[ad_1]

Key occasions

Hunt: IMF report exhibits a giant improve to the UK’s development forecast

Jeremy Hunt has introduced that the Worldwide Financial Fund had made a ‘massive improve’ to the UK’s development forecasts, following its annual healthcheck.

Hunt says:

“In the present day’s IMF report exhibits a giant improve to the UK’s development forecast and credit our motion to revive stability and tame inflation.

“It praises our childcare reforms, the Windsor Framework and enterprise funding incentives. If we follow the plan, the IMF verify our long-term development prospects are stronger than in Germany, France and Italy – however the job isn’t finished but.”

The Fund is because of launch its evaluation of the UK economic system at 11.15am, after we’ll her from Hunt and IMF chief Kristalina Georgieva.

However the information is already out – with a number of experiences that the IMF is not anticipating the UK to fall into recession this 12 months.

As an alternative of shrinking by 0.3%, because the IMF forecast in April, the UK economic system is now forecast to develop by 0.4% throughout 2023.

Reuters experiences that:

The Fund stated the improved outlook mirrored the sudden resilience of demand, helped partly by sooner than regular pay development, the autumn in hovering vitality prices, improved enterprise confidence and the normalisation of worldwide provide chains.

“Declining vitality costs and widening financial slack are anticipated to considerably scale back inflation to round 5 p.c y/y by end-2023, and beneath the two p.c goal by mid-2025,” the IMF stated.

The IMF forecast financial development of 1% in 2024 and a pair of% in 2025 and 2026 earlier than settling again to a long-run charge of round 1.5%.

UK non-public sector development slowing in Might

Development throughout UK corporations is slowing this month, whereas companies are persevering with to hike costs, in keeping with the newest survey of buying managers.

UK financial development remained centred on the service sector in Might, information supplier S&P World experiences, with journey, leisure and hospitality companies benefiting from resilient client demand.

However manufacturing ranges at manufacturing companies fell on the quickest tempo in 4 months.

This pulled the S&P World / CIPS flash UK composite output index all the way down to 53.9 in Might, from a 12-month excessive of 54.9 in April. Any studying over 50 exhibits development.

Companies reported a fractional easing in enter value inflation, due to a drop in vitality payments and uncooked materials prices for factories. However robust wage inflation pushed up prices for providers companies.

The costs charged by non-public sector corporations elevated at an traditionally steep tempo in Might, though the speed of inflation was the second-lowest since August 2021.

This might spur the Financial institution of England into persevering with to lift rates of interest to squash inflation.

Chris Williamson, chief enterprise economist at S&P World Market Intelligence, stated the UK is seeing a story of two economies, as manufacturing and providers diverge:

“The UK economic system loved one other month of robust development in Might, with the enlargement persevering with to be pushed by surging post-pandemic demand within the service sector, notably from shoppers and for monetary providers, with hospitality actions buoyed additional by the Coronation. The surveys are according to GDP rising 0.4% within the second quarter after a 0.1% rise within the first quarter.

“Nonetheless, this development spurt is driving renewed inflationary pressures, as service suppliers battle to fulfill demand and therefore not solely supply increased wages to draw workers but in addition discover themselves capable of cost extra for his or her providers.

It’s a distinct story in manufacturing, the place spending is being diverted away from items to providers, and lots of corporations are additionally winding down their inventories, exacerbating the downturn in demand and driving each output and costs decrease.

Inheritance tax take rises to £600m in April

The federal government pulled in extra money from inheritance tax final month.

New information from HMRC present that inheritance tax receipts rose to £600m in April, which is £100m increased than a 12 months in the past.

Alex Davies, CEO and Founding father of Wealth Membership stated:

“The 2023/24 tax 12 months is trying more likely to be one more record-breaking 12 months for inheritance tax. It truly is a money cow for HMRC.

Presently, folks can move on as much as £325,000 of their property with out them having to pay any IHT. Something above £325,000 might be topic to as much as 40% inheritance tax. The nil-rate band has stayed on the identical degree since April 2009, though asset costs (equivalent to homes) have risen since.

Dean Moore, Managing Director and Head of Wealth Planning at RBC Wealth Administration, says the freeze on inheritance tax thresholds is pushing up IHT receipts.

