[ad_1]

Solana (SOL) made headlines lately after being labeled as a “safety” by the US Securities and Trade Fee (SEC). Because of this, SOL is going through challenges in its value motion.

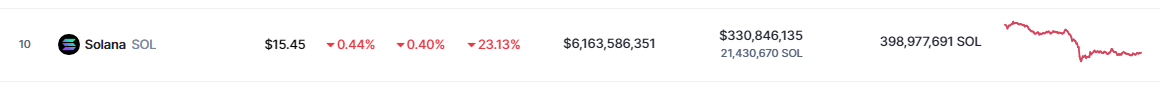

In gentle of this regulatory setback, traders carefully monitor SOL’s efficiency. In accordance with CoinMarketCap, SOL is presently priced at $15.45, sustaining a seven-day droop of 23.13%.

Supply: CoinMarketCap

Because the market stays unsure, one wonders: Will Solana be capable of get better from its latest downturn and regain its upward momentum?

SOL Faces Steep Decline As Assist Ranges Are Breached

The previous week has been difficult for Solana (SOL) because it skilled a big decline, inflicting it to breach the essential assist zone starting from $16.7 to $18.8.

This downward spiral was initiated by a weekend droop that coincided with Bitcoin’s (BTC) retest of $25,000. As SOL dropped beneath each the trendline resistance and March’s low of $16, it shifted right into a bearish bias.

Solana value in a downward trajectory. Supply: CoinMarketCap

For SOL to regain bullish momentum, it closely depends on Bitcoin surpassing $26,600 and efficiently crossing the $27,000 threshold. Nevertheless, with out this upward motion, the bulls may face challenges in clearing the confluence space located close to $17, which mixes bullish order guide assist and trendline resistance.

A possible rejection at this vital juncture might set off an additional decline in SOL’s value, probably main it towards the assist ranges at $14.9 and even $12.8.

Solana Basis Disagrees With SEC Label Of SOL As Safety

In separate lawsuits filed on June 5 and 6 in opposition to standard cryptocurrency exchanges Binance and Coinbase, the SEC designated the SOL token as a safety. The SEC’s classification was primarily based on numerous components, together with the expectation of income derived from the efforts of others, in addition to the way during which the tokens are utilized and promoted.

The Solana Basis disagrees with the characterization of SOL as a safety. We welcome the continued engagement of policymakers as constructive companions on regulation to attain authorized readability on these points for the 1000’s of entrepreneurs throughout the U.S. constructing within the…

— Solana Basis (@SolanaFndn) June 10, 2023

Addressing the SEC’s classification of SOL as a safety, the Solana Basis took to Twitter to precise its disagreement. In an announcement, the muse asserted, “The Solana Basis disagrees with the characterization of SOL as a safety.”

In accordance with the SEC, the time period “safety” encompasses not solely conventional funding devices like shares, bonds, and transferable shares but additionally extends to “funding contracts.”

SOL market cap presently at $6.16 billion. Chart: TradingView.com

By labeling SOL as a safety, the SEC alerts its intention to topic the token to rules governing securities, which may have vital implications for Solana and its ecosystem.

The classification will seemingly immediate additional scrutiny and discussions concerning the character and regulatory standing of cryptocurrencies within the evolving authorized panorama.

Featured picture from APKPure

[ad_2]

Source link