[ad_1]

A brand new report collectively produced by McKinsey & Firm, Elevandi and the Financial Authority of Singapore (MAS) reveals that fintech corporations might play a big function in serving to to mobilise the capital required to create world sustainability, notably within the effort in the direction of decarbonisation (web zero).

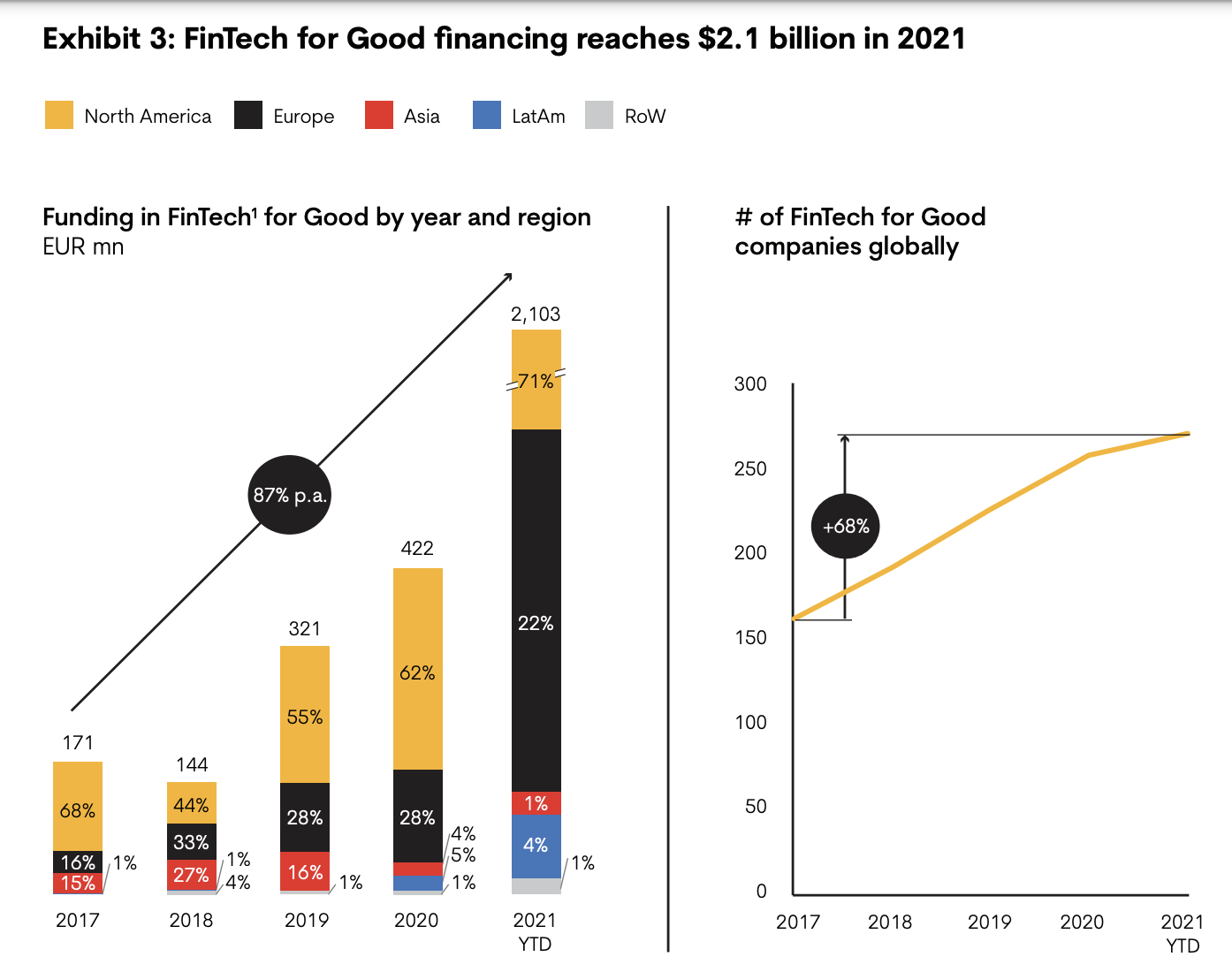

“Fintech might play a big function in serving to to mobilise the capital required to create world sustainability. To date, solely a really small portion of the entire want is roofed by financing. In recent times financing for initiatives focusing on decreased emissions grew, however remained effectively in need of the entire wants,” the report states.

