[ad_1]

Federal Reserve governor Christopher Waller has detailed he is able to get behind 50 bps price hikes till the intense inflationary pressures plaguing the U.S. financial system subsides. Waller confused that till inflation is diminished he doesn’t “see the purpose of stopping” 50 bps price hikes. Moreover, statistics from the U.S. Bureau of Financial Evaluation present that American financial savings have plummeted to ranges not seen because the ‘Nice Recession’ in 2008.

Christopher Waller Advocates for 50 Bps Fee Hikes at Each Fed Assembly Till Inflation Is Underneath Management

Inflation is wreaking havoc on the wallets of on a regular basis People as the price of items and providers has skyrocketed in the course of the previous few months. Inflation is so dangerous that president Joe Biden will host a uncommon Oval Workplace assembly on Might 31, with Federal Reserve chair Jerome Powell to debate inflation and the state of the U.S. financial system. In the meantime, Federal Reserve governor Christopher Waller is of the opinion that elevating the benchmark rate of interest by 50 bps at each assembly is important to cease inflation.

Waller defined his opinion whereas talking on the Institute for Financial and Monetary Stability in Frankfurt, Germany. Waller additional detailed that he’s optimistic in regards to the labor market having the ability to address the elevated charges with out spurring larger ranges of unemployment. “If we will get unemployment to simply 4.25%, I’d take into account {that a} masterful efficiency,” Waller remarked throughout his speech. Waller says he can envision the Fed rising by 50 bps all the way in which till inflation is tamed. Waller opined:

I’m advocating 50 [basis point hikes] on the desk each assembly till we see substantial reductions in inflation. Till we get that, I don’t see the purpose of stopping.

Waller confused that in time, the Fed’s financial coverage will ship outcomes and present how issues are working. “Over an extended interval, we are going to study extra about how financial coverage is affecting demand and the way provide constraints are evolving,” he famous in his speech. “If the information recommend that inflation is stubbornly excessive, I’m ready to do extra.”

Waller Believes an Inflation Fee of two% per Annum Is Nonetheless Attainable — Peter Schiff Says Financial savings Information From the Bureau of Financial Evaluation Signifies the US Economic system Is Not Wanting Wholesome

In reality, Waller appears to suppose the Fed may be properly above impartial and he wholeheartedly believes the central financial institution can get the benchmark price again right down to 2%. “Specifically, I’m not taking 50 basis-point hikes off the desk till I see inflation coming down nearer to our 2 p.c goal,” Waller stated. “And, by the tip of this yr, I assist having the coverage price at a degree above impartial in order that it’s decreasing demand for merchandise and labor, bringing it extra in keeping with provide and thus serving to rein in inflation.”

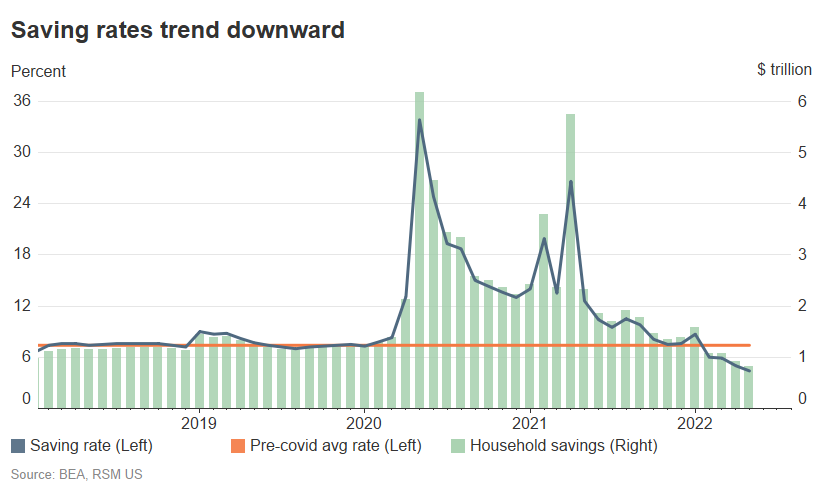

In the meantime, the gold bug and economist Peter Schiff isn’t so hopeful in regards to the Fed doing its job and he doesn’t consider Jerome Powell’s robust steadiness sheet claims. Schiff introduced up the truth that People are tapping into their financial savings to take care of the troubled financial system. The U.S. Bureau of Financial Evaluation has launched information that reveals private financial savings within the U.S. has dropped to the bottom ranges since September 2008.

“If the U.S. financial system and family steadiness sheets are as robust as Powell claims, Schiff stated. “Why did the financial savings price simply plunge to its lowest degree because the center of the worst recession since The Nice Despair? When instances are robust individuals faucet into what they saved after they had been flush,” the economist added.

What do you concentrate on the Federal Reserve governor Christopher Waller’s opinions? What do you concentrate on the most recent U.S. financial savings information and Peter Schiff’s feedback? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any harm or loss precipitated or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link