[ad_1]

Delivery big Maersk flags slowdown in demand as darkish clouds collect

Container delivery big Maersk has sounded a warning that international demand is slowing, saying that “freight charges have peaked”.

The Copenhagen-based firm instructed traders that the Ukraine warfare, Europe’s vitality disaster, excessive inflation and a ‘looming international recession’ had been all hitting the world financial system.

It now expects international container demand to fall by between 2% and 4% this yr, down from a earlier forecast of +1 to -1%.

Though A.P. Moller – Maersk posted one other document quarter for July-September, its chief government Søren Skou warned that demand was falling:

Nevertheless, it’s clear that freight charges have peaked and began to normalize in the course of the quarter, pushed by each lowering demand and easing of provide chain congestion.

The warning knocked shares in Maersk by over 5%.

The world’s greatest delivery firm noticed its earnings rocket as the worldwide financial system reopened after pandemic lockdowns, and demand for containers surged. Its earnings tripled in 2021 to $24bn.

However now, weakening demand as hovering inflation hits spending are weighing on the sector.

CEO Skou provides that ‘darkish clouds’ are gathering:

With the warfare in Ukraine, an vitality disaster in Europe, excessive inflation, and a looming international recession there are many darkish clouds on the horizon. This weighs on client buying energy which in flip impacts international transportation and logistics demand.

Key occasions

Filters BETA

Wall Road has dropped in early buying and selling, forward of tonight’s Federal Reserve assembly.

The Dow Jones industrial common has dipped by 130 factors, or 0.4%, to 32,522, whereas the broader S&P 500 index is 0.5% decrease.

The stronger-than-expected enhance in US jobs final month (on the ADP payroll report) has dampened hopes that the Fed may strike a dovish tone tonight.

The London inventory market has soured too, with the FTSE 100 now down 48 factors or 0.66%, at 7,137 factors.

UK provides two Roman Abramovich ‘enterprise associates’ to Russia sanctions record

Rupert Neate

Two Russian oligarchs and enterprise companions of Roman Abramovich have been added to the UK authorities’s sanctions record in response to the invasion of Ukraine.

Alexander Abramov and Alexander Frolov, whom the UK authorities mentioned had been “identified to be enterprise associates” of the previous Chelsea FC proprietor, had been on Wednesday amongst 4 new Russian metal and petrochemical tycoons added to the sanctions record.

The pair beforehand owned massive stakes in Russian metal and coking coal producer Evraz, which was part-owned by Abramovich and subjected to sanctions in Could. Abramovich was one of many first oligarchs to be subjected to sanctions.

Extra right here:

Tomorrow, UK households might be hit by the most important rate of interest rise in a long time when the Financial institution of England proclaims its financial coverage determination.

With inflation hitting a 40-year excessive of 10.1% in September, the BoE might hike Financial institution Charge by 75 foundation factors, or three quarters of a p.c, to three%.

That may be the most important enhance since 1989, should you exclude Black Wednesday in 1992 when charges had been briefly hiked from 10% to 12%, after which 15%, earlier than the Main authorities introduced Britain was crashing out of the European Alternate Charge Mechanism.

Nicholas Hyett, funding analyst at Wealth Membership, says it’s too early to name time on charge rise, however will increase might be slower from right here.

The Financial institution of England’s modest 0.5% rate of interest hike in October in all probability contributed to the market chaos brought on by Liz Truss’ catastrophic mini-budget. It’s unlikely the Financial institution of England will repeat the error, and we count on charges to rise by no less than the 0.75% the market is anticipating.

Nevertheless, the general financial image might be higher now than it was a month in the past. The financial institution could effectively really feel it might probably ease its foot off the gasoline going forwards – with charges rising slower and ending decrease than we’d have thought even a couple of weeks in the past.

It helps that the federal government and financial institution are actually pulling in the appropriate course. The Financial institution raises charges to curb inflation, by discouraging folks from spending cash. Rishi Sunak’s plans to lift taxes and minimize public spending have the identical impact. The latest stability in sterling reduces the necessity to hike charges to defend the forex too.

Provide fears as China lockdown hits world’s largest iPhone manufacturing unit

Verna Yu

Chinese language authorities have introduced a seven-day coronavirus lockdown within the space world wide’s largest iPhone manufacturing unit, stoking concern that manufacturing will probably be severely curtailed forward of the Christmas interval.

Foxconn’s plant in Zhengzhou, which employs about 200,000 folks, produces nearly all of Apple’s new telephones, together with the brand new iPhone 14.

