[ad_1]

Introduction: UK meals worth inflation pushed down by grocers’ worth battle

Good morning, and welcome to our rolling protection of enterprise, the monetary markets and the world economic system.

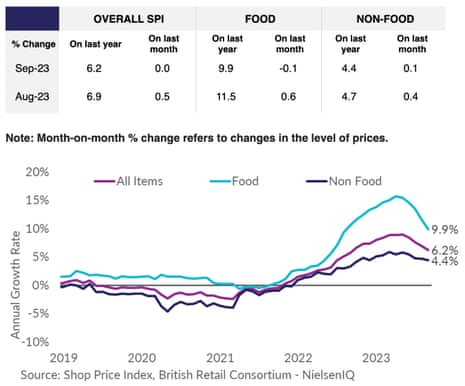

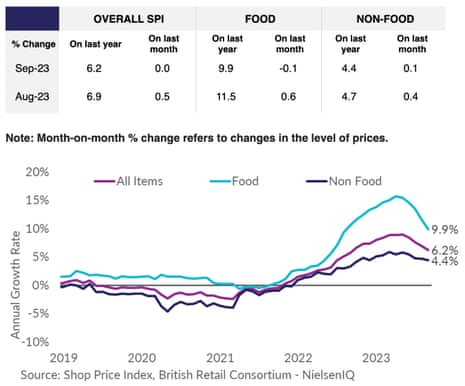

Meals costs within the UK are lastly falling, new information this morning exhibits, because of a grocery store worth battle and easing inflationary pressures.

The British Retail Consortium reviews that UK meals costs fell by 0.1% throughout September. That’s the primary month-to-month drop in the price of meals within the retailers in over two years.

It introduced the annual charge of meals worth inflation right down to 9.9% in September, down from 11.5% in August, and the bottom since August 2022.

Helen Dickinson, OBE, chief govt of the British Retail Consortium, stated ”fierce competitors between retailers” pulled year-on-year meals inflation right down to single digits.

Prospects who purchased dairy, margarine, fish and greens – all sometimes own-brand traces – could have discovered decrease costs in comparison with final month. Households additionally benefitted from worth cuts for varsity uniforms and different back-to-school necessities.

A number of UK supermarkets have introduced rafts of worth cuts in latest months, with Tesco squeezing suppliers so it may possibly move financial savings on.

Extra extensively, the BRC says costs in British retailer chains rose on the slowest tempo in a 12 months in September, with annual store worth inflation cooling to six.2% final month from 6.9% in August, its lowest since September 2022.

Annual non-food inflation dropped to 4.4% in September, its lowest since December 2022, and down from August’s 4.7%.

Dickinson predicts store worth inflation to proceed to fall over the remainder of the 12 months, nonetheless there are nonetheless many dangers to this pattern.

They embody excessive rates of interest, climbing oil costs, international shortages of sugar, and provide chain disruption from the battle in Ukraine.

Meals costs have been a key issue pushing up the official UK inflation charge within the final 18 months or so, so the BRC’s figures might point out the price of residing squeeze is easing.

That may cheer the federal government, with reviews final weekend that Rishi Sunak would possibly name a common election as soon as CPI inflation has dropped beneath 3%. It was 6.7% in August, having peaked round 11% final 12 months.

Additionally arising right now

The extremely anticipated legal trial of Sam Bankman-Fried, former CEO of bankrupt crypto alternate FTX, begins right now; he faces seven counts of fraud and conspiracy.

The agenda

-

8am BST: Spanish unemployment for September

-

2pm BST: Sam Bankman-Fried’s trial begins in New York

-

3pm BST: JOLTS US job openings information

-

3pm BST: IBD/TIPP index of US financial optimism.

Key occasions

Pound hits new six-month low

The pound has dropped to its lowest degree towards the US greenback since mid-March this morning.

Sterling has dipped to $1.2059 this morning, a six and a half-month low.

The slide got here because the greenback hit its highest degree of 2023 towards a basket of currencies. It has been strengthening on account of issues that rates of interest will keep excessive for longer than anticipated, because of the power of the US economic system.

Yesterday, manufacturing information confirmed that America’s manufacturing sector was near restoration, whereas final week’s jobless claims figures remained traditionally low. That might encourage the US Federal Reserve to boost rates of interest on extra time this 12 months.

In distinction, the Financial institution of England could have ended its climbing cycle, after leaving UK rates of interest on maintain final month.

September was the worst month in a 12 months for the pound, towards the US greenback, and October has not began strongly both.