The burden of IHT on households is reaching unprecedented ranges, with a projected report cost of £6.7 billion within the monetary 12 months 2022/23. This quantity is greater than double the £2.9 billion paid in 2011/12, and it’s anticipated to additional enhance to £7.8 billion throughout the subsequent 5 years.

“The numerous rise in IHT is primarily pushed by sustained will increase in property costs and the long-term freeze of the IHT threshold which is unchanged at £325,000 since 2009. In the meantime, common home costs in London have elevated from £245,000 to £532,000 over the identical interval. (Supply: Land registry).

“The present state of IHT locations a considerable monetary pressure on the family members left behind after an individual’s passing. In response, people are more and more resorting to measures equivalent to gifting, investing, donating, and insuring their cash to minimise or keep away from this tax.

“Failing to promptly and successfully deal with the problem of IHT can result in households dealing with overwhelming administrative and monetary burdens throughout a time of already profound emotional stress. By adopting a proactive and incremental method to IHT, the method may be made considerably simpler, assuaging the pressure on those that are grieving the lack of a liked one.”

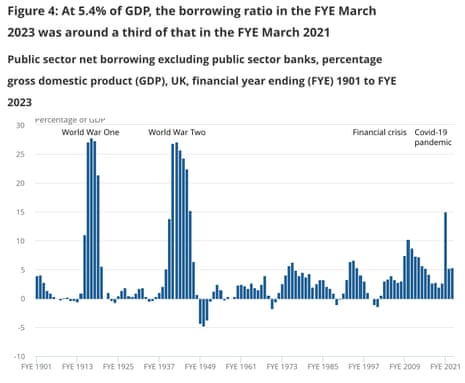

Right here’s a helpful chart from as we speak’s April public funds, displaying UK public sector borrowing as a proportion of GDP.

As you possibly can see, the Covid-19 pandemic pushed up borrowing within the 2020-21 monetary 12 months to fifteen%, the best for 75 years.

Shares in Pennon Group, which owns South West Water, have dropped over 2.5% this morning after regulators launched an enforcement probe into water leakage.

Pennon instructed shareholders that Ofwat have introduced an investigation into South West Water’s 2021/22 operational efficiency information referring to leakage and per capita consumption.

Pennon says:

This operational efficiency information was reported in South West Water’s Annual Efficiency Report 2021/22. This report is topic to rigorous assurance processes which embrace impartial checks and balances carried out by exterior technical auditor.

We are going to work overtly and constructively with Ofwat to adjust to the formal discover issued to South West Water as a part of this investigation.

Pennon shares are down 2.75% at 799.5p, buying and selling at their lowest for the reason that begin of March, among the many largest fallers on the FTSE 250 index of medium-sized corporations.

My colleague Nils Pratley has written about how the water trade is making an attempt to keep away from being held absolutely to account for the failures to take a position correctly over latest many years.

Right here’s a flavour:

We wish to be held to account …” stated Ruth Kelly, the brand new public face of the English water corporations, final week, briefly elevating hopes of a second of reckoning for the trade’s previous (and present) sewage spills. Then the chair of Water UK clarified what her model of accountability covers. The businesses want to be held to account “… for placing it proper”.

The previous 30 years, we had been invited to suppose, needs to be thought-about an unlucky chapter by which the trade, terribly sadly, didn’t give sewage spills sufficient consideration whereas different investments had been prioritised. That was the gist of her apology. “By and enormous, the water corporations had been finishing up their authorized duties however … what’s authorized isn’t essentially the best reply or what folks anticipate,” she argued on BBC Radio 4’s In the present day programme.

One trusts this “by and enormous” declare provoked spluttering amongst officers on the Setting Company and Ofwat. As Kelly should know, each regulatory our bodies have been engaged for the previous 18 months in an inquiry to find out whether or not the trade was, in essence, not treating as a lot sewage because it ought to have been at 2,000-plus therapy vegetation. Whether or not authorized duties had been met could be very a lot a reside query….

Capital Economics: UK makes shaky begin to the brand new fiscal 12 months

April’s public funds figures have gotten the brand new fiscal 12 months off to “a shaky begin”, say Capital Economics.

