[ad_1]

British retail gross sales stagnate

Retail gross sales throughout Britain stalled in March, as the price of residing squeeze continues to hit spending, new knowledge reveals.

The Workplace for Nationwide Statistics has simply reported that British retail gross sales volumes stagnated in March, following modest progress of simply 0.1% in February (revised up from stagnation).

That’s weaker than anticipated; economists polled by Reuters had anticipated gross sales progress of 0.3% in March.

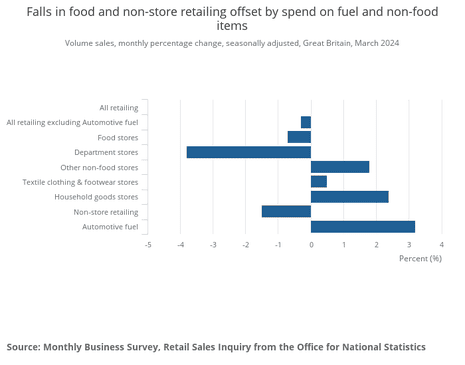

Whereas spending on motor gas and non-food items rose, there was a drop in spending at malls, on meals, and on-line.

On an annual foundation, gross sales volumes rose 0.8% over the 12 months to March 2024, weaker than the 1% anticipated.

That leaves them 1.2% under their pre-Covid-19 stage in February 2020.

ONS senior statistician Heather Bovill says:

“Retail gross sales registered no progress in March. {Hardware} shops, furnishings retailers, petrol stations and outfitters all reported an increase in gross sales. Nevertheless, these beneficial properties had been offset by falling meals gross sales and in malls the place retailers say greater costs hit buying and selling.

“Trying on the longer-term image, throughout the newest three months retail gross sales elevated after a poor Christmas.”

Key occasions

After approaching a report excessive early ths morning, gold has now slipped again as Tehran performs down at present’s assault.

Bullion is simply 0.1% greater at $2,381 per ounce, having traded as excessive at $2,417/ounce at one stage.

Within the constructing sector, building group Geoffrey Osborne is looking within the directors.

A discover saying the corporate’s intention to nominate adminstrators was filed with the Excessive Court docket shortly earlier than 4pm yesterday, Building Information stories.

This follows “an intensive effort” to safe new funding, Geoffrey Osborne explains, following tough years by which the development sector was hit by the pandemic, rising prices, and the surge in mortgage charges.

The corporate says:

Osborne has confronted important headwinds frequent to your entire building [industry] over the previous two years, fuelled by excessive inflation, the lingering impacts of Covid-19 and Brexit, and a slowdown in public sector procurement.

Regardless of these challenges, Osborne has maintained robust relationships with suppliers, contractors and employees, whereas delivering for patrons.

UK mortgage charges have crept just a little greater, after we realized on Wednesday that inflation fell by lower than anticipated final month.

The monetary markets are actually pricing in barely lower than two rate of interest cuts this 12 months, that means buyers aren’t totally satisfied that the Financial institution of England can have minimize Financial institution charge to 4.75% by December from 5.25% at present.

Information agency Moneyfacts stories that common mortgages charges are just a little greater this morning:

-

The common 2-year mounted residential mortgage charge at present is 5.83%. That is up from a median charge of 5.81% on the earlier working day.

-

The common 5-year mounted residential mortgage charge at present is 5.40%. That is up from a median charge of 5.39% on the earlier working day.

Britain’s FTSE 100 index can be being pushed decrease by retail shares.

JD Sports activities (-2.3%) and Marks & Spencer (-2.1%) are within the high Footsie fallers, amid disappointment that gross sales volumes had been decrease than anticipated in March.

UK retailers’ failure to develop gross sales volumes final month (see earlier publish) reveals value rises are deterring consumption, says Paul Donovan, chief economist at UBS International Wealth Administration:

UK March retail gross sales had been weaker than consensus expectations. Customers nonetheless appear intent on punishing makes an attempt at profit-led inflation— value will increase are deterring consumption.

UK retail gross sales knowledge doesn’t immediately seize the pivot to spending on having enjoyable as providers aren’t included, however stronger clothes gross sales trace at this pattern.

Airline shares fall as geopolitics takes centre stage

Falling airline shares are dragging European inventory markets to their lowest stage in a month this morning.

The primary airways are primarily decrease this morning, hit by the upper oil value (which pushes up gas prices) and fears of journey disruption if the Center East battle escalates.

Right here’s the scenario presently:

Kathleen Brooks, analysis director at XTB, says geopolitics are taking centre stage within the markets once more:

Almost every week to the day when Iran despatched drones and missiles into Israel, Israel has retaliated and despatched a missile into Iran. The preliminary stories prompted a big uptick within the oil value. Brent crude jumped almost $4 per barrel on the information above $90 per barrel, nevertheless it has since retreated as the small print concerning the extent of the assault emerge.