It has been rocked by discontent over stringent measures to curb the unfold of Covid-19, with staff fleeing the location over the weekend after complaining about their therapy and provisions through social media. Close by cities have drawn up plans to isolate migrant staff fleeing to their dwelling cities, to forestall the unfold of the virus.

Right here’s the total story:

Bloomberg have a very good Twitter thread on the problem too:

Foxconn is scrambling to mitigate the potential disruption, elevating wages and arranging for backup from its different Chinese language crops.

It’s fought additionally to quell hypothesis on social media that a few of the contaminated employees had died. https://t.co/oVsIfdGhcY

— Bloomberg (@enterprise) November 2, 2022

The lockdown in Zhengzhou comes at a vital time for Apple, which launched the iPhone 14 throughout an unprecedented hunch in international electronics demand

Extra ⬇️ https://t.co/bu0ZuHvqCA

— Bloomberg (@enterprise) November 2, 2022

Aston Martin isn’t the one automobile maker struggling provide chain issues (see earlier).

Ford has reported that US gross sales fell 10% final month, yr on yr, resulting from provide points that delayed shipments to sellers.

The Detroit carmaker offered 158,327 new autos in October, down from practically 176,000 items in October 2021.

The strikes deliberate at Royal Mail on Black Friday, and after Cyber Monday, will trigger in depth disruption for retailers, warns Nadeem Malik, head of digital know-how agency Software program AG, UK and Eire.

These are prime income alternatives, and supply delays for on-line orders threat a domino impact within the construct as much as Christmas.

“Strikes affecting the motion of products within the final mile have gotten extra commonplace, including strain to produce chains already impacted by international disruption. Due to this fact, provide chain networks and planning should develop into extra resilient but once more.

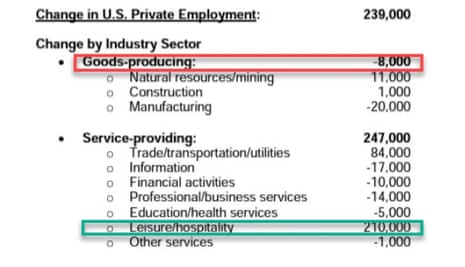

US payrolls report beats forecasts

US firms added extra jobs than anticipated final month, because of a surge in hiring at bars and eating places, retailers and journey corporations.

Non-public sector employment elevated by 239,000 jobs in October, in response to payroll operator ADP, greater than the 195,000 anticipated.

ADP reported that eating places, retailers and the journey sector ramped up hiring upfront of the vacations on the finish of the yr, however there was a drop in employment at producers, and in some service sectors.

Right here’s the

Items-producing: -8,000

Service-providing: 247,000

-

Commerce/transportation/utilities 84,000

-

Info -17,000

-

Monetary actions -10,000

-

Skilled/enterprise providers -14,000

-

Training/well being providers -5,000

-

Leisure/hospitality 210,000

-

Different providers -1,000

European inventory markets have had a subdued morning, as merchants await the US rate of interest determination later at present (6pm UK time).

Britain’s FTSE 100 index has dipped by 12 factors or 0.17% to 7,173, whereas the pan-European Stoxx 600 is flat.

With a one other 75-basis level hike priced in, traders are eager to listen to any suggestion that the Federal Reserve may ease off the whopping charge will increase.

It is like Groundhog Day for the markets, the place all of us collect round because the Fed emerges from its burrow to tell us whether or not to count on extra Winter or an early Spring pic.twitter.com/yY61jzWv3L

— Eric Balchunas (@EricBalchunas) November 2, 2022

However a bounce in US job vacancies yesterday, to 10.7m in September, cuts the probability the Fed will pivot tonight.

Neil Wilson of Markets.com explains:

The market continues to hope for some form of cautious language about decreasing the tempo of hikes. In his remarks on the final two press conferences Powell has mentioned that “in some unspecified time in the future, because the stance of financial coverage tightens additional, it would develop into essential to gradual the tempo of will increase whereas we assess how our cumulative coverage changes are affecting the financial system and inflation”. Any change to this – maybe suggesting that this level could be arriving – could also be seen as a pivot.

If Powell means that this level has arrived, and that the FOMC expects to start slowing the tempo of hikes on the subsequent assembly, it could be thought of very dovish and spark a significant transfer larger for equities with a transfer decrease for USD and US charges. Nevertheless, the market is already anticipating a slowdown within the tempo of hikes within the coming conferences and the Fed will wish to stay data-dependent – slowing is just not the identical as a pivot (beginning to minimize) however the market may prefer it anyway.

Iceland pushes authorities to increase free college meals

Iceland Meals has declared its public help for the Feed the Future marketing campaign which is looking at no cost college meals to be prolonged to all pupils residing in poverty.