There are a number of ways in which fintech corporations can contribute to the transfer in the direction of web zero. This consists of the businesses’ technological know-how that’s believed to be “pivotal” in growing and funding improvements associated to carbon seize or the safety of pure sources.

Fintech corporations also can play the function of educators in educating shoppers on the implications of the local weather transition for his or her companies and serving to them transfer ahead.

Additionally Learn: ‘There’s an absence of urgency amongst corporations in attaining web zero targets’: Unravel Carbon’s Grace Sai

The report lists particular actions within the fintech business’s effort to help sustainability which encompasses six identifiable themes:

Sustainable on a regular basis banking

Services and products that match prospects’ environmental values, corresponding to rewards for accountable buying.

Impression fundraising

Elevating funds for environmental and social causes.

ESG intelligence and analytics

Sustainability-related information and analytics, ESG scores and analysis companies.

Impression investing and retirement

Alternatives that generate social and environmental impression together with monetary returns.

Inexperienced and accessible financing

Financing for sustainability initiatives and offering credit score entry to underserved teams.

Carbon monitoring and offsetting

Monitoring particular person and company carbon footprints primarily based on monetary transactions and figuring out methods to offset them.

What blockchain can do

As probably the most talked-about topics within the tech business in the present day, naturally one could be curious in regards to the function that blockchain can play in assembly web zero objectives. In accordance with the report, blockchain can play a big function within the matter of deconstructing and securing information.

Additionally Learn: Fireplace chat: Racing to web zero with the voluntary carbon market

“Provided that ESG information is key to sustainability funding and lending selections, there should be a approach to deconstruct the info and confirm its integrity. In any other case, selections primarily based on this information have the danger of being illinformed and corporations stay open to accusations of greenwashing. Blockchain know-how might deal with this problem,” it explains.

However this know-how is just not with out criticism. Cryptocurrencies, as the preferred implementation of blockchain know-how in the present day, are identified for his or her huge electrical energy use and eventual environmental impression.

There have been a number of initiatives to assist scale back the environmental impression of cryptocurrencies, corresponding to by “The Merge” for Ethereum. The swap noticed the cryptocurrency shifting to a brand new algorithm Proof of Stake which is claimed to cut back energy consumption by nearly 100 per cent.

Aside from that, AI and machine studying are additionally the applied sciences which have been named to assist in the method of vouching for the validity of information. “They may hunt down and determine information abnormalities that might name into doubt the sustainability claims of explicit devices,” the report says.

Transferring in the direction of web zero

The report burdened that in our effort to transition in the direction of decarbonisation (web zero), by 2050, the worldwide financial system would require “the best reallocation of capital since World Warfare II coupled with an enormous inflow of economic innovation.” However as acknowledged earlier, up to now, monetary mobilisation in the direction of the objective nonetheless leaves a lot to be desired.