After one month of the 2023/24 fiscal 12 months, the Chancellor is already on observe to overshoot the OBR’s full-year borrowing forecast of £132bn (5.1% of GDP) by about £3.2bn, says Ruth Gregory, their deputy chief UK economist.

Gregory explains:

Revisions to previous information meant that public sector web borrowing within the 2022/23 monetary 12 months was revised down from £139.2bn (5.5% of GDP) to £137.1bn (5.4% of GDP). However the authorities borrowed greater than anticipated in April.

Borrowing was £25.6bn in April, greater than the OBR forecast and consensus forecast of £22.4bn and £11.9bn above final April’s outturn. Given the latest resilience within the economic system, weaker-than-expected receipts was a little bit stunning. At £69.7bn, whole receipts had been effectively beneath the £72.2bn the OBR forecast.

A good chunk of the overshoot additionally mirrored increased whole expenditure of £89.2bn (OBR forecast £83.5bn) as latest rises in RPI inflation (to which index-linked gilts are pegged) brought about debt curiosity funds of £9.8bn, the best April determine since information started in 1997 (the price of vitality assist schemes was in line the OBR forecast).

However, Capital Economics doubts it will stop the Chancellor from embarking on a fiscal splurge forward of the following election.

In the present day’s public funds information exhibits that the UK nationwide debt was nearly as massive because the nation’s annual financial output.

Public sector web debt on the finish of April 2023 was £2,536.9bn or round 99.2% of gross home product (GDP).

The present debt-to-GDP ratio is at ranges final seen within the early Sixties.

Public sector debt excluding public sector banks was £2,536.9 billion on the finish of April 2023.

Round 99.2% of gross home product, with the debt-to-GDP ratio at ranges final seen within the early Sixties.

➡️ https://t.co/Ak2EQ31AtV pic.twitter.com/hAh5WvgaGI

— Workplace for Nationwide Statistics (ONS) (@ONS) May 23, 2023

Drahi will increase stake in BT to 24.5%, however says won’t make a proposal

Mark Sweney

French billionaire Patrick Drahi has elevated his stake in BT to greater than 24%, however re-iterated that he doesn’t intend to make a bid for the £15bn British telecoms big.

Drahi, who controls an 18% stake via subsidiary Altice UK, raised his place to 24.5% on Tuesday, my colleague Mark Sweney writes.

The transfer comes days after BT introduced a serious restructuring to develop into a “leaner businesss” that can see workforce minimize by as a lot as 55,000 by 2030.

The cuts will come from a mixture of pure attrition, reducing contractors on the finish of the construct part rolling out fibre broadband and 5G cell networks nationwide, and a transfer into AI which might exchange about 10,000 jobs.

The corporate stated:

“Altice UK has restated its place to the board of BT that it doesn’t intend to make a proposal for BT.”

Drahi’s funding automobile first purchased a 12 per cent stake in BT in June 2021, rising it to 18 per cent later that 12 months.

The UK authorities moved to look at Drahi’s stake below new harder new powers to potential block the takeover of key nationwide belongings below the Nationwide Safety & Investments Act.

Victoria Scholar, head of funding at interactive investor, tells us:

Final week BT’s earnings despatched shares sharply decrease. Clearly Altice UK judged that now could be an opportune second to amass additional shares at a horny value with the inventory down a number of p.c since final week. In June 2021, billionaire Drahi paid round £2.2 billion for a 12.1% stake in BT. In December that 12 months, his firm Altice UK raised the holding to 18% at a price ticket of roughly one other £1 billion. Final 12 months the UK authorities gave the inexperienced gentle to Drahi’s stake constructing, ruling that it didn’t pose a nationwide safety menace.

BT’s outcomes final week highlighted the pressures dealing with the enterprise with falling free money stream and plans to slash 55,000 jobs. It has been coping with prices pressures from inflation and vitality payments in addition to capital expenditure on its nationwide fibre community rollout. Altice UK’s stake constructing gives a vote of confidence in BT however there are questions on what adjustments Drahi might wish to implement to the enterprise. Maybe he might push for extra aggressive price cuts at BT.

