[ad_1]

Russia’s income from fertiliser exports soared final 12 months regardless of a decline in gross sales volumes, as crop nutrient costs rose sharply after its invasion of Ukraine.

Within the first 10 months of 2022, Russian fertiliser exports jumped 70 per cent to $16.7bn in comparison with the identical interval in 2021, in line with UN knowledge.

Import statistics from Moscow’s commerce companions present that, in quantity phrases, abroad gross sales by the world’s largest fertiliser exporter solely fell 10 per cent from the identical interval the earlier 12 months, evaluation by the UN Meals and Agriculture Group discovered.

That is regardless of analysts’ predictions on the outbreak of the conflict in February that shipments would collapse.

Meals and fertiliser exports from Russia are exempt from western sanctions in an effort to assist meals safety, particularly for poorer international locations. Moscow has been rising its exports to international locations resembling India, Turkey and Vietnam.

“Clearly international locations like India have been the largest beneficiaries [in terms of fertiliser imports],” stated the FAO’s Josef Schmidhuber.

Russian and EU officers have been involved that some consumers and their banks and insurers have been self sanctioning and avoiding shopping for merchandise from Russia.

The EU final month clarified the exemption from sanctions for Russian agriculture and fertiliser exports after claims amongst EU member states that shipments have been typically being held up as a consequence of worries over doable involvement of sanctioned Russian firms or people.

The EU launched new exemptions permitting particular person EU member states to unfreeze cash of sanctioned people who have been concerned within the Russian fertiliser and agricultural sectors.

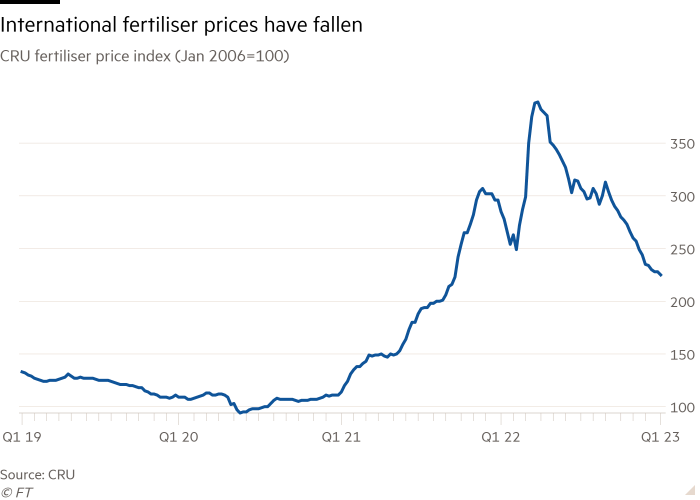

Worldwide costs fertiliser costs started to surge even earlier than the conflict as Russia curtailed provides of pure fuel, the principle feedstock for nitrogen fertilisers. Costs for potash, one other essential fertiliser, jumped after western governments imposed sanctions on Belarus, one of many main producers of the crop nutrient, after Minsk quashed anti-government protests.

The sharp rise in fuel costs after the Russian invasion led to plant closures in Europe, which drove up costs of nitrogen fertilisers, that are essential to output and high quality of meals manufacturing.

Nonetheless, Russia is unlikely to proceed to profit from larger costs this 12 months. Current falls in fuel costs in Europe because of hotter than regular climate have led to decrease fertiliser costs, with producers within the area ramping up manufacturing.

“This implies imports by EU international locations will fall significantly and is nice information for farmers all over the world,” stated Schmidhuber.

European fuel costs have now declined to ranges not seen since earlier than Russia’s invasion of Ukraine.

“European manufacturing is worthwhile and producers proceed to churn out fertiliser,” stated Chris Lawson, head of fertiliser at consultancy CRU. “International nitrogen provides are ample, and we anticipate continued declines in phosphate and potash costs,” he added of the three key vitamins.

Grain shipments have additionally returned to prewar ranges. The quantity of grains, together with wheat and corn, shipped in the course of the previous three months of 2022 was up 21 per cent from the identical interval the earlier 12 months, in line with knowledge from vessel trackers Sea/.

One commodity that has not seen a restoration in exports is ammonia, a feedstock for nitrogen fertilisers, as a result of closure of a pipeline by way of Ukraine. Russia accounts for about 12 per cent of the worldwide ammonia export market, and the FAO knowledge exhibits that Russian exports of the chemical, which can also be utilized in industries resembling plastics and textiles, fell 76 per cent by quantity within the first 9 months of 2022 in comparison with the identical interval the earlier 12 months.

The Black Sea grain settlement between Moscow and Kyiv brokered by the UN and renewed in November included a pledge to restart Russian exports of ammonia by reopening of the pipeline. Russian fertiliser firms and traders, together with sanctions-hit Russian fertiliser billionaire Dmitry Mazepin, have been calling for a resumption of shipments though the latest fall in worldwide nitrogen fertiliser costs weakens the urgency, analysts stated.

Further reporting by Andy Bounds in Brussels

[ad_2]

Source link