[ad_1]

That is an opinion editorial by Daniel Hinton, the pinnacle of finance and operations for sFOX, a bitcoin prime dealer and custodian, and Steve Jeffress, creator of Bitcoin UTXO set visualizer UTXO.reside.

We now know the right way to infer the every day worth of bitcoin inside 1% by wanting solely on the unspent transaction output (UTXO) set.

With this, we will construct decentralized functions that depend on the UTXO set — quite than on trusted third-party oracles — for the USD worth utilized in discreet log contracts (DLCs) and good contracts.

The chances for decentralized functions on Bitcoin utilizing this “UTXOracle” are monumental.

When You Need To Know ‘The’ Value Of Bitcoin, The place Do You Look?

There isn’t a single worth of bitcoin. Each second of the day, there are millions of exchanges, brokers, OTC desks, cost firms and different market contributors around the globe quoting the worth of bitcoin — and none of them is all the time appropriate.

On this article, we are going to discover a brand new method of decoding the Bitcoin UTXO set that precisely displays a bitcoin worth at every block peak and has the potential to function the inspiration for a brand new period of trust-minimized, decentralized finance on Bitcoin.

What trust-minimized instruments might you construct for those who might calculate an correct worth for bitcoin at every block peak, utilizing solely your Bitcoin full node and an open-source mannequin?

- DLC derivatives (choices, futures, perpetual futures)

- On-chain lending markets

- Peer-to-peer marketplaces

- Bitcoin-backed USD stablecoins on Lightning

- Secure-value USD accounts denominated in bitcoin

- Any use case that requires a USD element

Any one in all these ideas, efficiently applied on the Bitcoin blockchain in a trust-minimized method, might ship large worth to each Bitcoiners — using bitcoin for its superior financial properties — and contributors within the Bitcoin ecosystem who want to stay partially tied to USD however wish to make the most of Bitcoin as their settlement community.

On-Chain Transactions Encapsulate The World Sign Of Financial Weight

Through the 2016 to 2017 “Blocksize Wars,” the deserves of not solely working a fully-validating Bitcoin node, however conducting financial exercise utilizing your node, have been convincingly argued in serving to the community keep away from a significant fork that might have delayed Bitcoin’s success.

For functions of our present dialogue, it may be mentioned that this tumultuous time in Bitcoin’s historical past emphasised that, in the identical method that somebody can run 1 million “full nodes” on a cloud server that sign for a selected “improve” however not affect the community of financial actors in any method if they aren’t actively settling transactions, centralized exchanges can produce quantity and worth statistics that, in actuality, don’t carry financial weight, and which aren’t mirrored within the UTXOs which are settled onto the Bitcoin blockchain.

You’ll be able to quickly give the looks of getting extra bitcoin than you do inside a closed system like an change, however so long as there’s a credible risk of withdrawal for settlement to the Bitcoin base layer, any mispricing inside the closed system will finally resolve itself again to equilibrium with the exterior market.

For instance, when Mt. Gox was bancrupt in 2013 to 2014, however earlier than it formally collapsed, the reported worth of bitcoin on the platform was markedly completely different from different exchanges because of the truth that Mt. Gox didn’t have practically as a lot bitcoin because it claimed. Consequently, it wanted to entice new customers to deposit to the change in an effort to fulfill withdrawals from current clients. Inside the Mt. Gox system, the worth might be manipulated, however when customers tried to arbitrage the worth again to the market, Mt. Gox collapsed.

In distinction, the Bitcoin blockchain is the toughest ledger on the earth to deprave. It represents the whole historical past of financial settlement exercise to have occurred and is the ultimate arbiter of reality with regard to the standing of all bitcoin in existence.

Transactions that matter are settled on the Bitcoin blockchain, not in closed techniques. Last settlement is what issues.

UTXOs Are Created And Destroyed Every Time You Transfer Bitcoin

Individuals have a troublesome time greedy Bitcoin, because it’s unimaginable for them to take a bodily coin out of their pocket, level to it, and say, “It is a bitcoin.”

