[ad_1]

Key occasions

China’s providers PMI soars, as uneven restoration gathers tempo

In China, the providers buying managers’ index (PMI) climbed 2.8 factors to 57.8 in March, the best since June 2020. The composite survey confirmed improved general new orders and working situations following the elimination of Beijing’s zero-Covid coverage. The brand new export orders measure hit its highest studying on file, after the lifting of restrictions on inbound guests.

Price pressures are choosing up, as increased wages and uncooked supplies drove up enter prices for providers corporations, whereas promoting costs solely inched up. Aggressive pressures are prompting corporations to carry again from worth hikes, stated Duncan Wrigley, chief China+ economist at Pantheon Macroeconomics.

Shopper providers led China’s reopening rebound, as elsewhere on the earth. However now the providers rebound is broadening out. Enterprise exercise readings within the official PMI had been over 60 for retail, rail, street and air transport, web providers, monetary providers and leasing and enterprise providers.

China’s restoration is gaining momentum, although nonetheless uneven.

The Caixin manufacturing PMI fell to 50.0 in March, under the official manufacturing index at 51.9. Any studying under 50 signifies contraction; any studying above factors to enlargement.

Wrigley defined:

The Caixin index is weighted in direction of exporters, gentle trade and the non-public sector. Export manufacturing is prone to stay weak, given gentle international demand. Consequently a few of China’s roughly 300 million migrant staff shall be pressured to take lower-paid service sector jobs, as a substitute of working in, say, an electronics plant.

The primary demand drivers for present industrial are infrastructure and manufacturing funding, due to native governments entrance loading fundraising within the early a part of this yr. That is prone to drive heavy trade, akin to iron and metal and different supplies sectors. In contrast, gentle trade is extra uncovered to weak exports.

The property sector is exhibiting current indicators of life…

Policymakers will view the March PMIs as indicating that China’s restoration is step by step gaining momentum, regardless of weaknesses in sure sectors, like exports and smaller producers. Due to this fact, they’re prone to keep a wait-and-see method, earlier than contemplating a major coverage shift. They are going to be poised so as to add additional development help measures later within the yr, if the home demand restoration flags.

Apart from Better London and the North East, all areas of the nation skilled a slowdown within the fee of annual home worth inflation final month, the Halifax information exhibits.

Northern Eire continues to report the strongest annual development in home costs of 4.9% (common home worth of £186,459), adopted by the West Midlands (3.8%, common worth of £248,308).

In Wales, the speed of annual property worth inflation has slowed to 1.0% (common property worth of £213,959). Equally in Scotland, the annual fee of development fell to 2.3% (common worth of £199,853).

Common home costs in London are up very barely on this time final yr (+0.1%) with the everyday property now costing £537,250.

Tom Invoice, head of UK residential analysis on the property group Knight Frank, stated:

Exercise has been strong however unspectacular within the UK housing market this yr because the hangover from the mini-budget slowly fades. Costs are broadly in a holding sample however shall be examined this spring as provide rises and better mortgage charges trigger a pointy consumption of breath amongst a rising variety of patrons and householders.

We count on costs to fall by a number of p.c this yr because the transition to the brand new regular for borrowing prices takes place.

Introduction: UK housing market secure as costs rise once more in March

Good morning, and welcome to our rolling protection of enterprise, the monetary markets and the world financial system.

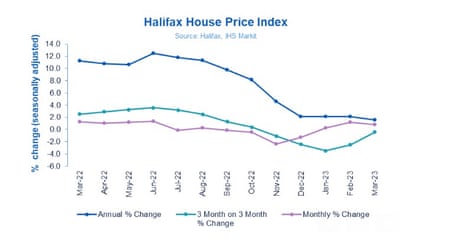

Home costs throughout the UK rose for the third month in a row in March, whereas the annual fee slowed to the bottom in three and a half years.

This implies that the market is secure, though an extra slowdown all through this yr appears to be like probably as mortgage prices have risen, stated Halifax, which is a part of Lloyds Banking Group.

A typical UK property now prices £287,880 (in comparison with £285,660 in February), in accordance with the month-to-month home worth index from Halifax.

Costs rose 0.8% in March from the month earlier than following February’s 1.2% acquire, and had been up 1.6% on a yr earlier, the slowest annual tempo since October 2019.

Home costs rose in all UK nations and areas final month, although the annual fee of development continued to sluggish in most areas. Mortgage prices have risen because the Financial institution of England has raised rates of interest 11 occasions to 4.25% to struggle double-digit inflation (at 10.4% in February).

Kim Kinnaird, director of Halifax Mortgages, stated:

The UK housing market continues to point out resilience following the sharp downturn on the finish of 2022, with common property costs rising once more in March.

Predicting precisely the place home costs go subsequent is harder. Whereas the elevated value of dwelling continues to place vital stress on private funds, the probably drop in vitality costs – and inflation extra usually – within the coming months ought to provide a bit extra headroom in family budgets.

Whereas the trail for rates of interest is unsure, mortgage prices are unlikely to get considerably cheaper within the short-term and the efficiency of the housing market will proceed to replicate these new norms of upper borrowing prices and decrease demand. Due to this fact, we nonetheless count on to see a continued slowdown by way of this yr.

The Halifax information has painted a extra secure image, whereas Nationwide Constructing Society’s home worth index confirmed an 0.8% month-to-month drop in home costs, and an annual decline of three.1%, the quickest because the aftermath of the monetary disaster in 2009.

However different indicators, such because the Financial institution of England’s mortgage approvals information and property web site Rightmove’s measure of asking costs have pointed to extra stability within the housing market, after the Liz Truss authorities’s unfunded mini-budget brought on chaos within the autumn.

UK housing market analyst Neal Hudson tweeted:

Matthew Thompson, head of gross sales on the property brokers Chestertons, stated:

Home hunters might not be seeing the drop in London property costs that they’d hoped for. In March, the typical worth at which properties offered by way of our branches stood at £1.37m with neighbourhoods akin to Putney, Fulham and Barnes being in notably excessive demand with patrons.

For the reason that begin of this yr, many owners put their sale on maintain to watch the market which has led to demand additional exceeding the variety of properties obtainable on the market. That is leading to properties protecting their worth with little room for worth negotiation. All through March, nearly all of London sellers have due to this fact been capable of safe their asking worth and even obtain increased gives from patrons.

The Agenda

-

8.30am BST: Eurozone S&P World Development PMI for March

-

9.30am BST: UK S&P World/CIPS Development PMI for March (forecast: 53.5)

-

1.30pm BST: US Preliminary jobless claims for week of 1 April (forecast: 200,000)

[ad_2]

Source link