Grocery value inflation inches down, however households nonetheless struggling excessive costs

Grocery value inflation has fallen for the second month in a row – however continues to be including an additional £833 to the common client’s annual invoice, in keeping with newest figures.

Costs over the 4 weeks to Might 14 had been 17.2% increased than a 12 months in the past, down from April’s 17.3%, information agency Kantar experiences this morning.

Kantar factors out that value rises are nonetheless extremely excessive – 17.2% is the third quickest charge of grocery inflation reported since 2008.

Fraser McKevitt, head of retail and client perception at Kantar’s Worldpanel Division, explains:

This might add an additional £833 to the common family’s annual grocery invoice if shoppers don’t store in numerous methods

Kantar additionally experiences that the common price of 4 pints of milk has come down by 8p since final month, however continues to be 30p increased than this time final 12 months at £1.60. A number of grocery store chains have trumpeted value cuts for milk lately.

Kantar additionally experiences that extra shoppers are turning to grocery store own-brand merchandise in a bid to maintain their payments below management. Gross sales of the most affordable own-label merchandise soared by 15.2% over the previous month, nearly double the 8.3% enhance seen for branded merchandise.

Though borrowing jumped in April, the UK really borrowed lower than beforehand thought within the earlier monetary 12 months.

The ONS revised down its estimate for the price range deficit within the 2022/23 monetary 12 months that resulted in March to £137.1bn, down from £139.2bn beforehand.

Hunt: we had been proper to borrow to guard households and companies

On this morning’s soar in UK borrowing, Chancellor of the Exchequer Jeremy Hunt says:

“It’s proper we borrowed billions to guard households and companies towards the impacts of the pandemic and Putin’s vitality disaster.

“However debt and borrowing stay too excessive now – which is why it’s one among our priorities to get debt falling.

“We’ve taken troublesome however needed selections to steadiness the nation’s books, and if we follow our plan and get our economic system rising, then debt is about to fall.”

John Allan says he regrets having to step down early at Barratt.

In a press release reported by PA Media, Allan stated:

“It’s with remorse that on the request of the board I’m stepping down as chairman of Barratt Developments Plc as of June 30 2023, forward of ending my tenure in early September as deliberate.

“My early departure from Barratt is a results of the nameless and unsubstantiated allegations made towards me, as reported within the Guardian which I vehemently deny.”

John Allan to step down early as Barratt chair at request of board

Outgoing Tesco chairman John Allan is stepping down from his function chairing housebuilder Barratt Developments sooner than deliberate, on the request of the board.

Barratt instructed the Metropolis this morning that Allan will step down as Chair of the Board and as a Director of the Firm from 30 June 2023.

Allan had been anticipated to step down in September, to get replaced by non-executive director Caroline Silver, however this plan – introduced in January – has been introduced ahead.

Barratt instructed shareholders that they’d determined to hurry up the transition to stop allegations made towards Allan from turning into disruptive to the corporate, saying:

On the request of the Board, John Allan will step down as Chair of the Board and as a Director of the Firm on 30 June 2023.

The Board believes it’s in the very best pursuits of Barratt to speed up the deliberate transition to the brand new Chair of the Board to stop the continuing influence of the allegations towards John from turning into disruptive to the Firm.

Barratt added that it has not acquired any complaints about John Allan throughout his tenure on the firm, which he joined in 2014.

Final Friday, Tesco introduced that Allan would step down in June, after the Guardian reported that Allan allegedly touched the underside of a senior member of Tesco workers in June 2022, on the firm’s final AGM.

4 allegations about Allan emerged through the Guardian’s investigation into the Confederation of British Trade (CBI) – the UK’s foremost enterprise lobbying group.

Allan was president of the organisation between 2018 and 2020 after which vice-president till October 2021.

He has denied three of the 4 claims made towards him. He has admitted making a remark a few CBI staffer’s look that she discovered to be offensive in 2019, and apologised for the comment.

Barratt senior impartial director, Jock Lennox, says:

“The Board is grateful to John for his 9 years of service to Barratt. He leaves the Firm in a robust monetary and operational place, persevering with to carry out effectively in difficult market situations.”