One analogy I’ve gravitated towards when describing a certain amount of bitcoin in an individual’s possession is visualizing a person invoice in a bodily pockets. These payments can characterize any quantity and are solely good for one use. So, if you’ll want to spend $3, and solely have a $100 invoice, you may’t rip off a nook of the invoice. You would want to spend the whole $100 invoice and get your change again. In Bitcoin parlance, every of those payments is a UTXO. Any time you ship bitcoin, you might be spending (and destroying) at the very least one UTXO whereas concurrently creating at the very least one new one. In case you run any model of the Bitcoin software program, at any time limit you may rely up all of the bitcoin contained in current UTXOs to find out precisely how a lot bitcoin at the moment exists.

In truth, when used collectively, the Bitcoin blockchain and UTXO set are completely correct in figuring out the historical past and present state of the Bitcoin community. This never-before-seen functionality in a decentralized system helped the 19 million bitcoin at the moment in existence develop to be value a number of hundred billion {dollars}.

The Bitcoin software program makes use of models of bitcoin (satoshis) for its inner accounting. Whereas it might be apparent that 1 bitcoin equals 1 bitcoin, this additionally implies that when somebody needs to “ship $100 of bitcoin,” the contributors on this transaction must agree on the worth of bitcoin on the time of the transaction to know the way a lot bitcoin this corresponds to.

On Common, 15% Of All Bitcoin Transactions Are In Spherical USD Values

Do you know that many individuals transact bitcoin in spherical USD quantities? Apparently, as a result of that is such a typical prevalence, there are clearly-recognizable patterns that exist within the UTXO set that can be utilized to intently infer the worth of bitcoin at any level prior to now or current (see the chart beneath).

Think about that you’re shopping for bitcoin at an ATM (or shopping for a present card on-line). Will you purchase $100 value or $39.27 value?

Spherical USD values starting from $1 as much as a number of thousand {dollars} are quite common denominations within the Bitcoin blockchain. In truth, since 2014, there was a rising on-chain footprint of those round-USD-value bitcoin transactions which on some days can account for as much as 25% of every day outputs created.

The US has by far the biggest put in base of Bitcoin ATMs globally. U.S. Bitcoin ATM operators have grown dramatically since 2019 and the Bitcoin UTXO set vividly shows this market’s development as extra folks select to carry or at the very least transact in bitcoin over USD.

Additionally, as seen with purchasers at sFOX, Bitcoin ATM flows are made from practically all buyer buys (placing money into an ATM and receiving bitcoin), so the on-chain footprint of this exercise consolidates alerts at spherical USD values. Different giant bitcoin markets, equivalent to present playing cards, peer-to-peer exchanges, and plenty of different, much less frequent use instances, additionally contribute to this sample of USD-denominated bitcoin utilization.

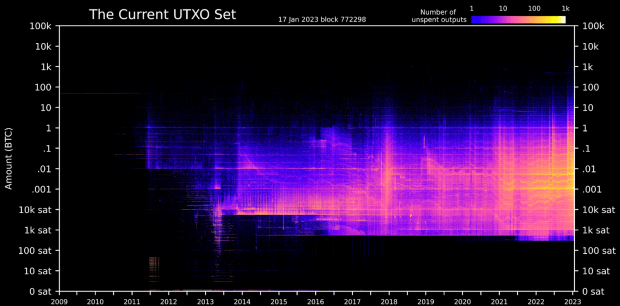

The Bitcoin UTXO Set As Of Block 772,298

There is just one bitcoin UTXO set at any given block peak. This image depicts the whole, roughly 70 million UTXOs that comprise all 19 million bitcoin in existence, as of block 772,298.

With Bitcoin being really permissionless, anybody working a fully-validating Bitcoin node has this very same knowledge on their laptop and might independently replicate this very same dataset for this time limit. A reside model of this visualization could be seen and interacted with at utxo.reside.

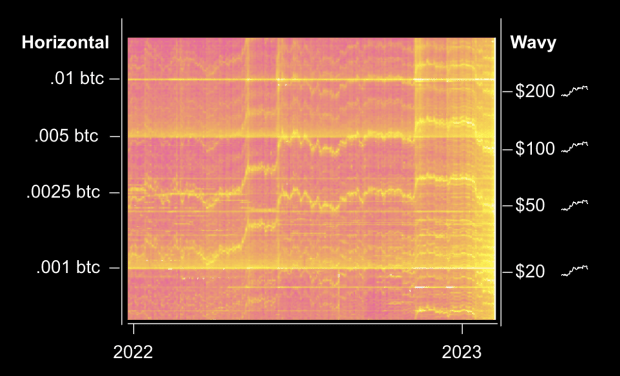

Zooming into the 2022 part of the chart highlights that there are constant patterns within the UTXO set. We’ll deal with two such patterns: Horizontal traces and wavy traces.

