[ad_1]

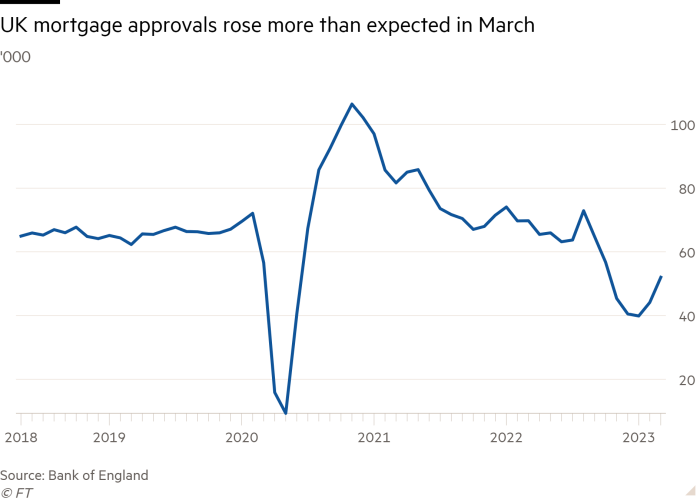

UK mortgage approvals rose greater than anticipated in March hitting a five-month excessive in an indication that the property market is stabilising after the volatility of latest months.

Internet mortgage approvals for home purchases rose to 52,000 in March, from 44,100 in February, in response to information from the Financial institution of England launched on Thursday.

The determine outstripped the 46,250 forecast by economists polled by Reuters and was its highest since October 2022.

The BoE information additionally confirmed that the failure of US financial institution SVB and takeover of Credit score Suisse in March triggered solely a small withdrawal of funds from UK banks.

UK financial institution deposits fell by £18.1bn in March, from a £4.3bn drop the earlier month, on a seasonally adjusted foundation. Ashley Webb, UK economist at Capital Economics, stated this was “not large enough to represent a financial institution run”.

Analysts stated the rise in total withdrawals might additionally mirror that households have been dipping into their financial savings extra as actual wages have been squeezed. The uncooked information confirmed family deposits into banks rose within the month, however not as a lot as regular for the month of March.

The leap in mortgage approvals suggests the property market is recovering after former prime minister’s Liz Truss’s “mini” Finances in September sparked panic that led lenders to withdraw dwelling loans.

Kim McGinley, director at Vibe Specialist Finance, stated that mortgage approvals fell sharply after the “mini” Finances however “confidence steadily returned as mortgage charges got here down and the financial outlook felt much less bleak”.

Britons borrowed an extra £1.6bn in client credit score in March, up from £1.5bn the earlier month and nicely above analysts’ expectations of £1.2bn, BoE information confirmed.

Separate information revealed earlier within the week by the mortgage supplier Nationwide confirmed that home costs rose 0.5 per cent between March and April, ending seven consecutive months of decline.

Regardless of the rise, mortgage approvals have been nonetheless 36 per cent beneath the extent in March 2021 when the housing market was boosted by record-low rates of interest.

Since then, the BoE has raised charges from a historic low of 0.1 per cent to the present 4.25 per cent. Markets are pricing in a quarter-point rate of interest rise on the financial coverage assembly subsequent week.

Webb anticipated rates of interest to stay excessive for the remainder of the yr, that means mortgage lending will “in all probability stay weak”.

A separate BoE survey of chief working officers, additionally launched on Thursday, confirmed that companies anticipated their year-ahead output worth inflation to be 5.5 per cent within the three months to April, unchanged from the three months to March.

This implies persistent worth pressures that have been confirmed by separate information by the S&P World/Cips UK companies PMI enterprise exercise survey additionally revealed on Thursday.

[ad_2]

Source link