The marketing campaign, coordinated by The Meals Basis, is urging the federal government to right away enhance the eligibility of Free Faculty Meals to incorporate all households who obtain Common Credit score or equal advantages.

This might give a further 1.4 million kids nutritious college meals, they are saying, at a time when many low-income mother and father are strugging to feed their households because of the surge in inflation.

At present, kids of fogeys who’re on common credit score and have an annual earnings of not more than £7,400, or are on one other profit equivalent to jobseeker’s allowance, are eligible at no cost college meals.

Richard Walker, mananaging director of Iceland Meals and potential Conservative MP (who we heard from earlier), says widening entry to high school meals would minimize the pressures on many households:

“Because the cost-of-living disaster continues to worsen, households are more and more involved about retaining meals on the desk – we see these worries first hand from our clients. By widening the factors for Free Faculty Meal eligibility, we will relieve the burden of stress that so many mother and father are experiencing and assist to offer kids the help they want.

Iceland is backing the Feed the Future marketing campaign and I’d encourage all companies to become involved and help in any means they’ll.”

Over 900 bus drivers employed by the Stagecoach group in East London have secured a ten% pay enhance, the Unite union has introduced, following the specter of strike motion.

Wheat costs fall as Russia returns to Black Sea grain deal

Wheat futures costs have tumbled nearly 6% in Chicago after Turkish president Recep Tayyip Erdoğan introduced that the hall for Ukraine exports will resume at present.

Russia introduced final weekend that it could pull out of the UN-brokered grain export deal, following an assault on its Black Sea naval base of Sevastopol.

That settlement allowed very important wheat shipments to circulation out from Ukraine to assist feed the thousands and thousands of impoverished folks dealing with starvation worldwide, so Russia’s withdrawal was threatening to reignite the worldwide meals disaster.

In the present day, although, Erdoğan mentioned Sergei Shoigu, the Russian defence minister, had phoned his Turkish counterpart to say Moscow was again on board.

And right here’s the end result:

Moscow has confirmed it would renew its participation. The defence ministry mentioned in a press release that:

“The Russian Federation considers that the ensures obtained in the meanwhile seem adequate, and resumes the implementation of the settlement.”

World’s prime bankers count on markets to remain turbulent

Among the world’s prime bankers have warned that markets will stay turbulent as central banks attempt to cool inflation with out plunging the worldwide financial system right into a downturn.

Reuters studies that Morgan Stanley CEO James Gorman instructed a summit in Hong Kong that his intestine feeling was that central banks would handle to curb value rises however traders would wish to get used to larger inflation — of round 4% versus 1-2% earlier than “this disaster”.

Gorman instructed the International Monetary Leaders’ Funding Summit that:

“It’s a painful transition, however not an surprising transition,”

Goldman Sachs CEO David Solomon additionally spoke, warning that inflation and “very fast” financial tightening (rate of interest rises) after over a decade of comparatively accommodative insurance policies are making the world extra risky and unsure.

Solomon added:

“(It) permits exposures the place there’s leverage within the system to be amplified in a short time,”

Solomon pointed to the latest turmoil within the UK, the place Liz Truss’s mini-budget triggered a hunch in gilts and liquidity crunch in pension funds in September and early October.

Power disaster placing most German corporations below duress

The vitality disaster is impacting practically each department of the German financial system, new knowledge exhibits.

The variety of firms that see excessive vitality prices because of the Ukraine warfare as a menace to enterprise on the highest degree on document, a enterprise survey by DIHK (the Affiliation of German Chambers of Commerce and Business) exhibits.

Some 82% of the 24,000 companies surveyed see the costs for vitality and uncooked supplies as a enterprise threat, the very best since DIHK started retaining information in 1985.

Euro zone manufacturing unit downturn deepens as demand slumped

The downturn at Europe’s factories intensified final month, one other signal that the area might be in recession.

S&P International’s eurozone manufacturing PMI index has fallen to a 29-month low of 46.4 in October from September’s 48.4, worse than the ‘flash’ studying final month, and deeper into contraction.

Many international locations, together with Germany and France, noticed their manufacturing unit sectors shrink at a sooner charge.

Corporations reported a bigger hunch in new orders – which inserts with Maersk’s prediction of weaker delivery demand.

Joe Hayes, senior economist at S&P International Market Intelligence, says the PMI surveys are actually “clearly signalling that the manufacturing financial system is in a recession,” including:

“In October, new orders fell at a charge we’ve not often seen throughout 25 years of information assortment – solely in the course of the worst months of the pandemic and within the top of the worldwide monetary disaster between 2008 and 2009 have decreases been stronger.”

