[ad_1]

Creator’s Word: Insights shared listed here are taken from the CFO Mixer and Investor Panel held on February 2023 in Singapore hosted by Stripe, that includes a panel with Jason Edwards of January Capital and VentureCap Insights and Insignia Ventures’ Yinglan Tan, in addition to a dialog with former Slack CFO Allen Shim.

Highlights

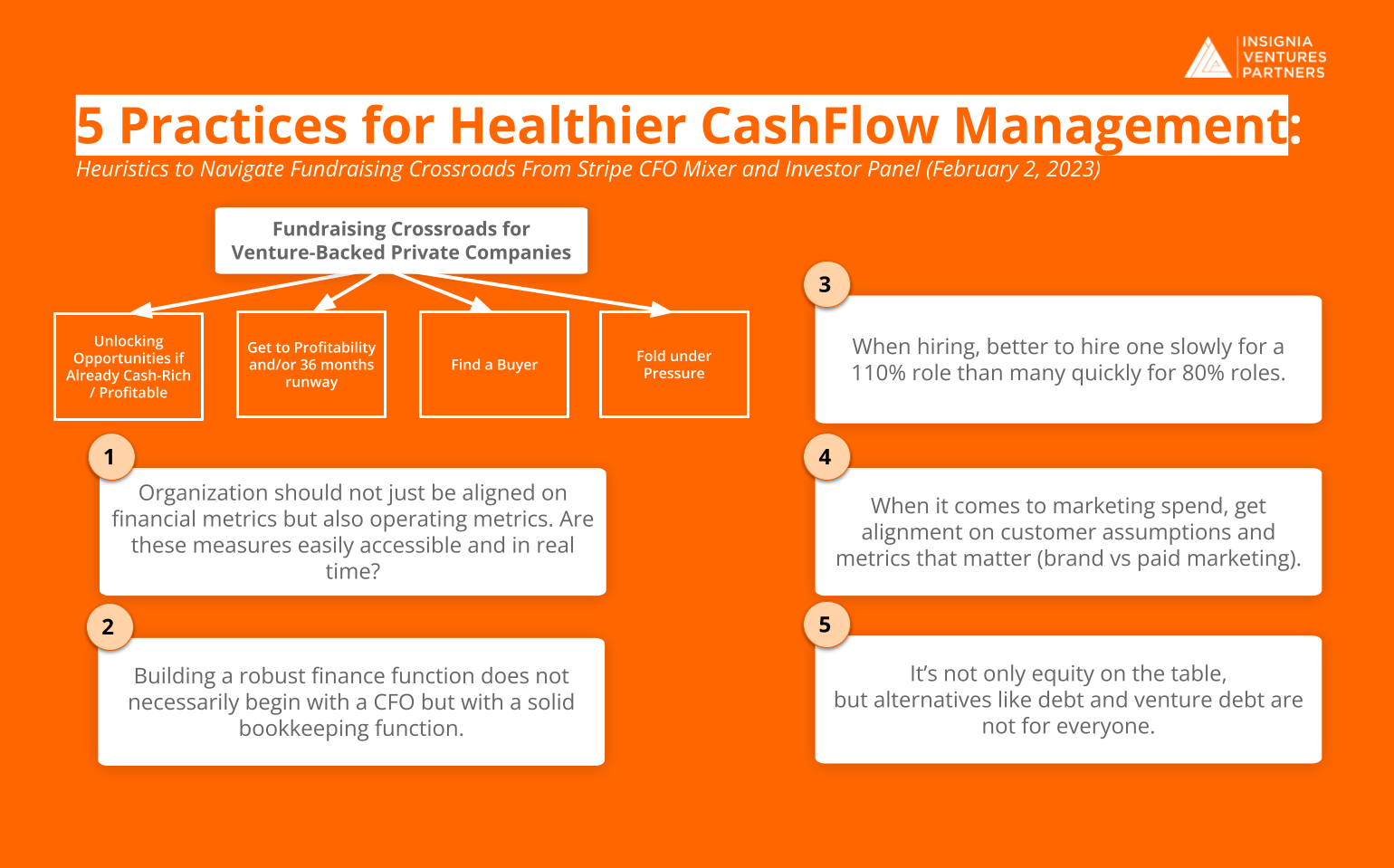

- Enterprise-backed personal firms now face a crossroads in fundraising (i.e., to boost or to not? To take a valuation hit or not? To boost fairness or debt or some mixture?). That is compounded by the necessity to prolong runways to outlive within the case of some firms or the stress to capitalise on their aggressive benefits within the case of others.

- From the buyers’ perspective, particularly late-stage buyers, the place the correction’s influence is extra extreme, the bars are greater. The problem is extra pronounced for firms that elevate at too excessive (or enticing) of a a number of and are actually confronted with doubtlessly getting penalised for his or her last-round valuation.

- The crossroads firms face on this market might be illustrated in 4 or 5 attainable situations: Already cash-rich, get to profitability or 36-month runway, take a down spherical, discover a purchaser, or fold below stress.

- 5 practices for more healthy money movement administration: You may’t handle what you possibly can’t measure, sturdy finance operate begins with strong bookkeeping, higher to rent one slowly at 110 per cent than many rapidly at 80 per cent, in relation to advertising and marketing spend, get alignment on what you’re really measuring, it’s not solely fairness on the desk, however these options (like debt, enterprise debt, and revenue-based financing) will not be for everybody.

From fundraising heydays to fundraising correction

“What we’ve seen main as much as the correction within the public markets was that there was an unlimited sum of money coming into the startup ecosystem in Southeast Asia. And that was actually brought on by a variety of elements,” shares Jason Edwards of January Capital.

These elements included many abroad buyers investing large quantities within the area for the primary time, from the likes of Jeff Bezos to Sequoia pouring as a lot as US$50 million into first-time conferences. This flush of cash within the 12 months put up “first-generation unicorn-minting” (the likes of Gojek, Traveloka, Seize) to the pandemic-induced digitalisation rush (2018 to 2021) shifted the fundraising worth chain in two methods.

