[ad_1]

For the primary half of this yr, I’ve steadfastly refused to hitch Membership Recessionista. I’ve not believed we had been already in a recession, and I used to be hopeful {that a} reasonable Fed step by step elevating charges to throttle inflation might execute that comfortable touchdown.

Not.

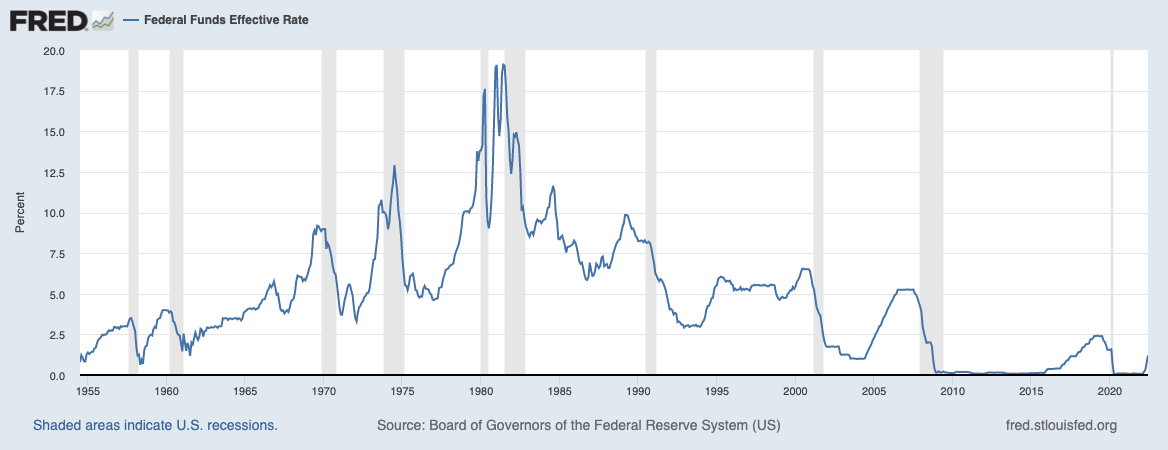

As I discussed to Tom Keene final week, Nick Timiraos within the Wall Avenue Journal revealed the Fed’s intention to lift charges 75 foundation factors introduced a reckoning to my hopes of a non-recessionary development decelerate.

A comfortable touchdown is now formally RIP.

What I’ve as an alternative are questions on what the remainder of 2022 seems like, and the way deep into 2023 any harm persists. Listed below are 5 of these questions:

1. Will second-quarter earnings (launched this month) disappoint or has the market already moderated expectations?

2. How a lot will the economic system gradual in Q3 and This fall?

3. How badly will third quarter earnings be hit?

4. Will the financial slowdown proceed into 2023?

5. How a lot of that is priced into the inventory market already?

Let’s dive into every of those:

1. Will second quarter earnings (launched this month) disappoint or has the market already moderated expectations? Q2 earnings have upset, however at the very least to this point appear to be in keeping with modestly diminished expectations. Corporations have upset however haven’t been broadly punished for it.

Examine this with the response to Q1 earnings (April) when numerous companies had been savagely punished for barely lacking consensus expectations. Common rule of thumb: Corporations that disappoint however don’t unload are inclined to have the dangerous information already of their costs.

That is extra according to a mid-cycle slowdown than a full on finish to the bull market

2. How a lot will the economic system gradual in Q3 and This fall? The trillion-dollar query. We’ve got already seen a large slowdown in dwelling gross sales. There are different worrisome modifications in client conduct: Two Wall Avenue Journal columns reported {that a} widespread swap in the direction of cheaper retailer manufacturers and cheaper names is already pressuring client meals, beer and tobacco firms.

We don’t have a lot perception into the auto market given the dearth of availability; its a reaosnable assumption that larger financing prices will crimp client spending there too. Oother sturdy items like home equipment, furnishings and even HELOC-financed additions/renovations can be anticipated two reasonable within the coming quarters.

3. How badly will third quarter earnings be hit? This might be probably the most tough query to deal with of all as we’re simply three and half weeks into the 13-week quarter. Driving spending has been 2 years of pent up demand attributable to the pandemic lockdowns; People are happening trip, touring, seeing films in theaters, visiting household, and so on. That is offset by larger costs and the worst client sentiment we’ve seen in many years.

Regardless of inflation and poor sentiment, customers have – at the very least to this point – continued to do what they do finest: Spend like there’s no tomorrow.

However there’s a tomorrow and my expectations are that if the Fed overtightens (as they seem on monitor to do) then the subsequent 12 months can be much less economically sturdy than the prior 12.

4. Will the financial slowdown proceed into 2023? Too many variables to deal with this query with any diploma of confidence. Nonetheless, after we see the economists’ consensus expectations for Federal Reserve cuts in 2023, that informs us this group is anticipating not merely a recession however one deep and long-lasting sufficient to mandate the FOMC has to reply aggressively.

5. How a lot of that is priced into the inventory market already? There are such a lot of variables in answering this query reverse engineering doable Q3 and This fall earnings and developing with some a number of appears to be a idiot’s errand.

I’ll counsel the next: Down 20% on the S&P 500 is a reasonably cheap strategy to low cost a light recession. If we’ve got a deeper recession or a extra extreme earnings lower (from file highs) then we could have to work our method right down to -28% to 32%.

It’s onerous to extrapolate a lot worse than a modest financial contraction from the place we’re in the present day. The economic system, company revenues, earnings, and client spending are to a point path dependent. Households are in good condition and company stability sheets are very wholesome. For this reason I’ve such a tough time imagining something a lot worse than a medium (worse than a light) recession.

Therefore, my expectations are that we are actually about 2/3 by means of the sell-off, and I might foresee revisiting the lows and surpassing them on poor Q3 earnings or perhaps a weak September warning season.

After all, all of that is simply wargaming doable situations. We don’t make investments primarily based on forecasts, and any variety of random surprises might make the economic system appreciably higher or worse.

We undergo these workouts in order to not be stunned about a few of the doable outcomes if they arrive to go.

See additionally:

Weak Earnings Experiences Aren’t Fazing Buyers After Brutal Yr for Shares (WSJ, July 24, 2022)

Beforehand:

Danger & Reward: Two Sides of Similar Coin (July 20, 2022)

Rally🤗, A number of Compression✔️, Earnings¯_(ツ)_/¯ Recession😔, Double Backside⁉️ (July 18, 2022)

Too Late to Promote, Too Early to Purchase… (June 16, 2022)

Capitulation Playbook (Could 19, 2022)

[ad_2]

Source link