[ad_1]

TikTok Store surpasses Tokopedia to turn into the second-largest e-commerce platform in Southeast Asia in 2023, in accordance with a Momentum Works report.

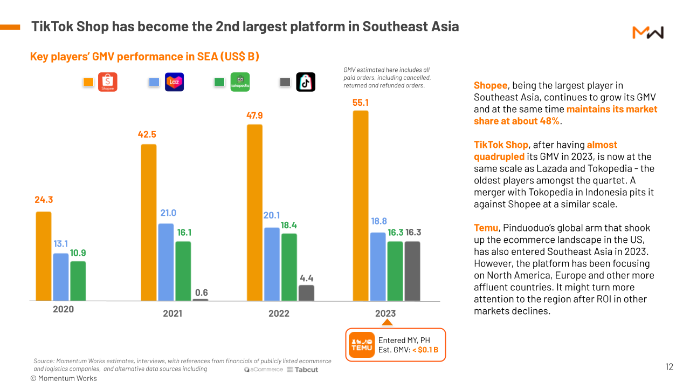

Shopee nonetheless maintained its dominant place with a GMV of US$55.1 billion, securing a 48 per cent market share.

TikTok Store, which quadrupled its annual GMV to US$16.3 billion in 2023, is now on the identical scale as Lazada and Tokopedia. TikTok Store’s merger with Tokopedia pits it in opposition to Shopee at the same scale.

Additionally Learn: TikTok vs Shopee EC battle in SEA: Unveiling methods for startups

There’s extra to this report; whereas Shopee, Lazada, and Tokopedia all diminished their workforce between 2022 and 2024, TikTok Store has expanded its workforce to over 8,000 workers since December 2021. It means it optimises its investments for more healthy development within the area.

The findings had been a part of Momentum Works’s ‘The Ecommerce in Southeast Asia 2024’ report. which supplies complete insights into the area’s six key e-commerce markets, analysing the aggressive panorama and ecosystem gamers, together with logistics.

The report additional revealed that Southeast Asia’s e-commerce market continues its spectacular development, attaining a complete Gross Merchandise Worth (GMV) of US$114.6 billion in 2023, a 15 per cent enhance from the earlier 12 months, reveals a research.

Indonesia stays the most important e-commerce market within the area, contributing 46.9 per cent to the area’s GMV. It is a decrease share in comparison with 54 per cent in 2022. Nonetheless, the archipelago’s e-commerce development fee of three.7 per cent is the slowest within the area.

Vietnam and Thailand are the fastest-growing markets, with GMV will increase of 52.9 per cent and 34.1 per cent year-on-year, respectively. Vietnam has now surpassed the Philippines to turn into the third-largest e-commerce market within the area.

The opposite three key markets, the Philippines, Malaysia and Singapore, all registered double-digit or very near double-digit development.

Additionally Learn: The evolution and regulation of social commerce in Indonesia: The TikTok Store ban

Temu, Pinduoduo’s international arm that shook up the e-commerce panorama within the US, has additionally entered Southeast Asia in 2023. Whereas it’s discovering a solution to enter Indonesia, its present cross-border mannequin won’t be welcome within the nation. Nonetheless, the platform would possibly flip extra consideration to the area after ROl declines in different markets akin to North America and Europe.

The report additionally highlighted 4 key tendencies shaping Southeast Asia’s e-commerce panorama:

Stay commerce: Main Key Opinion Leaders (KOLs) in Vietnam, Thailand, and Indonesia are attaining multi-million greenback gross sales in single stay periods.

Generative AI: E-commerce platforms within the area are starting to undertake generative AI functions, enhancing consumer expertise and operational effectivity.

E-commerce enablers: Confronted with market constraints and diminished model market shares on platforms, many e-commerce enablers are diversifying their enterprise fashions.

E-commerce logistics: Third-party logistics suppliers are experiencing elevated strain as platforms start to in-source parcel supply companies.

In accordance with Jianggan Li, Founder and CEO of Momentum Works, “The aggressive panorama of e-commerce in Southeast Asia stays dynamic and continually reworking. With markets like Vietnam and Thailand exhibiting exceptional development and platforms like TikTok Store quickly increasing, it’s clear that innovation and adaptation are key to success on this area. The adoption of generative AI and the evolution of stay ecommerce are reshaping the business, and we’re excited to see these tendencies drive continued development and alternatives for companies throughout Southeast Asia.”

Additionally Learn: GoTo completes merger with TikTok Store Indonesia

Headquartered in Singapore, Momentum Works builds, scales, and manages tech ventures throughout rising markets. The corporate leverages its intensive data, group, and expertise to tell, join, and allow the tech and new financial system ecosystem. Key enterprise areas embody ventures, insights, immersions, and advisory companies.

The put up TikTok Store beats Tokopedia to turn into SEA’s second-largest e-commerce platform appeared first on e27.

[ad_2]

Source link