[ad_1]

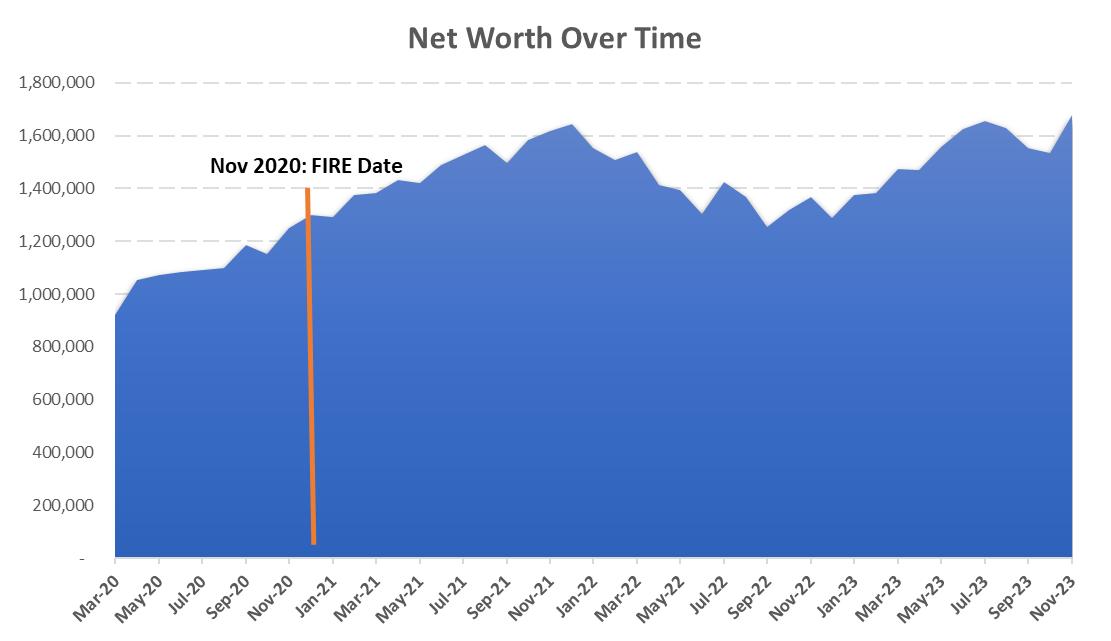

As of November 2023, I’m beginning my month-to-month portfolio replace for FIRE journey. Should you haven’t already learn my posts earlier than, I achieved Monetary independence again in late 2020 early 2021 with a portfolio of roughly $1.3m invested in primarily ETFs. This ballooned to $1.7m throughout the peak of the markets in early 2022 earlier than coming again right down to Earth later in 2022.

This publish shall be a part of a month-to-month collection of portfolio updates that summarizes how my portfolio carried out, what trades I executed, what my month-to-month bills had been, and my common outlook on the economic system/markets. That is by no means monetary recommendation so don’t look have a look at me for sage recommendation. I make silly trades and make even worse losses fairly incessantly.

That is merely the efficiency of my portfolio and the way it has carried out on a month to month foundation.

Month-to-month Highlights

- Web price is close to $1.7m m as of November 2023 Month finish

- +$0.12m for the month

- Stayed on the Ritz Carlton Maldives for five nights utterly on factors (absolute heaven on Earth)

What’s in my portfolio?

