[ad_1]

Lucie Pinson has labored on questions regarding the vitality transition and finance for plenty of years. Previous to this, she led campaigns specializing in the accountability of finance in social, environmental and local weather injustices. She has labored for Pals of the Earth and the Dawn Challenge. In 2020, she based the NGO Reclaim Finance, which campaigns to decarbonise the monetary sector and put it on the service of social and local weather justice. She was the laureate of the celebrated Goldman Prize (dubbed the “inexperienced Nobel”) in 2020.

To what extent is finance a “important lever” within the struggle in opposition to local weather change?

Cash is all the things. To see the sunshine of day, an infrastructure mission – be it a college, a railway line, a hospital, an oil platform or a gasoline energy station – wants financing and insurance coverage cowl.

Avoiding local weather breakdown and making the transition to sustainable societies requires large funding: greater than €406 billion a 12 months between now and 2030 for the European Union alone. The transition will solely occur if it succeeds in attracting the mandatory funding, and is insured. Huge finance due to this fact has a accountability. That is recognised within the Paris Settlement, which calls on the sector to align itself with local weather aims. In sensible phrases, this implies performing on two ranges: rising funding for “inexperienced” options, but in addition winding down the funding for polluting companies which should finally disappear.

Attention-grabbing article?

It was made potential by Voxeurop’s group. Excessive-quality reporting and translation comes at a value. To proceed producing impartial journalism, we want your help.

Subscribe or Donate

One other important issue is the necessity for sobriety. We’ll solely keep away from a crash if we scale back vitality consumption at a worldwide degree. Right here the monetary sector can play a task, as a result of this additionally requires particular investments. However politicians should act first to make sure that the primary effort is requested of probably the most prosperous – who’re by default the largest emitters – and never these whose elementary rights are already in danger.

For the vitality sector, the purpose for 2020 is to speculate ten euros within the transition, together with six in sustainable electrical energy manufacturing, for every euro invested in fossil fuels. Past the quantities, there may be the query of high quality, of what’s truly funded. The six euros needs to be centered on wind and solar energy, with out forgetting the grid and storage. As for the one euro that may nonetheless need to go to fossil fuels, it needs to be spent on current infrastructure and particularly on applied sciences to scale back emissions – and completely not on growing new infrastructure.

In brief, funding needs to be allotted with nice care. However neither is that this simply an train in logistics. It’s in the beginning about politics. The options exist, and traders realize it. If they’re nonetheless channelling large sums into the growth of fossil fuels, that’s just because they’ve determined to prioritise their short-term income over any social or environmental issues.

What (and the way a lot) are we speaking about once we discuss with “inexperienced finance“? Is it not an oxymoron?

The expansion in climate-friendly commitments by worldwide traders has coincided with a development in rhetoric about “inexperienced finance” or “sustainable finance”. These phrases largely discuss with monetary services and products that help sustainable initiatives, or not less than ones which are chosen on the premise of extra-financial standards. That is in distinction to conventional monetary merchandise, that are judged purely on grounds of their monetary returns.

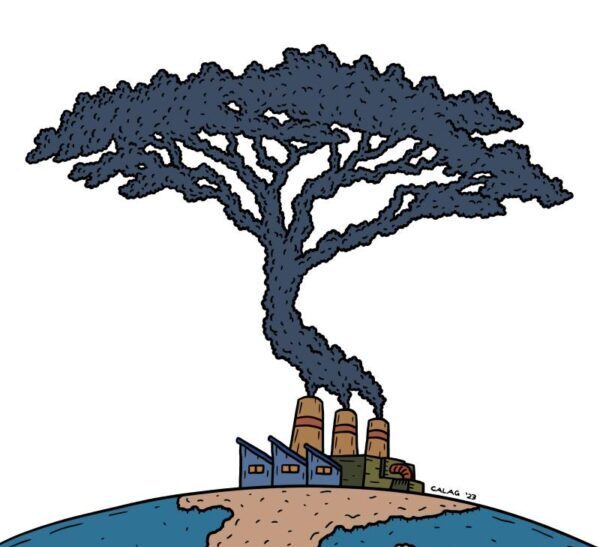

Clearly, abusive use of those phrases can quantity to greenwashing. As well as, “inexperienced finance” as I’ve simply outlined it does nothing to deal with the foundation reason behind local weather change, i.e. the extreme launch of greenhouse gases into the ambiance by way of polluting actions which are incompatible with 1.5°C of worldwide warming. The very time period can sound like a confession of guilt on the a part of the monetary sector, which is effectively conscious that conventional finance is at odds with the sustainability goal.

The expansion in climate-friendly commitments by worldwide traders has coincided with a development in rhetoric about “inexperienced finance” or “sustainable finance”

Sadly, this time period has grow to be the main focus of a lot hype as to distract consideration from the investments that proceed to worsen our predicament. It’s true that we’re seeing the emergence of official labels and makes an attempt at nationwide and European degree to control using terminology and the content material of merchandise labelled “inexperienced”. However in concrete phrases little has been carried out to pressure traders to cease supporting tasks and corporations with enterprise fashions which are incompatible with the target of limiting international warming to 1.5°C.

