[ad_1]

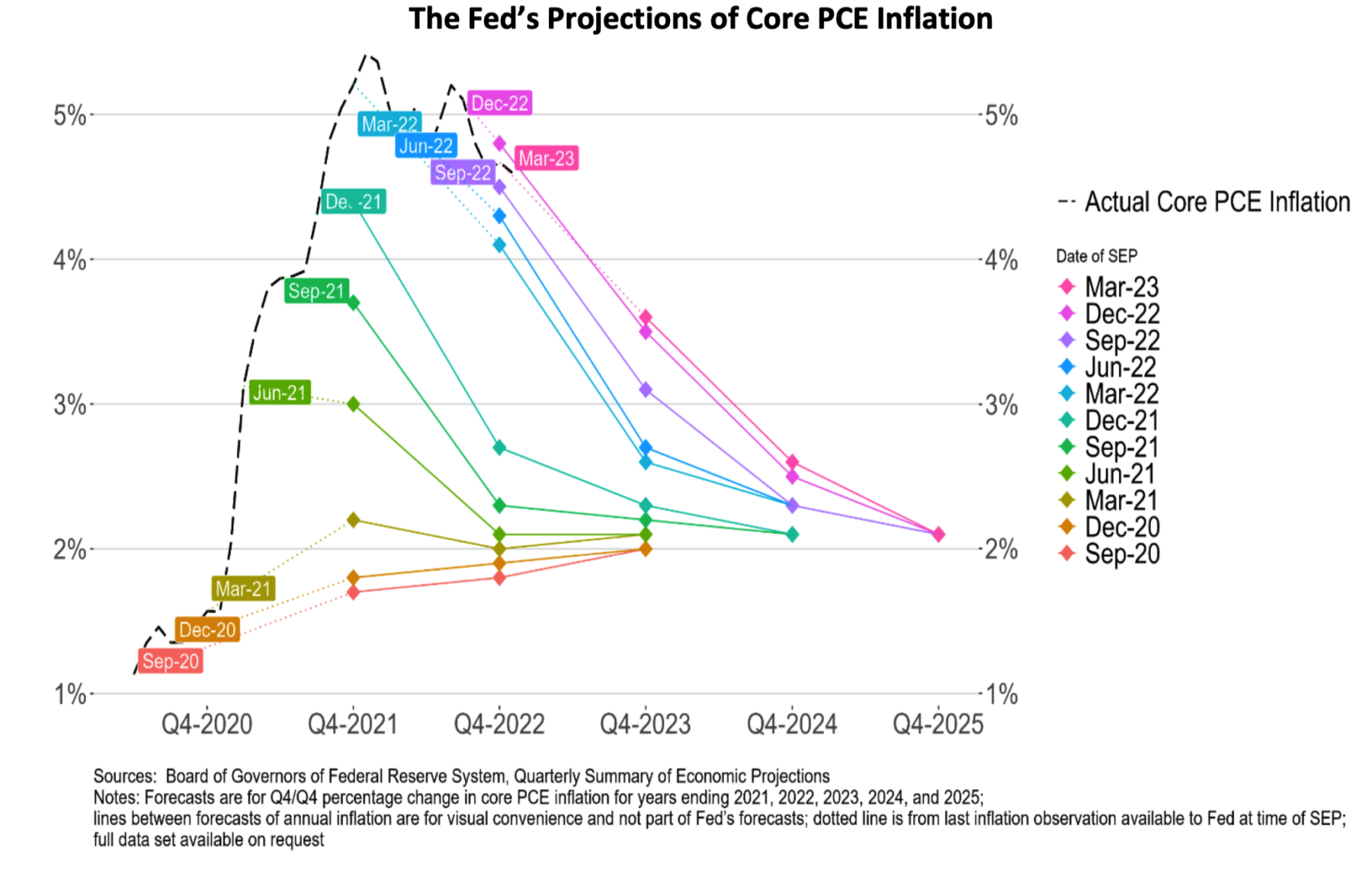

The September Federal Reserve assembly is behind us we nonetheless have November and December forward of us. Markets are nervous anticipating one other hike earlier than years over earlier than two cuts in 2024. My recommendation: ignore these expectations as they’ve been wildly inaccurate over the previous few years; they’ve been principally inaccurate over the previous decade.

In the case of forecasting financial outcomes, the Fed is not any higher or worse than anyone else.

I do know of no higher authority to quote than Federal Reserve Chairman Jerome Powell, from his June 16, 2021 presser:

“The dots aren’t an amazing forecaster of future price strikes. And that’s not as a result of—it’s simply because it’s so extremely unsure. There is no such thing as a nice forecaster of the long run—so dots to be taken with an enormous, massive grain of salt.”

