[ad_1]

“Time-series evaluation (Stern, 1993, 2000) exhibits that vitality is required along with capital and labor to clarify the expansion of GDP. However mainstream economics analysis has tended to downplay the significance of vitality in financial development. The principal fashions used to clarify the expansion course of (e.g. Aghion and Howitt, 2009) don’t embody vitality as an element of manufacturing.”

– The Function of Power within the Industrial Revolution and Fashionable Financial Development, Stern and Kander (2012)

If vitality is so essential to any and each economic system, why is it so aggressively prevented in analysis and dialogue? Going additional, why such heavy over politicization and division within the trade? Discard the tribalism in vitality as nothing greater than noise. It’s nonsensical all the way down to its very core. We want as a lot vitality being generated as attainable in a approach that doesn’t break an economic system, and that may permit us to maintain the wheels of society turning. How will we obtain such a lofty objective?

Direct monetization of vitality technology.

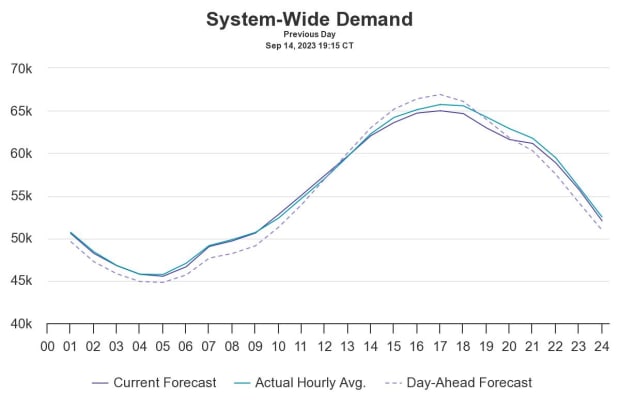

One problem: demand for energy is risky. It doesn’t stay constant all through the day, not to mention all year long. This volatility additionally bleeds into the various types of vitality for economies that have seasonal local weather volatility or could also be restricted in entry to various sources.

Is there a approach for us to smooth-out this demand volatility in order that vitality producers can preserve a constant run-rate whereas nonetheless being able to offering dependable energy to societal fluctuations?

The Way forward for Power

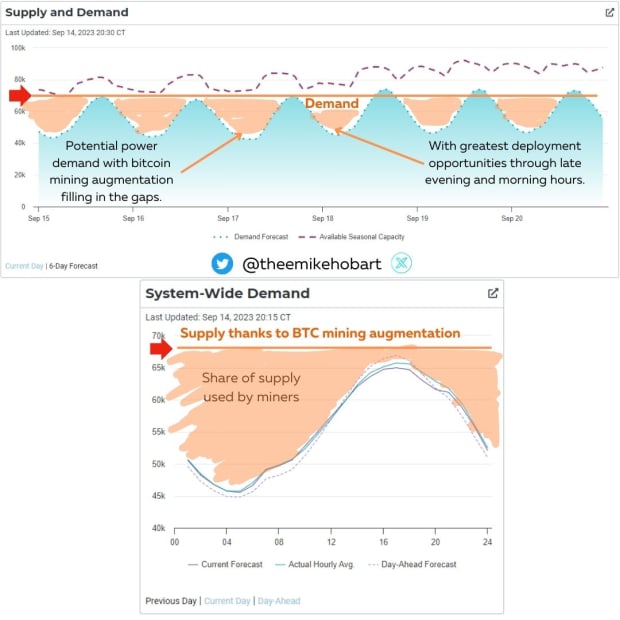

The reply is sure. That is achievable by bitcoin mining. We will use bitcoin mining to squelch the fraternal squabbles between all the vitality turbines. All are free to compete for hashrate and search that fabled subsequent bitcoin subsidy distribution, as long as they comply with redirect energy to the grid in society’s moments of want (which has been proven to be efficient in a number of occasions and situations on Texas’ ERCOT system in addition to in Georgia). The higher the ability producing capability of the operation, the extra that they will afford to provide society what it wants and nonetheless be able to capturing income through bitcoin mining. One of the best half is, that bitcoin doesn’t care the place the vitality is coming from or being sourced; it desires all of it.