Horizontal traces (the flat traces) characterize:

- UTXOs denominated in spherical values of bitcoin (e.g., 0.001, 0.005, 0.01, 1, and so on.)

- Flat at any USD worth as a result of sending 1 btc all the time equals 1 btc

Wavy traces:

- Signify groupings of UTXOs denominated in spherical USD values ($1, $20, $50, $100, $200, $500, $1,000, and so on.)

- Are very wavy, but parallel to one another as a result of folks ship in lots of USD denominations and these denominations all transfer in proportion to one another because the BTC/USD worth modifications

- Transfer inversely to cost. BTC/USD worth will increase trigger the wavy traces to slope down because it takes much less BTC to equal a USD worth as worth strikes up and vice versa.

Making Sense Of The Strains

The truth that horizontal traces exist isn’t all that spectacular. Individuals transacting in bitcoin usually transact in spherical quantities of bitcoin.

However the truth that the wavy traces exist clearly and persistently is a giant deal. It implies that, given an open-source mannequin, this might assist deliver in regards to the skill to:

- Independently calculate the worth of bitcoin utilizing solely your full node at any block peak

- Develop real DeFi functions with out the necessity for (or with out sole reliance upon) trusted third-party worth oracles

The UTXOracle Value Mannequin Has Native Logic Checks

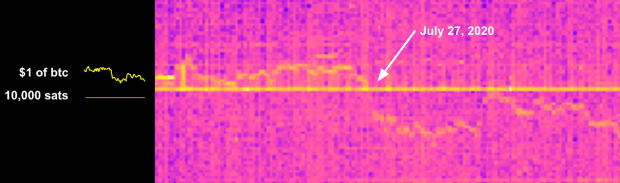

How will you simply take a look at the speculation that the wavy traces characterize motion of bitcoin denominated in USD? Merely decide a date when the BTC/USD worth crossed a spherical USD worth and see if the horizontal and wavy traces cross.

One such case is July 27, 2020. Bitcoin was recovering from the March 2020 mayhem and crossed over $10,000 per BTC.

The picture beneath exhibits the wavy line (USD) crossing down beneath the horizontal line (BTC) on the similar time that the worth rose above $10,000 per BTC. This explicit picture is the ten,000 sat (0.0001 BTC) line, however the identical sample exists at many different BTC denominations as you progress up the UTXO chart.

Nonetheless don’t see it? Zoom in and discover a high-resolution picture at utxo.reside.

Clearly, the wavy traces on the chart present transactions denominated in USD.

This has monumental ramifications, because the wavy line sample exists in various levels in each block, and is extraordinarily constant over rolling durations equivalent to each 144 blocks (roughly 24 hours).

The UTXOracle USD Bitcoin Value Is Fairly Correct

Seeing the horizontal and variable traces cross at spherical USD values is good, however a majority of the time, the traces are usually not very shut to at least one one other. We’d like a technique to prime a pricing mannequin from these crossing factors that may infer an correct, present worth at any block peak after the mannequin is primed.

Enter the UTXOracle mannequin.

On this preliminary mannequin, an enter date of July 27, 2020, a day when bitcoin rose above $10,000, is used to prime the mannequin to a finest match for that day’s worth. Utilizing solely this single day’s UTXOs, and an enter of that single day’s volume-weighted common worth (VWAP), we’re capable of create a mannequin that, when used with a future date’s UTXO set modifications, infers the every day worth of bitcoin with outstanding accuracy from this present day ahead, using solely the Bitcoin UTXO set with no reference to any exterior worth knowledge after July 27, 2020.

The purple line is the every day VWAP from sFOX, an aggregator whose worth encompasses the crammed trades from dozens of exchanges and OTC desks.

The blue line is the UTXOracle every day worth calculation based mostly on every day’s UTXO modifications.

For the measurement interval of July 2020 to January 2023, the mannequin performs exceptionally properly, with every day median and every day common variances between the precise VWAP and the UTXOracle worth of 0.65% and 1.04%, respectively, each of that are inside the regular vary of charges charged for bitcoin purchases at retail exchanges.

