[ad_1]

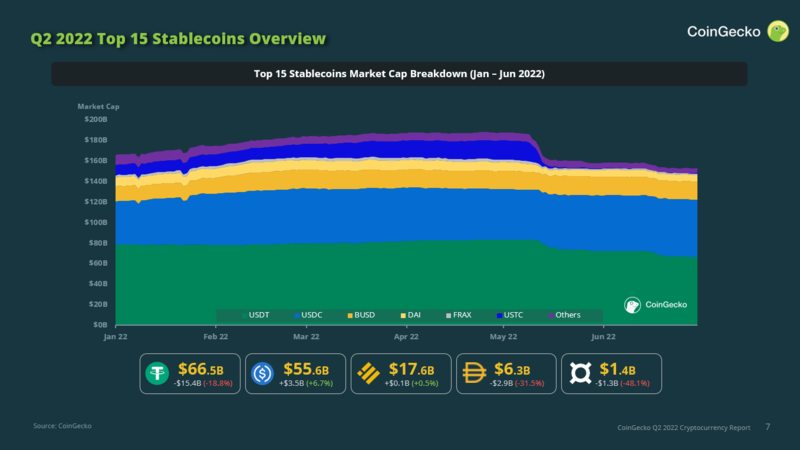

On July 13, the devoted crypto worth monitoring, quantity, and market capitalization internet portal Coingecko printed the corporate’s “Q2 2022 Cryptocurrency Report” which discusses the final quarter’s crypto market motion and insights. The 46-page report explains how the Terra UST and LUNA fallout wreaked havoc on the whole crypto ecosystem and the stablecoin economic system. Furthermore, Coingecko researchers say “a lower within the stablecoin market share means that a certain quantity of capital has fully exited the crypto ecosystem.”

Coingecko’s Information Suggests Q2 Buyers Exited Stablecoins Somewhat Than De-Risking Into Them

Coingecko has printed the corporate’s second quarter cryptocurrency report for 2022 as there’s been numerous vital adjustments over the last three months. The examine, printed final Wednesday, notes that Q2 2022 was “stuffed with many unlucky occasions within the crypto house.”

The crypto agency’s report explains that whereas spot market commerce volumes have remained regular at $100 billion each day, “the highest 30 cash have misplaced over half their market cap for the reason that earlier quarter.” A lot of the crypto blunder began from a domino impact brought on by the Terra UST and LUNA collapse.

Coingecko particulars that simply earlier than UST’s downfall, the stablecoin was the third-largest fiat-based token in existence, and $18 billion was erased in just some days. The report notes that BUSD managed to turn out to be the third-largest stablecoin. Beside’s Terra’s UST, different stablecoin property noticed their valuations endure and Coingecko’s analysts suspect a certain quantity of funds have left the crypto economic system. The researcher’s Q2 2022 examine says:

The slight lower (discounting UST) in stablecoin market share means that a certain quantity of capital has fully exited the crypto ecosystem, in distinction to final quarter when traders probably de-risked into stables amidst market uncertainty.

The Terra and 3AC Fallouts Unfold, Defi Market Cap Tumbles

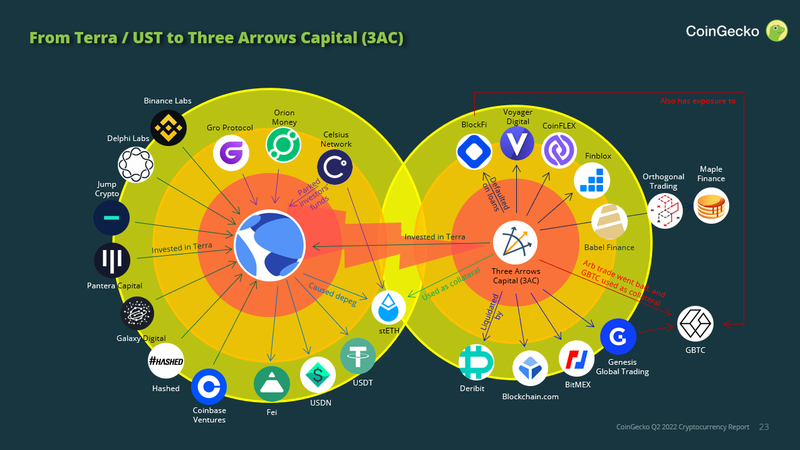

The 46-page report additional explains how Lido’s bonded property have been affected by the Terra blowout and the demise of the crypto hedge fund Three Arrows Capital (3AC). One particular chart shared within the examine exhibits how 3AC’s monetary points affected at the very least 12 totally different crypto corporations straight or not directly.

Decentralized finance (defi) was additionally hit, as Coingecko’s authors say “Because of third-order results, defi protocols reminiscent of Maple Finance weren’t spared as some customers’ funds have been lent to Orthogonal Buying and selling, which in flip had gone to Babel Finance, certainly one of 3AC’s collectors.”

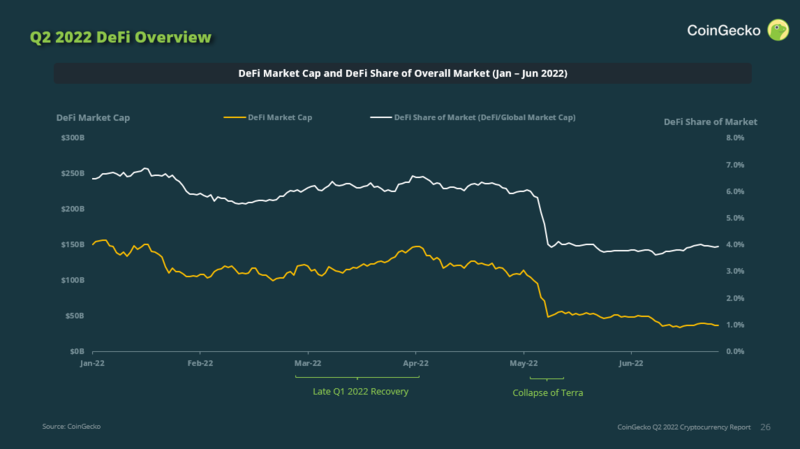

Defi itself suffered quite a bit and Coingecko’s information exhibits that the defi market cap slid from “$142 billion to $36 billion in a span of three months.” The report once more says that a lot of the worth in defi was “worn out largely because of the collapse of Terra and its stablecoin, UST.”

Coingecko’s examine covers all kinds of topics that pertain to Q2 2022’s crypto motion and touches on matters like different stablecoins dropping their peg, decentralized trade (dex) commerce volumes, non-fungible tokens (NFTs), and NFT marketplaces. Whereas the second quarter noticed lots of motion, Coingecko’s report highlights how most of it has been bearish and gloomy.

What do you consider Coingecko’s report and the motion recorded within the second quarter of 2022? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Coingecko

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any injury or loss brought about or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link