[ad_1]

Tomorrow is my first full day again at work after per week of go away with household; I’m slowly easing myself into my common routine.

There are such a lot of crosscurrents that I assumed a number of “meals for thought” questions would possibly assist the method. These are meaty points, a few of which I hope to handle in larger element within the coming weeks.

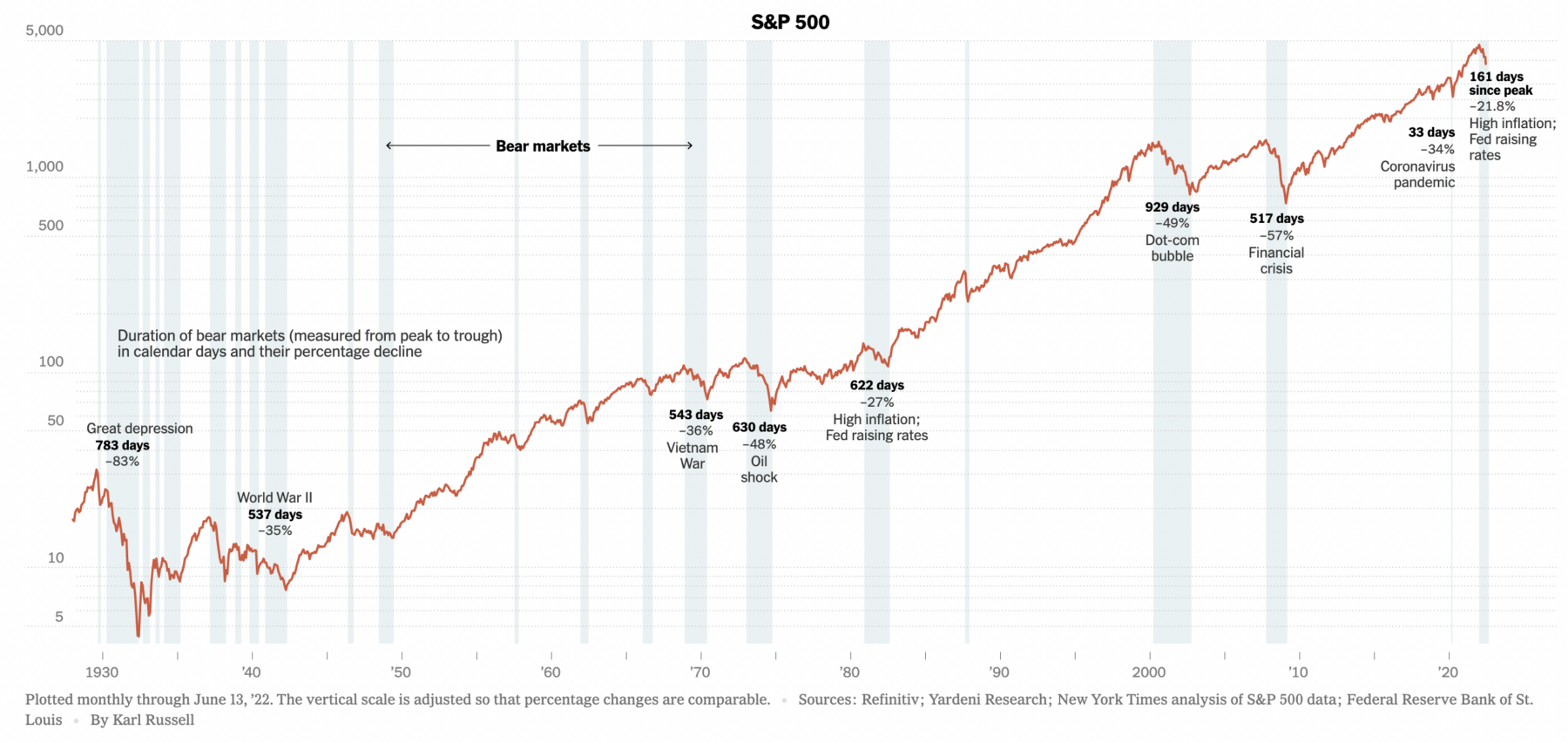

1. Bear Market: Recessions often see Bear markets accompany them, however not all the time. The New York Instances chart above reveals the historical past of the 2. Our first query: Will this Bear deliver on a recession?

2. Inflation: Are we close to peak inflation? Will the chew on shoppers sluggish consumption, and subsequently costs? Does the world return to the Deflationary regime anytime quickly? Does the FOMC consider inflation is monetarily based mostly? Do they suppose charges are the motive force?

3. Bonds: What are the ramifications of the bond bull market, which started 40 years in the past in 1982, ending?

4. Recession: Will the economic system undergo a progress slowdown? Can the Fed cool the economic system simply sufficient to curtail demand-driven inflation with out making a full-on contraction? Is a gentle touchdown doable/possible? Is the plan merely to crimp demand simply sufficient to permit provide chains to normalize? Or will the Fed over-tighten credit score and trigger a recession?

5. Crypto: Does Crypto current a systemic danger? Is that this an asset class that may spill over into the remainder of the economic system, e.g., Housing/Mortgages within the mid-2000s? Or, is that this extra just like the collapse of a single 3 trillion-dollar firm?

6. Cyclical versus Secular: Will this be a protracted and drawn-out secular bear market, e.g., 1966-82 or 2000-2013? Or will this be a cyclical bear inside a secular bull, e.g., 1998, 2010, 2018, 2020?

7. Earnings: Revenue progress has been wholesome the previous decade; can income develop with greater — or a lot greater — charges?

8. Retail Gross sales: How does the buyer reply to inflation and a common slowing? How will they modify to elevated provide? What do greater charges do to demand?

9. Housing: Are sufficient properties being constructed to steadiness the demand? How lengthy will a decade of undersupply have an effect on the housing market? What do 6%+ mortgage charges do to the demand aspect of the equation?

10. Struggle/Russian invasion of Ukraine: Will this conflict finish anytime quickly, or is that this one other Afghanistan that may run for years? Will it spill over into Europe? What does this imply for Russia as a nation?

These are the questions I’m asking myself. I don’t know the solutions, however I’ll proceed to discover all of them…

Beforehand:

Capitulation Playbook (Could 19, 2022)

Secular vs. Cyclical Markets, 2022 (Could 16, 2022)

Panic Promoting Quantified (March 24, 2022)

Bull & Bear Markets

Supply:

What Occurs When Inventory Markets Change into Bears

By William P. Davis, Karl Russell and Stephen Gandel

New York Instances, June 13, 2022

[ad_2]

Source link