It’s been mentioned that every one fashions are mistaken, however some fashions are helpful. One key distinction between the UTXOracle mannequin and different fashions that output a bitcoin worth is that the UTXOracle mannequin doesn’t search to foretell a future worth. It merely makes an attempt to deduce an correct present worth based mostly on current blocks and corresponding modifications within the UTXO set. Provided that the present mannequin has additionally not been high-quality tuned for a finest match and easily makes use of a single primer date for its enter, the mannequin is clearly mistaken — hopefully it may be helpful.

The UTXOracle Mannequin Has Commerce-Offs

If Bitcoin has taught me something, it’s that trade-offs exist. The UTXOracle mannequin isn’t any completely different.

The Bitcoin UTXO set is an attractive, dwelling monument to the human spirit however attempt as we might, any mannequin created from it won’t totally encapsulate the whole thing of the underlying exercise which it represents. A map can’t be as correct because the territory it represents.

The UTXOracle mannequin depends on a number of ideas to operate accurately:

- Bitcoin UTXO knowledge (free and widely-available knowledge accessed by working a full node)

- Bitcoin worth knowledge to determine a time or sequence of occasions upon which to prime the mannequin (based mostly on free and widely-available knowledge)

- A mannequin to use the primer date(s) usually to any date (there are a lot of methods to optimize this)

- A method for customers of the UTXOracle output worth to make the most of the worth in DeFi functions (this wants vital effort to develop)

Individuals might create UTXOs at quantities that might mimic the worth being one other degree than actuality.

On centralized venues, folks have been identified to “spoof” giant purchase or promote orders in an order guide to make it appear as if there’s a giant purchaser or vendor out there, solely to later take away these purchase/promote orders with out really having any trades crammed. This may really transfer markets on centralized venues, however you can not spoof UTXOs. They both exist in a mined block or they don’t.

It takes a very long time to create a faux worth sign and it’s apparent when somebody tries to take action.

At the moment, it appears to be like as if utilizing a every day UTXOracle sign, quite than a single block interval, achieves a worth correct sufficient to make use of in apply. This method has the additional advantage of vastly rising the price of assault in mimicking or censoring transactions which might be most helpful in producing the UTXOracle worth at any sure time.

Even when somebody created many UTXOs at ranges mimicking a unique bitcoin worth, there is no such thing as a mechanism to take away the actual transactions that replicate the correct worth. At finest, an attacker would create a further set of wavy traces.

UTXOs are costly to faux. There isn’t a such factor as “spam” within the Bitcoin blockchain. There are solely transactions that pay a price to be included in a block. Because of this blockchain knowledge is pricey to supply or censor and there’s a actual price of capital in creating UTXOs to faux a worth sign.

Present mannequin accuracy diminishes after about two years, as is seen within the chart. In apply, it’s doubtless {that a} mannequin will should be recalibrated after some time frame. Altering the mannequin to take note of completely different UTXO patterns carries a lot much less danger than altering consensus guidelines in Bitcoin. Except contributors are transacting in multi-year choices/futures contracts on chain, that is doubtless not a significant barrier to make use of.

The present mannequin doesn’t cope with excessive volatility properly. Mempool variations and worth volatility create conditions the place the UTXOracle worth can quickly differ from the centralized change worth by greater than 10%. Whereas this could doubtless be improved upon with a extra complete mannequin it does spotlight a possible critical limitation of the sensible use of the mannequin.

Then there’s the AI echo chamber drawback: If the mannequin may be very profitable, it might grow to be much less efficient. In a world the place many individuals are settling financial exercise utilizing the worth inferred by a UTXOracle mannequin, there will likely be many further UTXOs settled in spherical USD values. These UTXOs might diminish the mannequin’s accuracy or distort it in different methods just like how a large-language mannequin (LLM) skilled on LLM-generated content material won’t match the effectiveness of 1 skilled on human-generated content material.

Utilizing A UTXOracle Mannequin In Observe

Like it or hate it, the phrase “Ordinal.” Ordinals taught me that individuals can coalesce round a strategy of decoding the UTXO set that’s technically exterior to Bitcoin, however which could be solidified on the social layer as a further protocol on prime of Bitcoin.