The missiles struck targets in Western Iran, and no nuclear websites have been broken. Air house round Iran had been closed, however stories say it’s now again open. Thus, we are able to assume this is not going to be a barrage of assaults and as a substitute a one punch retaliation for Iran’s transfer final Saturday. As Jeremey Bowen of the BBC put it, the clandestine struggle between the 2 foes is now out within the open. Thus far, the assaults have been restrained, which is inflicting some aid to markets. Nevertheless, the danger premium throughout asset costs is more likely to rise as the long run stays unclear. Will Iran and Israel go away one another alone now that they’ve had their tit-for-tat reprisals? Or does this proceed, with well-planned ‘assaults’ which might be designed to trigger the least quantity of civilian injury and are extra a present of what might be doable?

Whereas that is clearly preferable to an all-out struggle, it’s a dangerous technique. One mistake that causes casualties or hits an sudden goal might set off an escalation in reprisals and a deeper, extra harmful scenario within the Center East. Because of this volatility is more likely to stick round, particularly because it comes at a fragile time for monetary markets as they recalibrate expectations for rate of interest cuts.

Though European inventory markets definitely aren’t in a full-blooded plunge, but anyway, the primary indices are all within the purple – following losses throughout Asia in a single day (see 7.21am).

The European Stoxx 600 is at a one-month low, as buyers fret about occasions within the Center East.

Right here’s the scenario in early buying and selling:

-

FTSE 100: -36 factors or -0.46% at 7842 factors

-

Germany’s DAX: -152 factors or -0.9% at 17,681 factors

-

France’s CAC: -45 factors or -0.6% at 7,976 factors

-

Italy’s FTSE MIB: -345 factors or -1% at 33,533 factors

-

Wall Avenue is heading for losses when it opens in 4 hours, too, with the S&P 500 down 0.5% in pre-market buying and selling.

Richard Hunter, head of markets at interactive investor, says:

“Asian markets bore the brunt of the breaking information of a retaliatory assault on Iran by Israel, additionally sending Dow futures sharply decrease and leading to additional spikes in gold and oil costs.

US markets is not going to have the chance to react on to the developments till later, however the escalation will put strain on the primary indices, which had been already lining up for a weekly drop. The Dow Jones managed a wafer-thin acquire on Thursday, whereas the Nasdaq and S&P500 continued on a downward pattern which is eroding the heady beneficial properties remodeled current months.

Within the 12 months thus far, the Dow has now added simply 0.2%, the Nasdaq 3.9% and the S&P500 5% as rate of interest considerations proceed to weigh on investor sentiment.

Gasoline costs have jumped this morning, with the UK month-ahead contract up 1.9% to 82.7p per therm.

Airline shares drag FTSE 100 down

Shares are dipping in Europe as merchants digest occasions within the Center East in a single day.

In London, the FTSE 100 blue-chip share index is down 38 factors or 0.5% at 7838 factors.

IAG, the mother or father firm of British Airways, is the highest faller, down virtually 4%, adopted by easyJet (-2.5%).

Engineering agency Rolls-Royce, which makes and providers jet engines, are down 1.7%.

European markets are additionally decrease, with the pan-European Stoxx 600 down 0.6%.

Retail recession is over, says Capital Economics

Though gross sales volumes (the quantity of stuff individuals purchased) had been flat in March, the primary quarter of 2024 has been a brighter time for retailers than the final quarter of 2023.

Gross sales volumes elevated by 1.9% within the three months to March 2024 in comparison with the earlier three months, the ONS stories.

That brings the retail recession to an finish, declares Capital Economics this morning.

Alex Kerr, their assistant economist, explains:

Regardless of the softer-than-expected knowledge, retail gross sales nonetheless added virtually 0.1 proportion factors to actual GDP progress in Q1. Furthermore, the prospect of rate of interest cuts and the enhance to actual family incomes, from falling inflation and the 2p minimize to nationwide insurance coverage in April, counsel the restoration in shopper spending will proceed all through this 12 months.

Automotive gas gross sales volumes rose to their highest stage since Might 2022 in March, at present’s retail gross sales report reveals.

Retailers informed the ONS this rise was linked to elevated footfall on their forecourts.

March’s retail gross sales stagnation is “disappointing”, says Nicholas Hyett, Funding Supervisor at Wealth Membership, commented:

“Retailers had a gloomier March than many anticipated, and general gross sales stay 1.2% under their pre-covid peak.

Department shops stay an space of explicit weak point, not excellent news for John Lewis which introduced it could not be paying its common employees bonus for the second 12 months in a row throughout the month. Nevertheless, excessive avenue retailers extra broadly have really carried out higher, it’s meals retail and on-line buying which have held again progress.

The disappointing numbers will gas hypothesis that the Financial institution of England will take into account rate of interest cuts this summer season, although aren’t poor sufficient to necessitate a transfer.

British retail gross sales stagnate

Retail gross sales throughout Britain stalled in March, as the price of residing squeeze continues to hit spending, new knowledge reveals.

The Workplace for Nationwide Statistics has simply reported that British retail gross sales volumes stagnated in March, following modest progress of simply 0.1% in February (revised up from stagnation).

That’s weaker than anticipated; economists polled by Reuters had anticipated gross sales progress of 0.3% in March.

Whereas spending on motor gas and non-food items rose, there was a drop in spending at malls, on meals, and on-line.

