[ad_1]

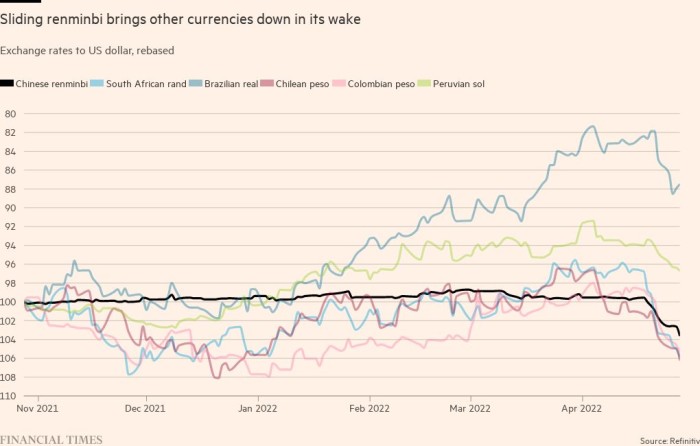

China’s forex has fallen steeply towards the greenback over the previous two weeks, hit by the financial affect of the nation’s Covid lockdowns, the conflict in Ukraine and the prospect of tighter US financial coverage. However the renminbi has not moved in isolation: analysts warn it’s dragging down different rising market currencies with it, together with these exterior of the Asian manufacturing complicated.

With meals and vitality costs hovering, currencies of commodity-exporting rising markets comparable to Brazil and South Africa are among the many few to have gained any benefit from Russia’s invasion of Ukraine in late February. Many such currencies additionally benefited from Chinese language demand for industrial commodities, comparable to copper and iron ore, earlier this 12 months.

In April, nonetheless, the mix of China’s slowing financial system and the worldwide fallout of the conflict despatched emerging-market currencies all over the world into reverse.

Yerlan Syzdykov, international head of rising markets at Amundi, says the proliferation of strict lockdowns in China is inflicting weak point throughout the financial system. The worst-case state of affairs projected by Amundi’s analysts is that lockdowns will trigger a ten per cent discount in manufacturing and an 18 per cent fall in metal manufacturing.

Amundi was bearish on Chinese language development earlier than the current lockdowns started. Its home view was for GDP development this 12 months to come back in at virtually a full proportion level under the IMF’s forecast of 4.4 per cent. However even that determine is now below strain, stated Syzdykov.

“That is having a damaging impact on commodity costs — these nations particularly in Latin America which have had a constructive impact to this point on their phrases of commerce, they’re going into retreat,” he stated. “It will positively have an effect on their longer-term prospects.”

In late April, the Brazilian actual was one of many best-performing currencies on the planet earlier this 12 months, with a 20 per cent achieve towards the greenback. A pointy pullback since then has left it a extra modest 13 per cent increased.

In the meantime, the Peruvian sol and Colombian pesos have fallen closely. The Chilean peso and South African rand, have worn out virtually all of this 12 months’s good points.

Central banks in Brazil and several other different rising markets reacted early to the prospect of rising US rates of interest and a stronger greenback by lifting borrowing prices from the primary half of final 12 months.

However whereas the expectation earlier than the Ukraine conflict was that inflation in growing economies would peak across the center of this 12 months, Syzdykov stated, this was now more likely to be delayed by a minimum of one other three months — probably placing extra sustained strain on these nations’ currencies.

It is just after that time {that a} recent restoration would possibly ensue, Syzdykov steered. “That may be the second when worldwide traders begin going again in, and people flows will assist to propel these currencies once more,” he stated.

[ad_2]

Source link