This example fits the pursuits of financiers effectively, particularly these most closely uncovered to hydrocarbons. Not solely does inexperienced rhetoric divert consideration from their most climate-damaging merchandise, it additionally means new markets and thus new alternatives for development and income, this time on ostensibly inexperienced merchandise which procure status.

There are already devices, such because the European Inexperienced Finance Regulation (SFDR), which impose requirements on banks when defining the monetary merchandise provided to traders. Alas, as proven in Voxeurop‘s reviews on inexperienced finance, the SFDR is written in deceptive and ambiguous language that leaves it open to abuse.

What do you see because the position of establishments? Are there any clear points at stake within the run-up to the European elections in June?

The European Fee’s earlier time period of workplace was that of the Inexperienced Deal; the subsequent should be that of its strengthening and, above all, its financing. The difficulty has been largely ignored till now. Our bodies such because the Worldwide Power Company (IEA) and the European Fee agree that 80% to 85% of the financing wants for the transition should come from the personal sector. Public intervention shall be important to pressure monetary gamers to make the suitable asset-allocation decisions.

There isn’t any scarcity of cash, but it surely won’t be directed in the direction of local weather options with out correct regulation. And never simply any regulation: we have to transfer away from regulation that’s restricted to calls for for transparency and reporting, and in the direction of regulation that places politics entrance and centre. It should form the behaviour of monetary establishments and the companies they fund.

The outgoing commissions might have made it obligatory for monetary gamers to undertake correct plans, particularly by the directive on company responsibility of care. However that directive finally excluded the monetary sector, largely because of the French financial system ministry and France’s EU presidency.

As on many different dossiers, the French authorities cynically reneged on the 2019 marketing campaign pledges of its personal candidates and went in opposition to the votes of its personal parliamentarians: within the EU Council France opposed regulation of the monetary sector regardless of a majority vote in favour by MEPs within the EU Parliament. It appears that evidently marketing campaign guarantees are solely binding on those that imagine them.

In June, voters shall be finest suggested to decide on on the premise of what has been voted for and supported by the varied events over the past 5 years. As for teams like Reclaim Finance, we shall be trying past the elections, and we urge others to remain mobilised too. These elections will kick off one other 5 years of wrestle to place European finance on the service of social and environmental justice.

Who’re crucial gamers? The banks are on the centre of our financial system.

Banks play a key position as a result of they maintain the purse strings. Although securities and bonds are purchased by traders, their issuance on the markets requires the involvement of banks. And but European banks proceed to work in opposition to the worldwide local weather aims, in addition to these of their very own international locations and the EU. For the reason that final European elections, the EU’s prime 15 banks have offered greater than €170 billion to the hundred or so firms on the forefront of the fossil-fuel trade. Two-thirds of this comes from the 4 main French banks, which have made progress on coal however little or no on oil and gasoline.

Of the 15 French banks which have financed fossil-fuel growth in recent times, what number of have dedicated to ending that funding sooner or later, in keeping with the scientific suggestion and projections by the IEA? Only one. And none has dedicated to the 2030 goal of investing six euros in sustainable energies for every euro allotted to fossil fuels.

This even though banks are actually coming to phrases with the science. For instance, the CEO of Crédit Agricole publicly acknowledged on the group’s final normal assembly that oil and gasoline growth was not suitable with limiting warming to 1.5°C, and that his financial institution couldn’t simply flip a blind eye to the brand new hydrocarbon tasks of the sector’s giants. And but the financial institution nonetheless finds a method to finance them: even at this time it’s instantly funding the development of liquefied pure gasoline (LNG) terminals. The Banque Populaire Caisse d’Epargne group is probably an excellent worse foot-dragger: it just lately took half in a $4.25 billion deal for TotalEnergies, cash that may go to grease and gasoline – particularly, to the event of recent LNG fields and terminals, to which TotalEnergies nonetheless allocates two-thirds of its investments.

What options and instruments do we now have to cope with this?

The options exist. All that is still is to make them occur, and that may solely be potential by taking over the establishments in place. Within the space of finance, folks typically speak in regards to the significance of fixing one’s financial institution or selecting monetary merchandise which are good for the planet and human rights. Such actions are certainly vital, however they solely grow to be actually efficient when carried out collectively by political motion. So it stays important to talk out and mobilise collectively to demand that we regain management of our personal cash and of finance normally.

What progress can we level to?

We are able to welcome the introduction of double materiality, by the European Company Sustainability Reporting Directive (CSRD). Double materiality signifies that monetary gamers should listen not solely to the monetary dangers to which they’re uncovered – as an example, these linked to local weather change – but in addition to the impression of their investments on the local weather, human rights and ecosystems.

However to date this stays a easy train in transparency. It must be prolonged to incorporate an obligation to undertake correct transition roadmaps. These ought to point out, particularly, how a monetary agency intends to align its enterprise with European and worldwide local weather aims. The plan should additionally specify how the corporate intends to wind down its investments in polluting companies, to extend its investments in inexperienced options, and to help the transformation of sectors that – as with metal and electrical energy era – have a future offered they decarbonise.

[ad_2]

Source link