[ad_1]

Over at Alphaville, Robin Wigglesworth appears at whether or not ‘Greedflation’ (aka price-gouging) meaningfully contributed to Eurozone inflation. Particularly, Financial institution of England analysis means that whereas they “discover no proof of an increase in general income within the UK” they did discover that “firms within the oil, gasoline and mining sectors have bucked the development” with “some firms… far more worthwhile than others.”1

I used to be fairly skeptical about Greedflation initially; when i ranked the highest 15 sources of US inflation in mid-2022, “Company Revenue Searching for” was on the backside, ranked 13 out of 15 inflation causes.

However as time went on, extra analysis and knowledge turned obtainable. Slowly however absolutely, we got here to study that extra firms had been adapting to the pandemic period’s mixture of rabid demand and provide chain snarls with a selected strategy selecting “Value over quantity.”

The primary particular person to determine this was Corbu’s Samuel Rines. (Twitter) He first started discussing the company choice for sustaining margin in 2022; over time, he noticed some firms had pricing energy for each value AND quantity. Quickly after, “Value over quantity” started to morph into “Value AND Margin” (PAM).

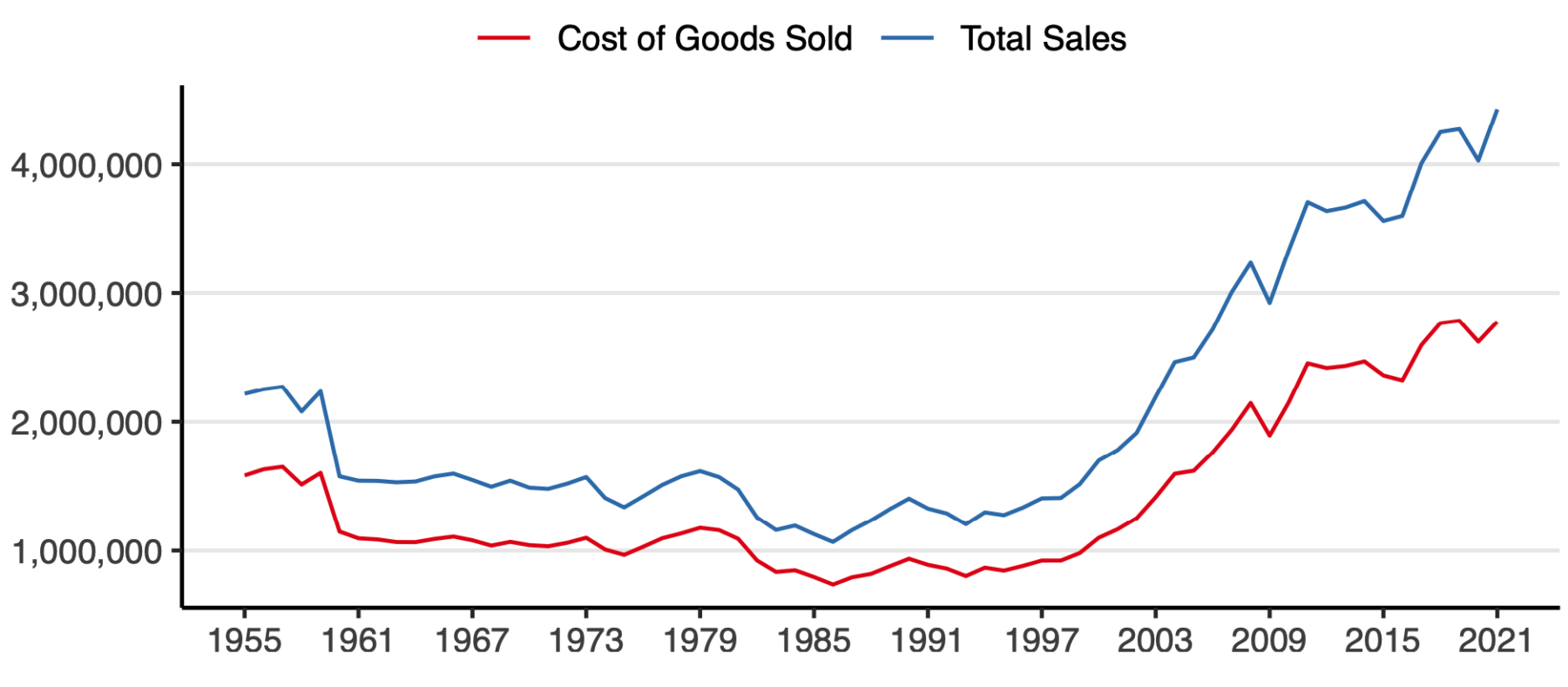

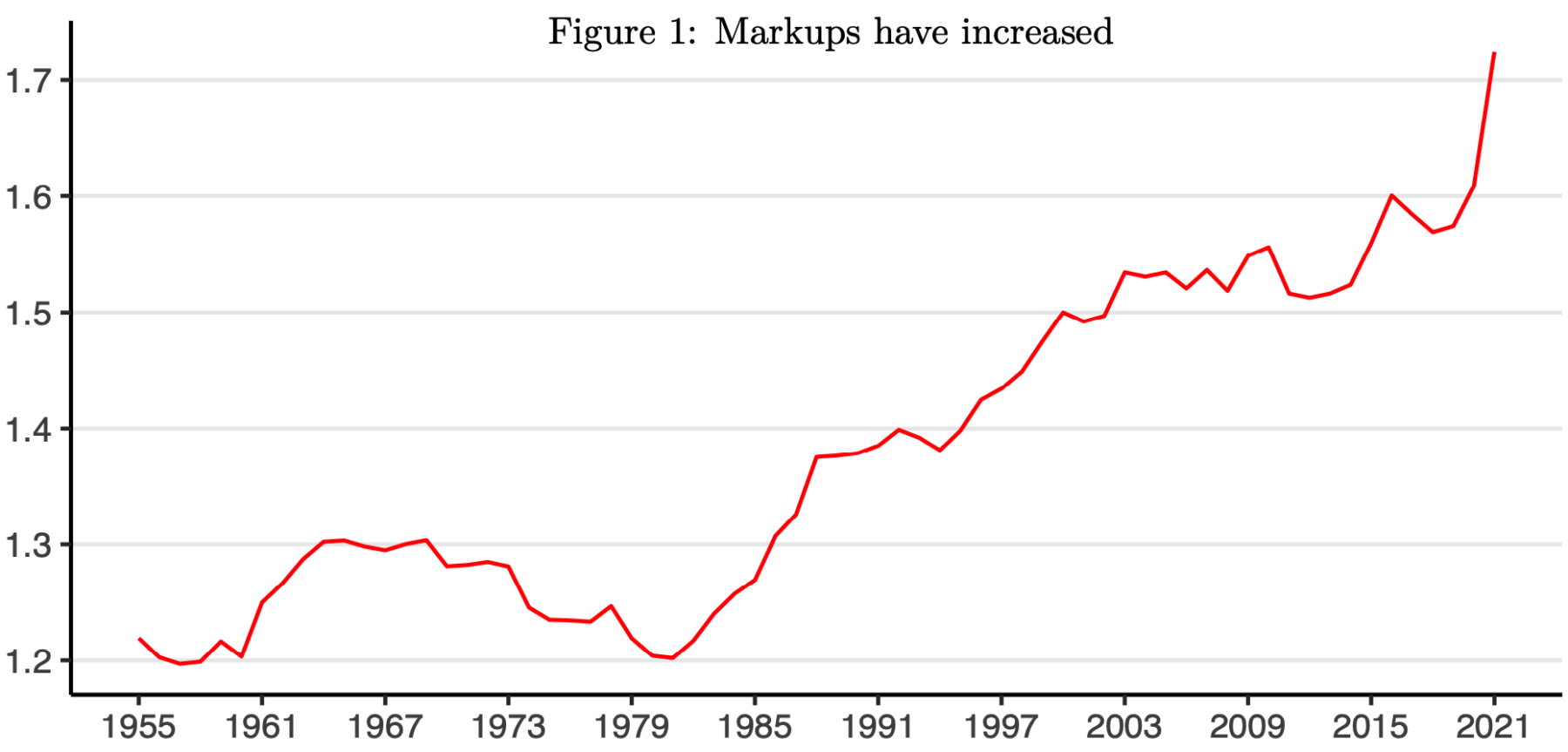

It’s the form of topic ripe for educational evaluation. Mike Konczal, director of the macroeconomic evaluation program on the Roosevelt Institute, wrote a report, Costs, income, and energy. (See charts above and under) The main target was on annual web revenue margins. It was about 5.5% within the 1960 to 1980 period. Within the ZIRP decade of ultra-low charges within the 2010s, it rose to six%. In 2021, it shot as much as 9.5%.