What makes them completely different is that they achieve this very publicly and preserve an ongoing report of their forecasts about federal funds charges inflation and GDP. They might be horrible financial forecasters however give them credit score for not burying unhealthy predictions like so many on Wall Road are inclined to do. Credit score to Powell for admitting what so many different financial prognosticators fail to do: Personal up that they have no idea what’s going to occur sooner or later.

To wit: The Dot Plot.

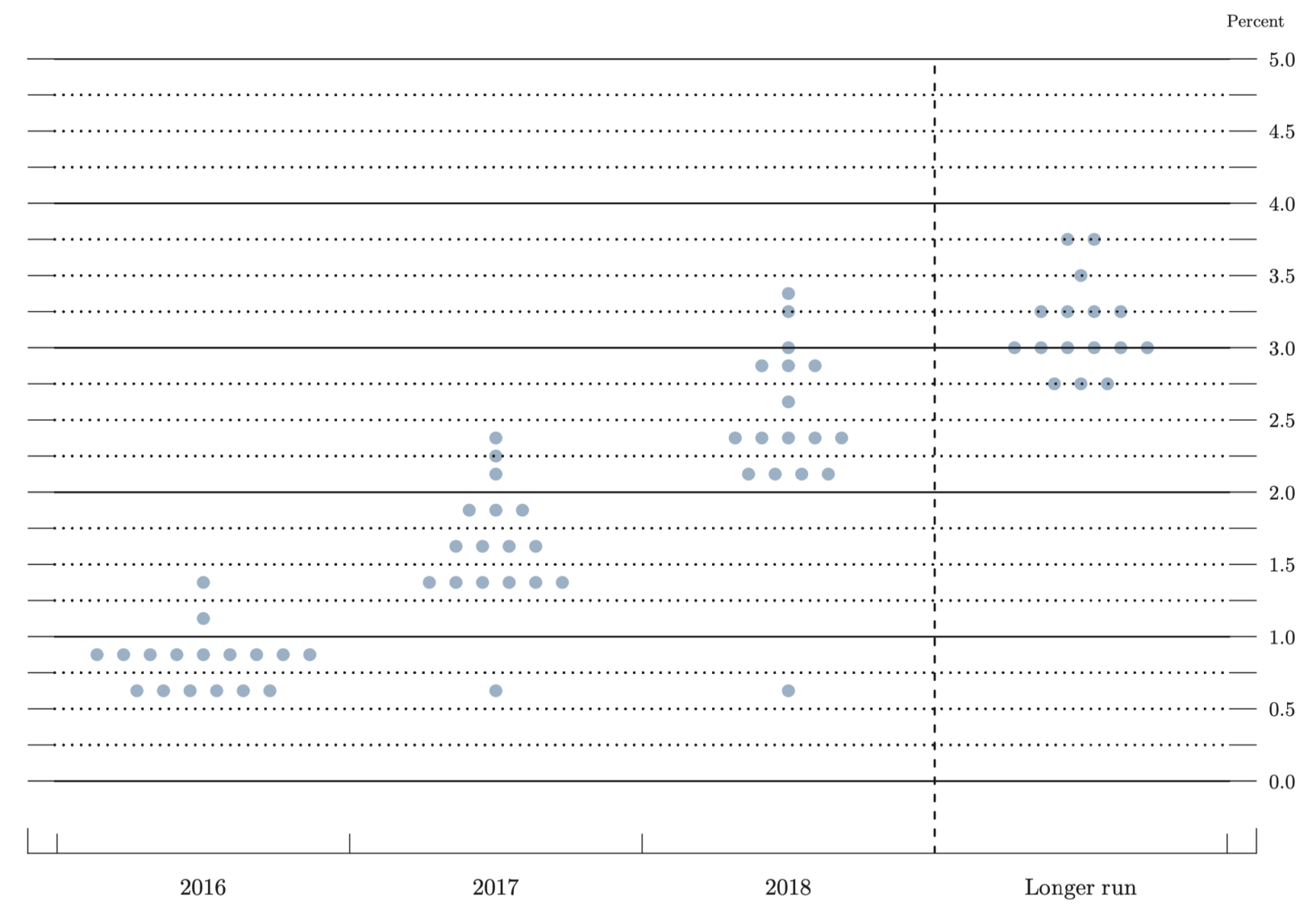

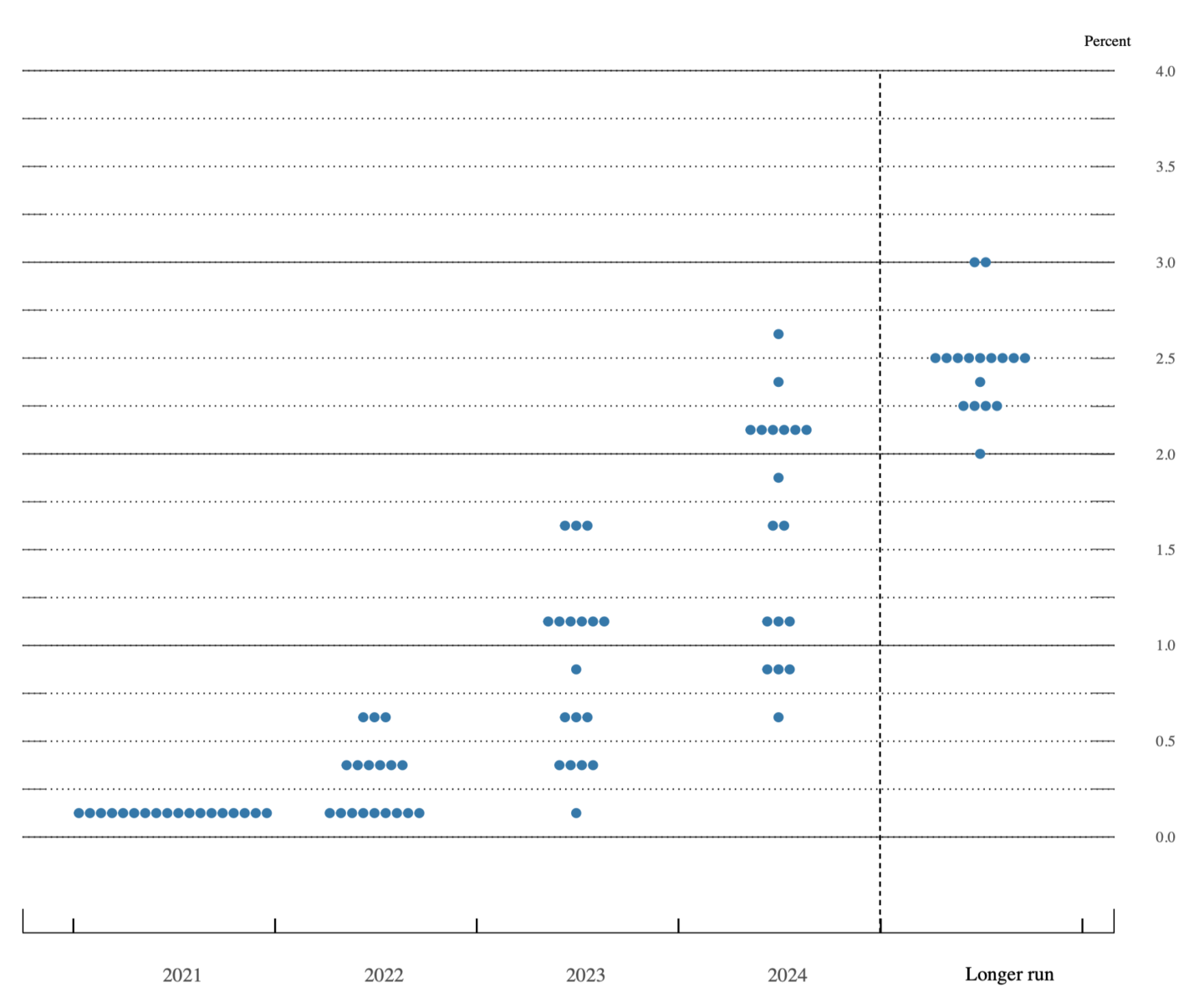

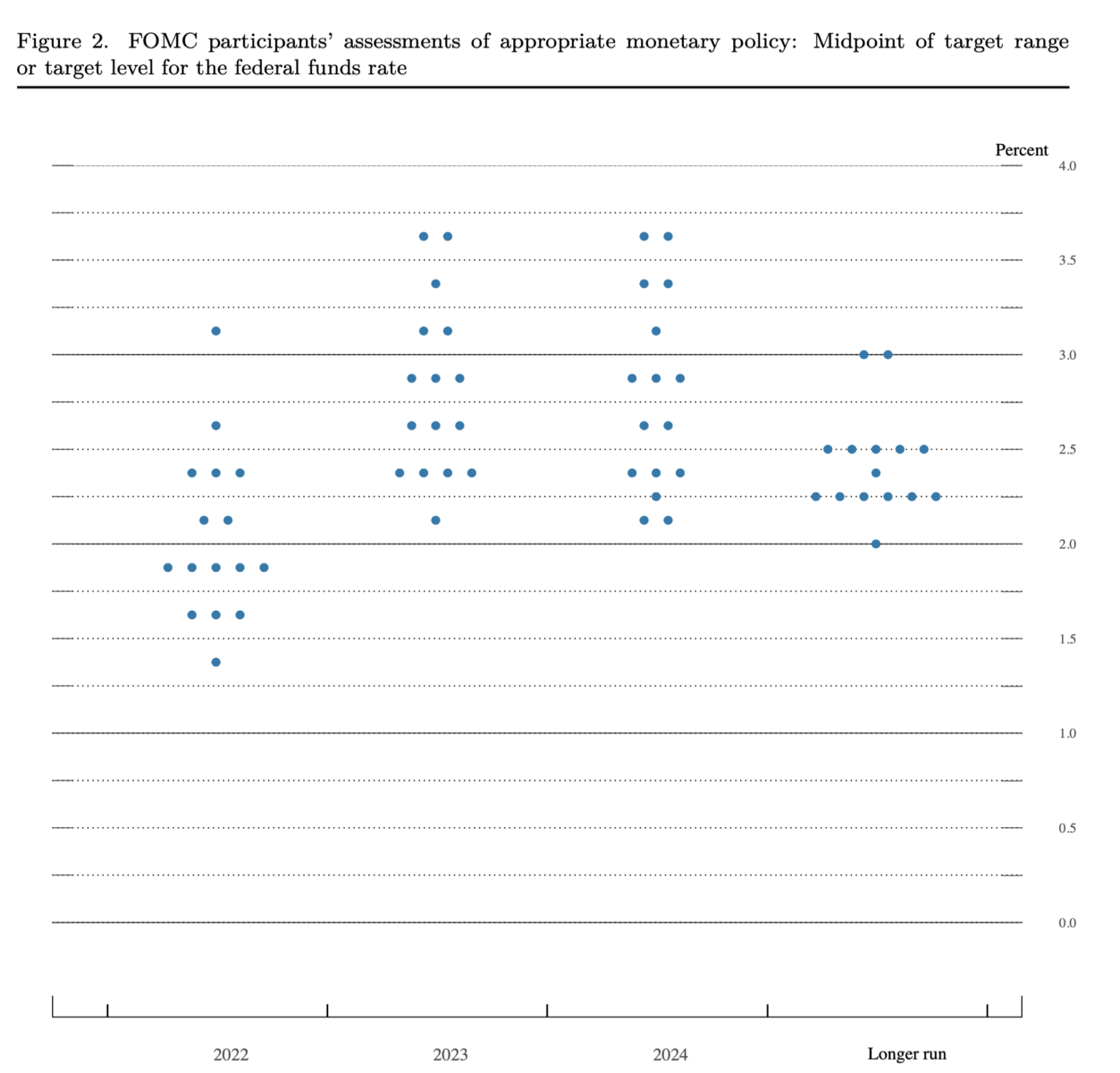

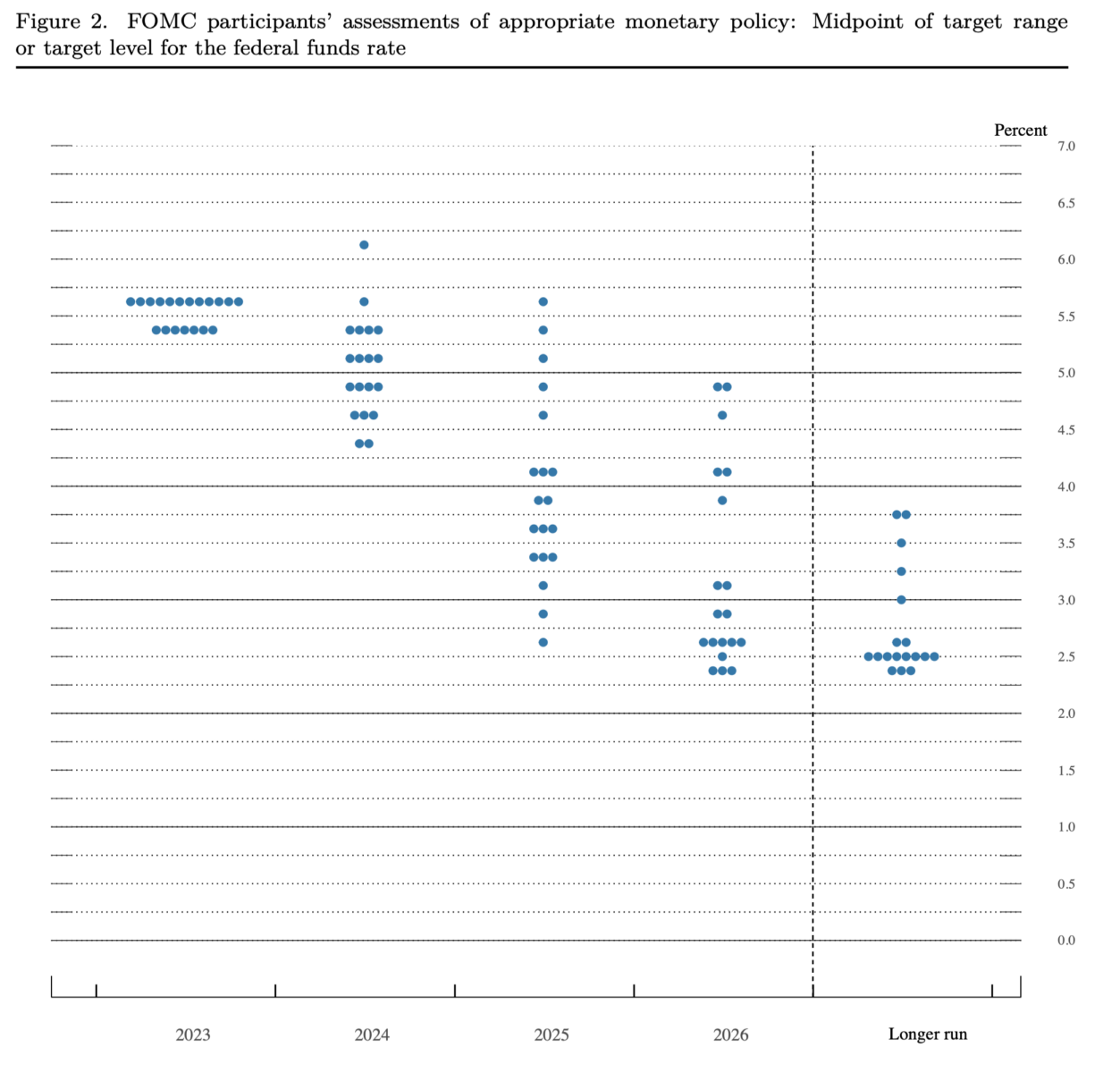