Maersk CEO: Europe near recession with US not far behind

The boss of Maersk has additionally warned that Europe is near getting into a recession and the US financial system might not be far behind.

After predicting that international container demand might fall 4% this yr, CEO Soren Skou instructed Bloomberg TV:

“It’s actually onerous to be very optimistic with a warfare on our doorstep and an even bigger vitality disaster this winter so that’s impacting client confidence and due to this fact additionally demand.

“It’s fairly probably that we both are or will quickly be in a recession, actually in Europe however probably additionally within the US.”

Delivery big Maersk cuts its forecast for worldwide container demand, saying utilization will shrink as a lot as 4% this yr due to an financial slowdown https://t.co/VITdNL7emn

— Bloomberg (@enterprise) November 2, 2022

Delivery big Maersk flags slowdown in demand as darkish clouds collect

Container delivery big Maersk has sounded a warning that international demand is slowing, saying that “freight charges have peaked”.

The Copenhagen-based firm instructed traders that the Ukraine warfare, Europe’s vitality disaster, excessive inflation and a ‘looming international recession’ had been all hitting the world financial system.

It now expects international container demand to fall by between 2% and 4% this yr, down from a earlier forecast of +1 to -1%.

Though A.P. Moller – Maersk posted one other document quarter for July-September, its chief government Søren Skou warned that demand was falling:

Nevertheless, it’s clear that freight charges have peaked and began to normalize in the course of the quarter, pushed by each lowering demand and easing of provide chain congestion.

The warning knocked shares in Maersk by over 5%.

The world’s greatest delivery firm noticed its earnings rocket as the worldwide financial system reopened after pandemic lockdowns, and demand for containers surged. Its earnings tripled in 2021 to $24bn.

However now, weakening demand as hovering inflation hits spending are weighing on the sector.

CEO Skou provides that ‘darkish clouds’ are gathering:

With the warfare in Ukraine, an vitality disaster in Europe, excessive inflation, and a looming international recession there are many darkish clouds on the horizon. This weighs on client buying energy which in flip impacts international transportation and logistics demand.

Shares in Subsequent have risen 2% this morning, to the highest of the FTSE 100 risers index, after it reported barely stronger gross sales than anticipated (see 7.37am publish).

However the retailer, like the remainder of the sector, faces troublesome occasions as clients may have much less disposable earnings to spend.

Matt Britzman, fairness analyst at Hargreaves Lansdown, explains:

“Broadly talking, Subsequent’s had an honest third quarter, although cost-of-living headwinds are nonetheless mounting for the retailer. Though the headline factors to gross sales progress, if curiosity earnings is stripped out underlying gross sales noticed a small decline.

A bumper week on the finish of September was the standout for gross sales. ‘Winter is coming’ rang true as a colder week meant consumers headed out to fill up on woollies and different heat garments.

That’s about the place the excellent news ends because the final two weeks of the quarter confirmed gross sales down 3.7% and 1.3% respectively and the outlook for the remainder of the yr factors to a 2% drop over the fourth quarter, in keeping with earlier steering.

Adam Vettese, analyst at social investing community eToro, agrees:

Circumstances are set for a disappointing Christmas interval, with many households beginning to really feel the cost-of-living disaster start to chew.

“Gross sales are forecast to dip 2% year-on-year for the remainder of the yr, though the agency has maintained its revenue outlook.

Within the Metropolis, shares in luxurious carmaker Aston Martin have tumbled 10% in the direction of a document low, after it minimize its forecast for automobile deliveries this yr.

Aston Martin blamed international provide chain issues for pushing again an anticipated enchancment in its funds, saying deliveries of its DBX SUV car had been held again by logistical disruption.

The corporate now expects to ship as few as 6,200 vehicles, down from an earlier projection of greater than 6,600 items, resulting from components shortages.

Shares have dropped to 94p, the worst-performing inventory on the FTSE 250.

Aston Martin’s shares have tumbled 81% throughout 2022.

However Lawrence Stroll, government chairman of Aston Martin Lagonda, says the corporate made “wonderful progress” this yr in the direction of changing into the world’s “most fascinating, ultra-luxury British efficiency model”.

Stroll insists Aston Martin noticed “very spectacular demand throughout our product vary” and substantial income progress, pushed by document common promoting costs.

Nevertheless, Stroll provides…

“Alternatively, and within the context of provide chain and logistics disruption in addition to inflationary pressures impacting the broader automotive trade, during the last two quarters we have now encountered particular provide chain challenges which have delayed our capability to satisfy buyer demand.

[ad_2]

Source link