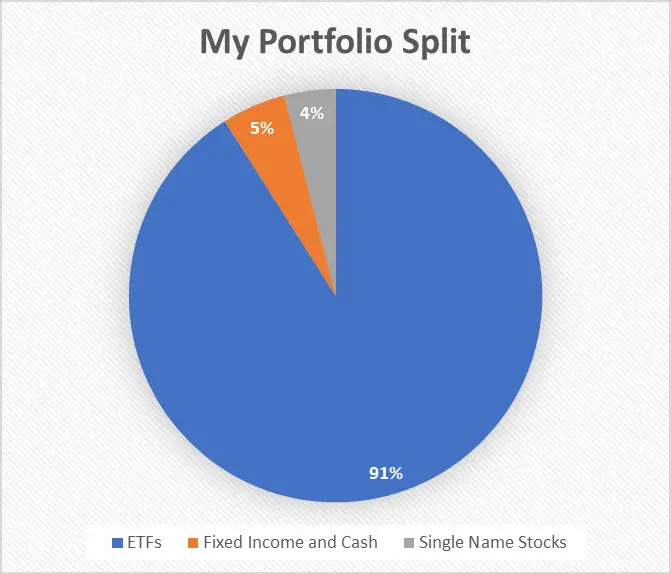

My portfolio is sort of easy and straight ahead. I’ve my holdings primarily unfold out between just a few ETFs, mounted earnings, and varied single identify shares.

Mounted Earnings

Because of rising charges, I’ve additionally allotted a small a part of my portfolio (<5%) to mounted earnings merchandise. I’ve been buying 5.5% yielding treasury payments with a 3-6 month expiry. I at the moment have about ~$60k invested in a 3-mo T-Invoice that can expire in Dec ME. I plan to purchase one other 3 month T-Invoice upon maturity.

That is assured cash with zero threat which I made a decision to benefit from whereas ready for higher entry factors. Nevertheless, it looks like this cash most likely would have been higher used simply shopping for the market however that is alternative price I’m prepared to sacrifice.

I additionally bought I-Bonds in 2022 on the peak of inflation peak when I-Bonds had been paying 9.5%. The charges have come down considerably since then as inflation itself has come down. I’ll promote my remaining I-Bonds of $20k in December 2023 when they’re eligible for withdrawal.

ETFs

Once more, my main holdings are in just a few ETFs. My main holdings are in VTI, VGT, and VCR. I’ve all the time been an enormous proponent of huge tech and have been closely invested within the Nasdaq for over a decade. This has paid off very properly for me given the large bull market of the 2010s.

I used to carry extra dividend producing shares as I used to be actually into any such investing at a time frame. I at the moment shouldn’t have many dividend particular ETFs as I want progress greater than earnings. This type of goes towards the ethos of monetary independence however I have the funds for coming in from different sources that I don’t must focus a lot on earnings.

I added to my ETF positions in November as I wished to capitalize on the October dip. This turned out to be fruitful because the markets had a fierce rally in November.

Single identify shares

Among the single identify shares I personal are the next

These single identify shares make up lower than 10% of my complete portfolio. I are likely to not purchase a lot single identify shares anymore as there’s no level to tackle pointless dangers once I’m already so diversified with my ETFs.

Actual Property

I at the moment personal no actual property. I used to personal property within the US however have offered it in 2022 earlier than charges began rising. I’m not an enormous fan of actual property. Whereas it undoubtedly could be a good funding, I don’t assume it beats investing within the markets. As well as, actual property is very illiquid with excessive transaction prices that few individuals think about.

Lastly, as somebody that travels all over the world and doesn’t prefer to be tied down to 1 location, actual property doesn’t make sense as managing it from afar creates a bunch of complications. I a lot want to have my cash liquid and within the inventory market.

November 2023 was a month for the bulls. The Fed was dovish for the primary time throughout the mountaineering cycle and inflation got here in gentle which gave the inexperienced gentle to traders to purchase the dip that fashioned in October. Markets ran as much as earlier resistance at a blazing tempo and a few of my ETFs are again in any respect time highs. The markets rally simply as laborious as they crash.

I do assume price cuts are coming subsequent yr and my guess is someplace round 1% can be the quantity except some black swan occasion happens. The market tends to agree because the CME Fed Funds watch additionally signifies an identical stage of cuts.

Markets have been off their 2021 all time highs for nearly 2 years now and statistically talking, that is on the upper finish of time between market highs. Finally, markets must rally again to their highs even with adversarial market circumstances and it’s not a shock to me that they’re nearly there. I believe this can most likely occur both in December or early subsequent yr earlier than a pull again. I don’t foresee any main pullbacks in December as seasonality kicks in, buying and selling volumes are lighter, and financial information appears favorable.