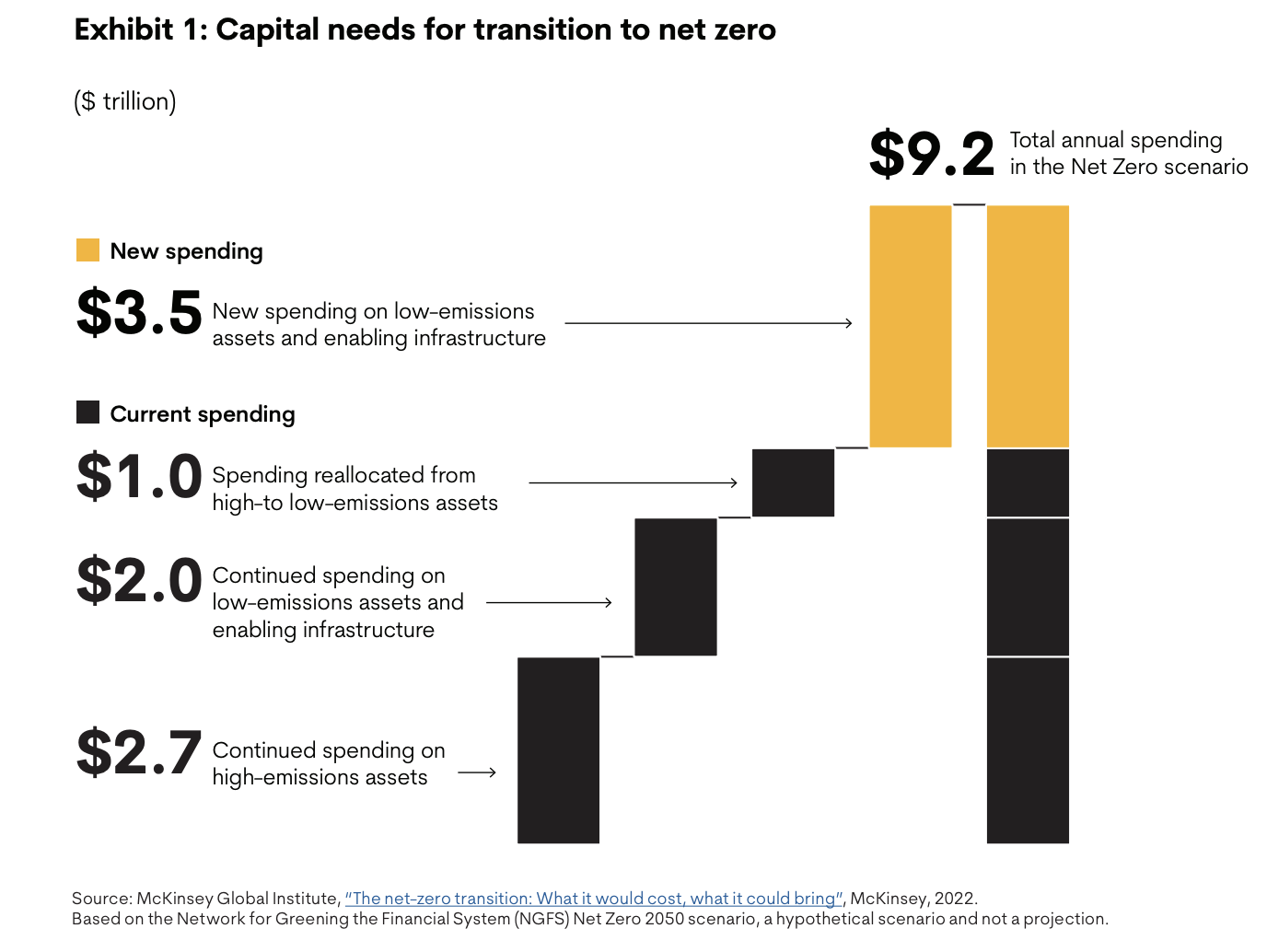

“In its January 2022 report, the McKinsey World Institute (MGI) calculated that capital spending wanted for the transition would whole US$275 trillion between 2026 and 2050 or about US$9.2 trillion a yr … The necessity represents

a median enhance in annual spending of about US$3.5 trillion or, for illustration, an quantity equal to about half the annual world company earnings,” the report elaborates.

Additionally Learn: BillionBricks closes US$2.45M seed spherical to construct inexpensive net-zero properties

The main points are described within the following illustration:

There are additionally different components that make the prospect appear darker relating to fulfilling web zero objectives, a minimum of quickly. This consists of the COVID-19 pandemic and different latest world crises which can power buyers to take the safer, extra cautious method relating to investing.

” … the geopolitical shocks of 2022 would possibly tempt many to put aside sustainability objectives a minimum of quickly in favour of tried-and-true fossil fuel-based operations, for instance stopping or delaying funding in renewable power sources. This would possibly particularly be true for the manufacturing, transportation, and power sectors,” the report states.

Nonetheless, it highlights that this method is perhaps a “false trade-off.”

“Corporations may be versatile and preserve a long-term concentrate on sustainability whereas creating the required resilience to resist shocks. Certainly, continued efforts towards sustainability can construct power independence and add considerably to resilience,” it stresses.

Additionally Learn: Singapore’s local weather change: Transferring in the direction of net-zero by greener buildings and rising know-how

As a way to attain the objectives of decarbonisation by this dual-focus method, corporations are inspired to discover supplies transition and different inexperienced enterprise approaches early to safe entry to probably the most promising improvements, based on the report.

It acknowledged that whereas the dangers could also be considerably increased for first-movers within the subject, the rewards are additionally mentioned to be “proportionally increased”.

“For instance, early buyers can profit from coverage incentives, expert expertise interested in cutting-edge employers, companions who’re equally prepared to discover the potential, and securing a spot in rising worth chains,” the report stresses.

—

This text was first printed on February 8, 2023.

Fundraising or making ready your startup for fundraising? Construct your investor community, search from 400+ SEA buyers on e27, and get linked or get insights relating to fundraising. Strive e27 Professional at no cost in the present day.

Picture Credit score: Blake Wisz on Unsplash

The put up Understanding the function of fintech, blockchain in transitioning to web zero appeared first on e27.

[ad_2]

Source link