall stated that account suppliers don’t all the time provide merchandise for kids as younger as six.

She stated some accounts, together with these from Starling Financial institution, Rooster Cash, HyperJar and GoHenry are geared toward youngsters as younger as six years outdated.

[ad_2]

Source link