There’s nonetheless lots of money sloshing by the system and central financial institution injections stay sturdy all through the previous two years. In fact, nothing within the markets occur based on plan, particularly mine. It’s simply as possible we might see continued elevated inflation and different points that causes a brand new bear market.

Market Worth of portfolio

Here’s a historical past of my portfolio worth. As you’ll be able to see, it’s moved in keeping with the markets as ought to be the case since most of my holdings are in ETFs that observe the S&P 500 and the Nasdaq.

Trades executed for the month

I spent November 2023 shopping for the October dip. I scooped up extra shares of my perennial VTI, VGT, and some single identify shares. I don’t commerce out and in of shares like I used to so sadly, you gained’t get any good inventory suggestions from me!

- Purchase 45 shares of VGT

- Purchase 50 shares of VTI

- Promote 10 lined calls on VGT with a 470 strike and Dec 17 expiry

- Promote 1 lined calls on VGT with a 460 strike and Dec 17 expiry

- Promote 12 lined calls on VTI with 230 strike and Dec 17 expiry

I offered lined calls on my holdings like I are likely to do each month or two to generate further earnings. I prefer to promote my calls with a 0.15 to 0.2 delta which is usually conservative sufficient to keep away from being known as however in current months, I’ve needed to roll contracts just a few instances because the underlying appreciated a lot quicker than anticipated. I typically prefer to promote 1 or 2 contracts with a strike nearer to the cash to seize extra premium. I like doing this when the markets have had a big run up, is bumping up towards resistance, and probably primed for a pull again.

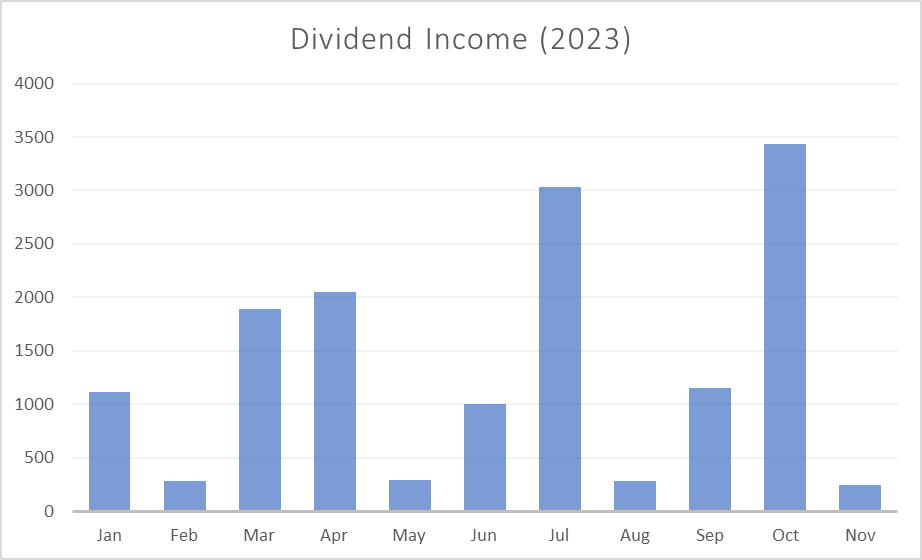

For November, I offered lined calls on my VTI and VGT portfolio which generated roughly $2,900.

Portfolio withdrawals and bills

Withdrawals from my portfolio is a crucial a part of the monetary independence ethos. The 4% withdrawal price rule is among the primary ideas of the FIRE motion which I attempt to adhere to. Typically, I want to promote from my portfolio when markets are close to or in any respect time highs to seize, and solely once I really need the money.

For the month of November 2023, I traveled extensively by the Maldives and spent a ship load of cash staying at fancy resorts. As well as, each day life in Singapore simply prices some huge cash so in complete, I spent about $5.5k within the month.

I made no withdrawals from the portfolio as I had sufficient money coming in from my weblog in addition to leftover money from different sources. My weblog generates cash each month to the tune of ~$3k and I cowl precisely how I earn cash from running a blog in different posts.

In future posts, I’ll have a chart that breaks down precisely how a lot earnings I produced from my portfolio and different earnings streams towards my bills.

Proceed Studying:

[ad_2]

Source link