Because the Chairman famous, the dot plot is solely a chart displaying every Federal Reserve member’s projection for the Fed funds price over the subsequent few years. Every dot corresponds to a policymaker’s expectations of future rates of interest. Whereas they might not be official forecasts, they do present what particular person FOMC members are pondering. The substantial adjustments from one assembly to the subsequent reveal simply how risky financial information will be, particularly in the case of CPI.

Go to the Fed’s web site, and seek for “Abstract of Financial Projections.” These are the quarterly summations that embody the dot plots inside them. Randomly seize a couple of, and scroll to the 4th to eighth web page or so the place the dot plots are discovered. Then evaluate them to what truly occurred, through the FOMC’s goal federal funds price or vary, change (foundation factors) and stage. The financial seriousness of this could forestall you from pondering “Hilarity ensues.”

Listed here are the June 2016 dot plots:

Quick ahead to September 2021, the place the Fed imagined 2023 fund charges to be round 1%:

Now, March 2022 dots imagined a yr later we’d be about 3%:

Final, the present September 2023 Dot Plot, which I assume is reassuring(?) because the out years are actually trending downwards:

The dots are helpful to offer Fed watchers one thing to speak about, however for the remainder of us, it’s actually a humbling reminder that no person is aware of what the long run holds. As a lot as folks criticize the Fed I give them credit score for saying what they’re going to do after which doing it. Kudos to them for admitting they’ll’t see the long run.

Now if we are able to simply get them to grasp the current, possibly we’ll be OK…

Beforehand:

5 Methods the Fed’s Deflation Playbook May Be Improved (Businessweek, August 18, 2023)

Why Is the Fed All the time Late to the Occasion? (October 7, 2022)

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

No one Is aware of Something (Assortment)

See additionally:

Powell’s Taper Tightrope May Be Sophisticated by Fed ‘Dots’ (WSJ, Sept. 21, 2021)

The Federal Reserve’s newest dot plot, defined (BankRate September 20, 2023)

The Fed and its Dots lavish portrait (James Lavish, Dec 18 2022)

The Fed ‘Dots’ Put Monetary Markets In A Tizzy (Forbes 6/19/21)

[ad_2]

Source link