Susannah Streeter, head of cash and markets at Hargreaves Lansdown, says:

The greenback’s power is about to compromise different nations efforts to convey down inflation as their weaker currencies within the face of the dollar’s power makes imports costlier.

The pound has been despatched reeling once more to $1.207, the bottom ranges since mid-March.

The collision of a weaker outlook within the UK with the resilience the US economic system is exhibiting is weighing closely on sterling, amid expectations the Federal Reserve will hike rates of interest once more, whereas the Financial institution of England has pressed pause and the trail is extra unsure.

Authorities bond costs additionally fell yesterday, pushing up the yield (or rate of interest) on UK gilts to the best degree for the reason that fallout from Liz Truss’s mini-budget a 12 months in the past.

The oil worth is weakening this morning, which might take some strain off inflation.

Brent crude is down 0.5% at $90.25 per barrel. Final week it hit $97.69 per barrel, however has slid again because the greenback has strengthened, and issues over the worldwide financial outlook have risen.

Extra excellent news on inflation: Greggs shouldn’t be planning to boost costs earlier than Christmas.

Greggs CEO Roisin Currie instructed Reuters this morning that:

“We don’t have any plans presently to take any additional worth rises pre-Christmas.”

Greggs has not raised its costs since June, when some merchandise went up by 5p to 10p every, Reuters provides.

Shares in quick trend retailer Boohoo have hit an eight-year low, after it warned that revenues this monetary 12 months might fall rather more than forecast.

Boohoo instructed shareholders that the restoration in its gross sales volumes has been slower than anticipated. It now believes revenues this monetary 12 months will fall by between 12% and 17%. In Could it had predicted a fall of as much as 5%.

Boohoo has been hit by falling gross sales as prospects returned to the excessive road after the pandemic, and by falling demand for leisurewear as staff headed again to the workplace.

Boohoo says it has reduce its common promoting costs, year-on-year, whereas the broader UK clothes market noticed worth inflation of 8%.

However revenues within the UK are down 19%, reflecting “the impression of the macro surroundings on client demand”, in addition to worth cuts.

Shares dropped round 10% in early buying and selling to the bottom since August 2015.

Greggs outcomes: What the analysts say

Greggs stated it has loved robust buying and selling and inflation is starting to ease, says Victoria Scholar, head of funding at interactive investor:

The bakery’s providing of drinks and snacks with speedy service have been having fun with robust gross sales from staff and different individuals on the go. Regardless of the cost-of-living disaster with customers compelled to make cutbacks, demand at Greggs stays sturdy because of its aggressive pricing and interesting vary of cold and hot objects like sandwiches, sausage rolls, coffees, and candy treats.

Even confronted with pressures from inflation, Greggs remains to be increasing with between 135 and 145 internet store openings this 12 months and it is usually investing in its provide chain.

Shares in Greggs are up over 40% over the previous 12 months. However they’ve been giving again some good points for the reason that Could highs. Nonetheless the analysts stay bullish on the inventory with 8 purchase suggestions versus 3 holds and 0 sells.”

Charlie Huggins, supervisor of the High quality Shares Portfolio at Wealth Membership, says Greggs’ efficiency up to now this 12 months is spectacular, and it ought to return to revenue progress in 2024 as value pressures ease:

“That is one other stable efficiency from Greggs in a difficult financial surroundings, with little signal up to now of customers reducing again on sausage rolls and pasties.

Greggs has continued to achieve market share in a troublesome surroundings which is mightily spectacular. There is no such thing as a doubt Greggs’ model is resonating strongly with the UK client and is in positive fettle.

The price of uncooked supplies, power and wages have risen quickly during the last 12 months, however encouragingly these value pressures at the moment are starting to ease. This isn’t simply excellent news for revenue margins however must also assist underpin client demand by decreasing the necessity for worth will increase.

Matt Britzman, fairness analyst at Hargreaves Lansdown says the baker chain “continues to please”.

Greggs is beginning to construct fairly the popularity for delivering robust outcomes, and right now’s replace actually hasn’t bucked that pattern. As soon as heralded for its sausage rolls, Greggs has labored onerous to increase the menu while retaining its core worth providing. All of the whereas, the increasing supply service (like the brand new partnership with Uber Eats), click on & acquire choices, and later opening occasions make it simpler than ever to get your bakery repair.