On an annual foundation, gross sales volumes rose 0.8% over the 12 months to March 2024, weaker than the 1% anticipated.

That leaves them 1.2% under their pre-Covid-19 stage in February 2020.

ONS senior statistician Heather Bovill says:

“Retail gross sales registered no progress in March. {Hardware} shops, furnishings retailers, petrol stations and outfitters all reported an increase in gross sales. Nevertheless, these beneficial properties had been offset by falling meals gross sales and in malls the place retailers say greater costs hit buying and selling.

“Trying on the longer-term image, throughout the newest three months retail gross sales elevated after a poor Christmas.”

S&P cuts Israel’s credit standing on heightened geopolitical threat

Final night time, rankings company S&P International lowered Israel’s credit standing, earlier than the stories of explosions in Iran.

S&P minimize Israel’s long-term rankings to A-plus from AA-minus, citing Heightened Geopolitical Threat, and left its outlook on detrimental.

S&P says:

“We forecast that Israel’s common authorities deficit will widen to eight% of GDP in 2024, largely on account of elevated protection spending”

S&P International predicts {that a} wider regional battle shall be prevented, however that the Israel-Hamas struggle and the confrontation with Hezbollah seem set to proceed all through 2024.

Asia-Pacific inventory markets are a sea of purple at present, after Israel carried out army operations towards Iran.

Japan’s Nikkei share index has shed 2.3%, or 883 factors, to 37,196, away from the report excessive set final month.

China’s CSI 300 is off 0.8%, and South Korea’s KOSPI is down 1.9%.

Introduction: Oil jumps after Iran explosions

Good morning, and welcome to our rolling protection of enterprise, the monetary markets and the world economic system.

Stories of highly effective explosions in Iran in a single day have pushed up the oil value, as buyers worry escalation within the Center East disaster.

Brent crude surged again over $90 amid stories of explosions close to the Iranian metropolis of Isfahan, with US officers confirming that Israel has carried out army operations towards Iran.

Oil jumped on fears that the battle had entered a brand new section, whereas shares fell.

Stephen Innes, managing associate at SPI Asset Administration, says:

Stories of an Israeli aerial bombardment focusing on a key nuclear facility in central Isfahan have sparked a major shift out of threat belongings and into safe-haven investments.

Metallic and tender commodity costs – reminiscent of wheat, soybeans and corn – additionally rose, on fears of transport disruption and better vitality enter prices.

Larger oil and meals costs, and transport prices, would add to inflation, undermining efforts to carry the price of residing disaster below management.

However… markets are calming down considerably, with Brent crude now easing again to $89/barrel (up 2% at present) as Iran seems to minimize the incident.

Oil and gold costs coming down

👉 “Opposite to the rumors and claims made by the Israeli media on Friday morning, there are not any stories of an assault from overseas on Iran’s central metropolis of Isfahan or another a part of the nation,” Iran’s semi-official Tasnim stories

— Stephen Stapczynski (@SStapczynski) April 19, 2024

A senior commander of Iran’s Military Siavosh Mihandoust has stated that no injury was prompted within the in a single day assault, in line with state TV, including that the noise heard in a single day in Isfahan was on account of air defence methods focusing on a “suspicious object”.

Diplomat Carl Bildt, co-chair of the European Council on Overseas Relations, says that is vital, and that the bottom line is to interrupt the harmful cycle of escalation.

Whether or not there was a big 🇮🇱 assault or not isn’t significantly related – vital is that 🇮🇷 is taking part in down the stories. Key now’s to interrupt the harmful cycle of escalation. https://t.co/h8TqFmKn8O

— Carl Bildt (@carlbildt) April 19, 2024

Our good Center East Disaster liveblog has all the small print:

Additionally arising at present

Some lenders to Thames Water are going through the prospect of dropping as much as 40% of their cash if the troubled provider is nationalised, with a lot of its £15.6bn debt ending up on the general public books.

EXC: The key Whitehall blueprint for Thames Water’s renationalisation:

– bulk of £15.6bn money owed go on state steadiness sheet

– some lenders to lose 35-40% of £

– new public company takes possession, based mostly on Crossrail

– fairness worn outBy @Annaisaac https://t.co/3oRjheFnQf

— John Collingridge (@jmcollingridge) April 18, 2024

The Guardian revealed final night time {that a} authorities blueprint, codenamed Challenge Timber, is being drawn up; it could flip Britain’s greatest water firm right into a publicly owned arm’s-length physique.

Some lenders to its core working firm might lose as much as 40% of their cash below the plans, which which is at a sophisticated stage. Extra right here:

There’s additionally pleasure within the crypto foreign money world, the place bitcoin is about to bear a halving. This can minimize the rewards for bitcoin miners in half, to reduces the tempo at which new bitcoins enter the market.

The agenda

-

7am BST: UK retail gross sales for March

-

2pm BST: IMF/World Financial institution Spring Assembly continues in Washington DC

-

3.15pm BST: Financial institution of England deputy governor Dave Ramsden on panel about classes to be taught from post-pandemic inflation

[ad_2]

Source link