[ad_1]

UK financial exercise contracted at its quickest tempo in nearly two years in October, suggesting the nation has fallen right into a recession throughout a interval of political uncertainty and excessive power and borrowing prices.

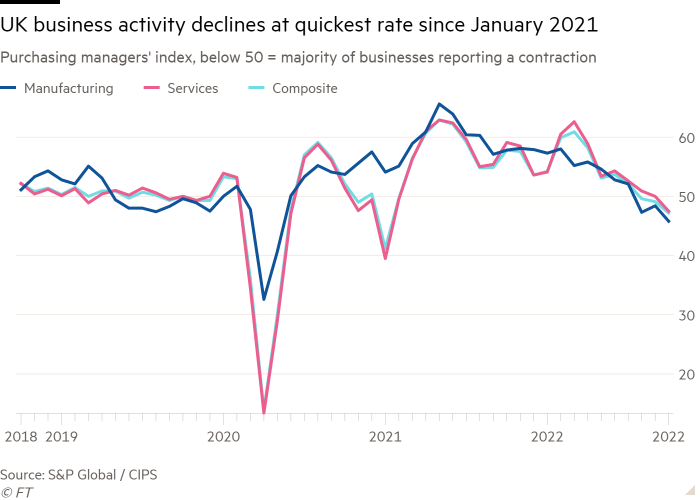

The S&P International/Cips flash UK composite output index, a measure of exercise within the non-public sector, dropped to a 21-month low of 47.1 in October from 49.1 in September.

October’s was the third consecutive studying underneath 50, which signifies a majority of companies reporting a contraction in exercise, and was beneath the 48.1 forecast by economists polled by Reuters.

The gloomy outlook comes amid home political uncertainty, with Rishi Sunak on target to grow to be prime minister after Liz Truss was deposed final week.

Chris Williamson, chief enterprise economist at S&P International Market Intelligence, mentioned October’s flash PMI information confirmed “the tempo of financial decline gathering momentum” after current political and monetary market upheaval.

The financial system “due to this fact appears sure to fall within the fourth quarter after a possible third quarter contraction, which means the UK is in recession”, he added.

The most recent official information confirmed that financial output fell 0.3 per cent within the three months to August in contrast with the earlier quarter.

Eurozone PMIs additionally fell one level to 47.1 in October, suggesting recessionary pressures are widespread throughout Europe.

The UK survey, based mostly on responses collected between October 12 and 20, additionally confirmed that new orders had decreased on the sharpest tempo since January 2021, with panellists attributing it to the worsening financial outlook. Producers reported a very steep fall in new work, with export gross sales falling on the quickest tempo in nearly two-and-a-half years.

Enterprise confidence additionally collapsed, sliding to a stage not often seen in 25 years of survey historical past, with escalating political uncertainty and rising rates of interest among the many mostly cited causes for the downbeat sentiment.

Corporations reported that they had been nonetheless hiring however on the slowest tempo for 20 months. The autumn in sentiment steered companies would “transfer decisively to scale back employment this winter”, mentioned Samuel Tombs, economist on the consultancy Pantheon Macroeconomics.

Williamson mentioned that though worth pressures had eased due to the financial downturn, the weak pound and excessive power prices meant enter value inflation remained greater than at any time within the survey’s pre-pandemic historical past, mentioned Williamson.

Ashley Webb, economist on the consultancy Capital Economics, mentioned that whereas the newest PMIs offered additional proof that the financial system was heading into recession, with home inflationary pressures remaining sturdy the Financial institution of England would have “little alternative” however to proceed elevating rates of interest.

Markets count on the BoE’s Financial Coverage Committee to boost charges by between 75 and 100 foundation factors when it meets subsequent week.

The manufacturing sector remained in a downturn for the third consecutive month, whereas the companies sector reported the primary contraction in 20 months.

John Glen, Cips chief economist, mentioned that “considerations over rising power and meals payments affected client urge for food for pubs and eating places and demand was scaled again”.

[ad_2]

Source link