Additionally Learn: Cashflow and financing: what firms have to know

Late-stage buyers had been compelled to maneuver earlier as a result of the costs went up in later rounds, whereas smaller funds that had been capable of elevate a lot bigger funds on high of the Southeast Asia potential sought to gasoline bigger fundraising rounds.

This capital inflow closed the well-documented “growth-stage funding hole” within the area as cash chased investments. Edwards provides, “For founders, at the moment, it was a heyday. You simply had a lot cash chasing investments, and other people had been elevating greater than they wanted. And the valuations had been, I feel, greater than they need to have been.”

New market, new guidelines

Now the script has flipped with the general public markets correction, and venture-backed personal firms now face a crossroads in fundraising (i.e., To boost or to not? To take a valuation hit or not? To boost fairness or debt or some mixture?). That is compounded by the necessity to prolong runways to outlive within the case of some firms or the stress to capitalise on their aggressive benefits within the case of others.

From the buyers’ perspective, particularly late-stage buyers, the place the correction’s influence is extra extreme, the bars are greater. Specifically, Tan factors out two key questions: “Once you speak to the late-stage buyers, they ask you two questions. One, are you worthwhile? The second query they ask you is, do you may have audited financials to fundraise?”

The requirements for product-market match have additionally modified, as Tan provides, “…the founders which have succeeded up to now 5 years might elevate 10 million on a PowerPoint deck and will give subsidies to develop. They won’t be the founders that may succeed within the subsequent 5 years as a result of the setting has completely modified, proper? It’s a must to present economics a lot earlier within the course of. It’s a must to have merchandise that truly have product market match. And once I say product market match, it’s not simply progress, transactions must be EBITDA optimistic or actually unit economics optimistic.”