Inflated prices are beginning to ease, which supplies extra wiggle room on pricing over the second half. Don’t be stunned to see a slight cooling impact on like-for-like gross sales from right here, because it laps intervals final 12 months when costs moved larger. It’s a win in the long term although, much less strain on prices makes it simpler to maintain costs in test and retain that coveted worth providing.

Bears will argue the valuation doesn’t go away a complete lot of room for error, they usually’d be proper. However with nice meals comes with even larger expectations and Gregg’s broadening shoulders look robust sufficient to hold that weight.”

Greggs prospects will probably be eager to know that its autumn menu is now out there.

It features a sizzling spicy rooster and veg bhaji baguette, whereas new vegetarian choices embody a cheese and honey mustard toastie, veg bhaji flatbread and mozzarella and cheddar bites.

on the drinks facet, there’s a brand new hazelnut mocha and hazelnut sizzling chocolate, whereas the pumpkin spice latte is again on the menu too.

Greggs lates quarterly outcomes additionally exhibits that it continued to increase throughout the UK.

It opened 144 new shops up to now this 12 months, and closed 62, resulting in a internet enhance of 82 shops.

It expects between 135 and 145 internet store openings in 2023 and round 40 relocations.

Greggs: Some easing in value inflation in newest outcomes

British baker and quick meals chain Greggs has confirmed that value pressures are easing.

In its newest quarterly outcomes, simply launched to the Metropolis, Greggs says there was “some easing in value inflation” within the final three months.

The corporate explains that it’s now round a 12 months for the reason that “vital commodity-led will increase” of 2022 for power and meals elements, which implies annual inflation charges at the moment are slowing.

It provides:

At a time when prospects wish to make their cash go additional Greggs continues to supply distinctive worth and develop market share.

We’ve robust product and promotional plans for the fourth quarter and the extension of our supply service will make Greggs accessible to extra prospects on extra events.

Greggs reported that like-for-like gross sales in company-managed retailers have risen by 14.2% within the 13 weeks to 30 September.

It’s sticking with its steering for the monetary 12 months, regardless of “the uncertainty within the economic system as a complete”.

Introduction: UK meals worth inflation pushed down by grocers’ worth battle

Good morning, and welcome to our rolling protection of enterprise, the monetary markets and the world economic system.

Meals costs within the UK are lastly falling, new information this morning exhibits, because of a grocery store worth battle and easing inflationary pressures.

The British Retail Consortium reviews that UK meals costs fell by 0.1% throughout September. That’s the primary month-to-month drop in the price of meals within the retailers in over two years.

It introduced the annual charge of meals worth inflation right down to 9.9% in September, down from 11.5% in August, and the bottom since August 2022.

Helen Dickinson, OBE, chief govt of the British Retail Consortium, stated ”fierce competitors between retailers” pulled year-on-year meals inflation right down to single digits.

Prospects who purchased dairy, margarine, fish and greens – all sometimes own-brand traces – could have discovered decrease costs in comparison with final month. Households additionally benefitted from worth cuts for varsity uniforms and different back-to-school necessities.

A number of UK supermarkets have introduced rafts of worth cuts in latest months, with Tesco squeezing suppliers so it may possibly move financial savings on.

Extra extensively, the BRC says costs in British retailer chains rose on the slowest tempo in a 12 months in September, with annual store worth inflation cooling to six.2% final month from 6.9% in August, its lowest since September 2022.

Annual non-food inflation dropped to 4.4% in September, its lowest since December 2022, and down from August’s 4.7%.

Dickinson predicts store worth inflation to proceed to fall over the remainder of the 12 months, nonetheless there are nonetheless many dangers to this pattern.

They embody excessive rates of interest, climbing oil costs, international shortages of sugar, and provide chain disruption from the battle in Ukraine.

Meals costs have been a key issue pushing up the official UK inflation charge within the final 18 months or so, so the BRC’s figures might point out the price of residing squeeze is easing.

That may cheer the federal government, with reviews final weekend that Rishi Sunak would possibly name a common election as soon as CPI inflation has dropped beneath 3%. It was 6.7% in August, having peaked round 11% final 12 months.

Additionally arising right now

The extremely anticipated legal trial of Sam Bankman-Fried, former CEO of bankrupt crypto alternate FTX, begins right now; he faces seven counts of fraud and conspiracy.

The agenda

-

8am BST: Spanish unemployment for September

-

2pm BST: Sam Bankman-Fried’s trial begins in New York

-

3pm BST: JOLTS US job openings information

-

3pm BST: IBD/TIPP index of US financial optimism.

[ad_2]

Source link