That’s an enormous, unexplained enhance:

Fortune lined Greedflation on July 11, 2022: “There’s an enchanting debate enjoying out about markets, costs and inflation. Do firms increase costs as a result of they should, with a view to preserve tempo with inflation? Or, sensing a possibility to notch larger income, do they benefit from an inflationary atmosphere to lift costs, thereby fueling inflation?” (emphasis added)

There are different sources of value will increase, together with hyper-regulated localities, particularly in vitality and housing. In August 2022, Vox recommended that in case you had been mad about inflation it’s best to blame your native officers.

The drip of information made me surprise how a lot I underestimated greedflation initially. As shoppers, we frequently don’t (and can’t) see lots of the inputs into last unit costs. Take into account The Hidden Charges Of Ship Cargo:

“A cadre of ocean carriers are charging exorbitant, probably unlawful, charges on transport containers caught due to congestion at ports. Sellers of furnishings, coconut water, even youngsters’ potties say the charges are inflating prices.”

As ballooning prices hit the wallets of American households, the worldwide ocean transport trade is having fun with its most worthwhile interval in current historical past. Within the first quarter of 2022, the largest carriers’ working margins hit 57%, in line with one trade analysis agency, after hovering within the single digits earlier than the pandemic.” (emphasis added)

Any trade having fun with its most worthwhile interval in historical past will get my consideration.

My bias is that I used to be on Crew Transitory from the start. For positive, transitory took longer than anticipated, however as we realized earlier this week, it asserted itself once more. However the threat of “stickier” inflation stays, pushed largely by company income, aka Rines’ PoV and PaM:

“In uncommon conditions—reminiscent of an economic system’s reopening after a pandemic—widespread data that prices are rising permits companies to lift their costs understanding that their opponents will act in the identical approach, in line with a paper by Isabella Weber, assistant professor of economics on the College of Massachusetts, Amherst, and her colleague, Evan Wasner.”

The “inform” about company income and greedflation got here after 2022 proved to be such a difficult 12 months within the markets. Regardless of 500+ BPS of charge will increase, a ~20% drop within the S&P500, and a 30+% drop within the Nasdaq 100, income have remained significantly better than anticipated:

“A comparability reveals how extraordinary our present inflationary misery really has been and nonetheless is. Not like through the Seventies, firms in the present day wield ample market energy to successfully defend their revenue mark-ups (and, by doing so, to understand larger income) throughout a time of inflationary stress that’s corresponding to that of the Seventies.”

At the same time as inflation has come again down, the aftermath is that value will increase have held. Company margins and income may very well be the rationale why value will increase will stick, whilst CPI falls again to regular. The speed of value will increase could have normalized, however the absolute value ranges in the present day are a lot larger.

As Emily Stewart noticed, “What goes up could not come down. Like, ever.”

Let’s hope she is mistaken…

See additionally:

Greedflation’ revisited (FT, November 16, 2023)

Earnings in a time of inflation: what do firm accounts say within the UK and euro space?

Gabija Zemaityte and Danny Walker

Financial institution Underground, 16 November 2023

Banana Ships And The Hidden Charges Of Ship Cargo

GCaptain, July 3, 2022

Costs, Earnings, and Energy: An Evaluation of 2021 Agency-Stage Markups

Mike Konczal Niko Lusiani

Roosevelt Institute June 2022

Why Is Inflation So Sticky? It Might Be Company Earnings

Paul Hannon

WSJ, Could 2, 2023

Revenue Inflation Is Actual

By Servaas Storm

Institute for New Financial Pondering June 15, 2023

The issue isn’t inflation. It’s costs.

by Emily Stewart

Vox, Nov 14, 2023

Beforehand:

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

Has Inflation Peaked? (Could 26, 2022)

Transitory Is Taking Longer than Anticipated (February 10, 2022)

The Tide of Value over Quantity (April 21, 2023)

__________

1. There are many similarities between the UK and the USA, however loads of variations as nicely. The experiences with company margin growth throughout a interval of inflation within the U.S. appear to have been markedly totally different than these within the UK.

[ad_2]

Source link