We will now justify the speedy enlargement of vitality technology and distribution infrastructure by offering perpetual and extremely aggressive demand for that vitality. Demand that’s each purchaser of first resort and final. This demand will be sourced by the most affordable vitality sources, or by increasing present operations to offer higher output and maximize effectivity. All methods are viable with this strategy. Offering a responsive demand to the grid that may smoothen out the full demand curve is revolutionary.

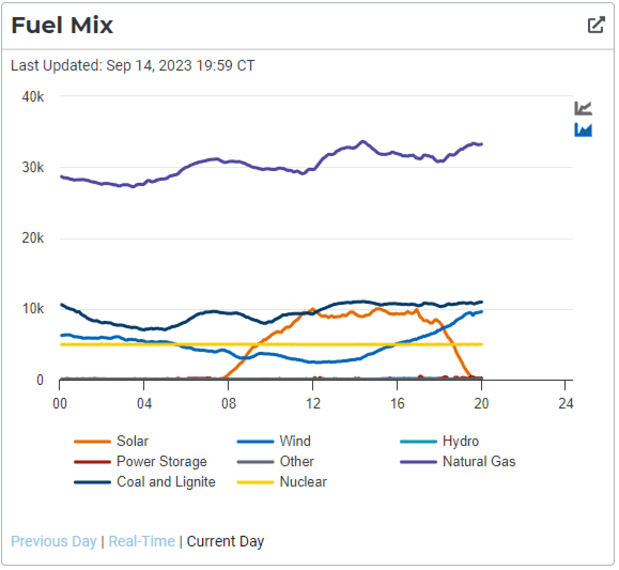

A properly balanced system would have general demand wanting as constant and flat as that line representing nuclear energy provide above (yellow). However when you could have pure demand ebbing and flowing (as seen in Figures 7 & 9) you want a versatile demand supply that may fill within the hole between. You want a load that may shut off when societal demand surpasses forecasts, however offers such a profit by each operational enhancements and revenues that their product is instantly wanted when circumstantial calls for are glad, that they are often introduced again on-line as quickly as attainable.

That, girls and gents, is what the bitcoin miners down in ERCOT and Georgia are doing. They’re filling the gaps. What that is additionally doing is offering an incentive for vitality turbines to supply as a lot as attainable. That means there’s now a justification to construct out operations which are able to producing much more vitality than is required now (however will be of use sooner or later).

Slippery Orange Coin

What occurs to demand when the availability of electrons doesn’t make manufacturing of the commodity simpler. The place such an asset solely continues to gobble-up as a lot vitality as is thrown at it, not like gold, not like oil. These are two commodities that end in pure market forces bringing an finish to excessive costs by justifying elevated manufacturing throughout excessive costs and decreased manufacturing throughout low costs.

That’s the fantastic thing about the problem adjustment in bitcoin mining. When extra energy will get devoted to the community, and blocks start to get accomplished too quickly, the community ratchets up the problem (and vice versa when blocks are coming in too slowly). There isn’t any over manufacturing and over saturation of provide as a consequence of excessive costs.

In the meantime mining swimming pools permit for bitcoin miners to work collectively to earn the bitcoin subsidy. When such an final result happens the mining pool distributes earnings to the pool members based on how a lot effort was devoted as a share of the pool whole (a good collaborative system). Leading to a much more constant stream of earnings than if these miners have been working alone.

Conclusion

All vitality turbines stand to profit from deploying datacenters stuffed with ASIC miners to benefit from the perpetual demand afforded the bitcoin mining community. Moreover the extremely aggressive trade is offering visceral demand for enhancements in chip effectivity in addition to the sourcing of not solely the most affordable vitality, however probably the most plentiful capability that isn’t being successfully utilized. Which is why vitality producers and utilities are doing simply that; utilizing bitcoin mining to maximise efficiencies and enhance operations, whereas incomes an additional line of income.

The very foundations of vitality are being retooled. The tribalism inside vitality will die away as all producers purpose their sights on the nice orange future cresting over the horizon. And so they’re all positioned to make some huge cash for it.

It is a visitor submit by Mike Hobart. Opinions expressed are completely their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

[ad_2]

Source link