Introduction: UK information £25.6bn price range deficit in April

Good morning, and welcome to our rolling protection of enterprise, the monetary markets and the world economic system.

Britain borrowed greater than £25bn to steadiness the books final month, the second-highest borrowing for an April ever, and greater than anticipated.

Hovering inflation and the price of capping vitality payments drove up borrowing once more, the newest figures from the Workplace for Nationwide Statistics present.

Borrowing hit £25.6bn final month, which is £11.9bn increased than in April 2022, and the second highest since month-to-month information started in 1993 (behind April 2020, when the pandemic hit the economic system).

Economists polled by Reuters had predicted that public sector web borrowing, excluding the influence of state-owned financial institution, would have hit £19.75bn in April.

Public sector web borrowing (excluding public sector banks) was £25.6 billion in April 2023.

The second highest April borrowing since information started, largely resulting from:

▪️ the price of vitality assist schemes

▪️ elevated profit funds

▪️ debt curiosity➡️ https://t.co/Ak2EQ31AtV pic.twitter.com/QWovgCse9G

— Workplace for Nationwide Statistics (ONS) (@ONS) May 23, 2023

Though public sector receipts rose by £900m in April in contrast with March, that was dwarfed by a £12.8bn rise in public sector spending.

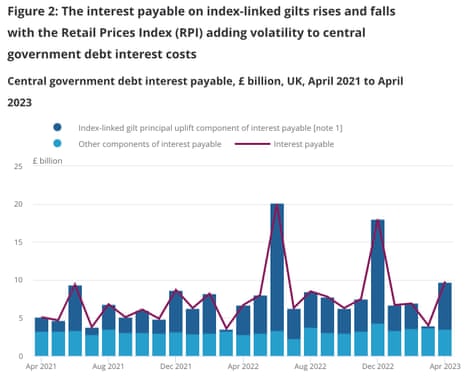

Excessive inflation continued to drive up the price of the nationwide debt, as many authorities bonds are pegged to the rising price of dwelling.

The curiosity payable on central authorities debt jumped to £9.8bn in April, a soar of £3.1bn in contrast with April 2022. Thas was as a result of enhance within the RPI measure of inflation.

The ONS explains:

Rises within the Retail Costs Index have elevated the curiosity payable on index-linked gilts. This represents the third-highest curiosity payable in any month on report, behind the £20.0bn in June 2022 and the £18.0bn in December 2022.

The UK’s vitality assist packages meant central authorities spent £3.9bn on subsidies, £1.8bn greater than within the April 2022.

Most of that enhance was resulting from the price of the Power Worth Assure for households and the Power Payments Low cost Scheme.

Additionally developing as we speak

The UK economic system, and its policymakers, are within the highlight as we speak.

A group from the Worldwide Financial Fund are in London to provide their annual healthcheck on Britain’s economic system.

The IMF will give its verdict after conferences with the Financial institution of England, the Treasury, impartial watchdogs on the Workplace for Finances Duty and the Monetary Conduct Authority.

Final month the IMF forecast that UK GDP would shrink by 0.3% this 12 months, the weakest of all main industrialised international locations.

However chancellor Jeremy Hunt has vowed to beat these forecasts, and earlier this month the Financial institution of England upgraded its personal estimates resulting from a brightening financial outlook.

Hunt, and IMF managing director Kristalina Georgieva, will maintain a press convention to debate the report this morning, from 11.15am.

MPs on the Treasury Committee will quiz high officers from the Financial institution of England this morning too.

The Governor of the Financial institution of England, Andrew Bailey, chief economist Huw Capsule, and Financial Coverage Committee members Catherine Mann and Silvana Tenreyro will likely be questioned about this month’s rate of interest rise to 4.5%, the best since 2008.

Huw Capsule’s latest remark that British households and companies “want to just accept” they’re poorer might come up too….

The agenda

-

8am BST: Kantar grocery survey

-

9am BST: Eurozone flash PMI surveys for Might

-

9.30am BST: UK flash PMI surveys for Might

-

10.15am BST: Treasury Committee listening to with the Financial institution of England over financial coverage.

-

11.15am BST: IMF 2023 Article IV end-of-mission press convention in London.

[ad_2]

Source link