The sturdiness of money has additionally modified. Earlier than, 12-18 months would have sufficed to ferry by way of one other spherical and generate sufficient progress to make the markup justifiable, however now that will not be sufficient for many firms.

It additionally takes for much longer to boost cash, given the extra rigorous due diligence anticipated by buyers. Given the upper bars for fundraising vis-a-vis value changes, Tan advises attending to 36 months or a three-year runway, if not profitability.

The problem is extra pronounced for firms that elevate at too excessive (or enticing) of a a number of and are actually confronted with doubtlessly getting penalised for his or her last-round valuation. As Edwards places it, “The problem I feel that basically brings about is in case you’re a great firm that’s doing nicely at a late stage, and also you’ve raised when the occasions had been actually good, you’ll’ve raised at a very enticing a number of. And that’s not gonna occur now. It’s all modified.

Additionally Learn: Meet the 22 notable startups which have brightened up the Filipino tech ecosystem

“So how do you keep away from being penalised by what’s taking place within the markets in case you are performing nicely since you don’t need to have flat rounds and down rounds? So I feel a part of what you need to take into consideration is managing that with the flexibility to boost…How do you make your runway work? That’s one factor individuals ought to take into consideration.”

The fundraising crossroads

With this in thoughts, the crossroads firms face on this market might be illustrated in 4 or 5 attainable situations. First is that if the corporate is already cash-rich (worthwhile and/or has a three-year runway), then it’s time to be aggressive. If the corporate will not be in that place but, the plain different is to make that occur.

So second is to give attention to chopping burn to create an extended runway or, even higher, refocus the enterprise in direction of profitability. In some circumstances, the corporate is ready to safely elevate a bridge spherical or a decently priced follow-on so as to add to this money “cushion” as they refocus the enterprise. If the corporate has already executed these measures however continues to be not in a secure place in any case, taking a down spherical could also be needed, or contemplating different devices (enterprise debt, debt, and different revenue-based financing devices) as we share later within the article.

If these measures nonetheless don’t work, it could be time to discover a purchaser to inject a major amount of money in alternate for possession of the corporate. Relying on the founder or administration, this will likely really be the optimum alternative to make sure the services or products continues to be delivered and in addition relieve the stress of getting to navigate the bear market alone. That stated, there must be purchaser curiosity, to start with.

Additionally Learn: Chunk-sized recommendation on cashflow in time of disaster for startups and SMBs

Finally not all companies shall be caught inside the security of this crossroads, and others will fold below stress, some extra spectacularly than others.

Whereas there are exterior elements to account for, how an entrepreneur could make it by way of this crossroads begins with a sensible and considerate response. As Tan places it, “…what I see these days is that the extra mature, considerate founders say it’s a good time. “We obtained fed final 12 months. Now we’re going to, roughly, see our productiveness per worker. We made the laborious choices.”

5 practices for more healthy money movement administration

The crossroads simply illustrated above will not be a tough quick determination tree that applies to each firm. That is only a simplified heuristic as an example the significance of increase wholesome money flows and runway if the corporate is to proceed rising sustainably on this market.

With that in thoughts, we listing down 5 practices coated each within the panel beforehand talked about and in a dialog with former Slack CFO Allen Shim that adopted the panel. These practices transcend fundraising and pure finance and apply to numerous elements of firm constructing, from inside communication to hiring and advertising and marketing.

Word that these are practices (and never treatments) which suggests they’re greatest utilized as a part of an organization’s working ideas and administration ethos somewhat than as one-off actions.

Learn extra concerning the 5 practices for more healthy money movement administration on Insignia Enterprise Overview.

–

Editor’s word: e27 goals to foster thought management by publishing views from the group. Share your opinion by submitting an article, video, podcast, or infographic

Be part of our e27 Telegram group, FB group, or just like the e27 Fb web page

Picture credit score: Canva Professional

This text was first revealed on March 14, 2023

The put up Oh my money: Navigating money movement administration in at present’s market appeared first on e27.

[ad_2]

Source link