It’s my hope {that a} sufficiently-accurate UTXOracle mannequin will likely be produced by somebody which can enable folks to make use of that model of the mannequin as a schelling level in constructing decentralized functions on Bitcoin.

It’s my additional hope that Bitcoiners can develop a way of utilizing these a number of competing fashions in a trust-minimized technique to increase how Bitcoin is ready to deliver monetary peace to the world.

A profitable implementation can be one during which:

- Mannequin inputs are publicly identified and outcomes are verifiable

- DLC contributors can contest fraudulent outcomes by calculating their very own worth utilizing the mannequin inputs. (A sublime answer to this problem stays an unsolved problem.)

And one during which any of those safety fashions is feasible:

- Peer to see: Two or extra abnormal contributors can make the most of the UTXOracle mannequin with out third events

- Verifiable, centralized oracle attestations: A centralized oracle indicators a message with a selected UTXOracle pricing mannequin that the oracle will use and contributors are capable of confirm outcomes and punish wrongdoing

- UTXOracle as a quorum member: Use the UTXOracle worth as a logic examine in a standard, centralized oracle mannequin or in a two-of-three or three-of-five multi-oracle setup

UTXOracle Use Circumstances

DLC Derivatives (Choices, Futures, Perpetual Futures)

This could allow customers to purchase or promote contracts in an open market the place outcomes are administered by contributors utilizing a UTXOracle worth.

For instance: Alice deposits an quantity of bitcoin to a DLC-governed deal with. Bob pays Alice an quantity of bitcoin denominated in USD (as evidenced by the UTXOracle worth). On the time of settlement, Alice or Bob might produce a signature from an oracle testifying to the worth calculated underneath the UTXOracle mannequin to find out the settlement move of funds as expired or exercised.

On-Chain Lending Markets

Customers can borrow or lend in an open market the place the mortgage life cycle is run by contributors utilizing a UTXOracle worth.

For instance: I’ve 1 BTC (at a $100,000 worth) and wish to take a partial mortgage of $30,000 with out promoting my bitcoin. I can coordinate with a market-maker to deposit my 1 BTC and the market maker’s 0.3 BTC (at a price of $30,000) to an deal with ruled by a DLC. Upon funding, I could spend the 0.3 BTC for my desired use case.

Regular Mortgage Compensation

On this use case, the borrower has the choice to signal a transaction granting the market maker $30,000 in worth of the unique 1 BTC or to deposit $30,000 in worth (as evidenced by the UTXOracle worth) and withdraw the unique 1 BTC.

Upon liquidation, if the worth of the 1 BTC within the DLC-governed deal with falls to someplace close to $30,000 (as evidenced by the UTXOracle worth), the market maker can sweep out the whole 1 BTC to liquidate the mortgage and recoup their principal.

StableSats

The UTXOracle mannequin additionally gives an attention-grabbing use case round “stablesats,” referring to bitcoin-backed USD stablecoins or stable-value USD accounts denominated in bitcoin on Lightning.

For example, think about that you simply wish to maintain $1,000 value of bitcoin for the subsequent month. You don’t want to or can’t maintain the $1,000 in money, at a financial institution, in Ethereum- or Tron-based stablecoins or on an change. You can enter into an settlement with a market maker on the Lightning Community to stream the every day web worth change in worth to you. You’d have the ability to independently validate that the right quantities are being paid by utilizing the UTXOracle mannequin you agreed to. On the finish of the month you should have a unique quantity of bitcoin in your Lightning channel, however it will likely be value $1,000.

Peer-To-Peer Marketplaces

As a vendor in a web-based market, it’s at the moment troublesome to cost gadgets in bitcoin as a result of volatility in addition to the truth that your bills are doubtless in USD. However accepting funds in USD means accepting chargeback danger, fraud and the charges and complexity inherent in fashionable cost techniques. Pricing merchandise in USD, however having the pliability to just accept a USD worth in bitcoin by way of the UTXOracle mannequin, might encourage extra bitcoin-denominated commerce.

The Subsequent Steps For UTXOracle

As outlined on this article, I consider the UTXOracle mannequin might be a strong instrument in advancing Bitcoin use instances and increasing monetary freedom to extra of the world. Whereas it has trade-offs, I consider it represents an thrilling frontier that may enhance upon current options that require extra belief in third events.

If you’re excited in regards to the prospect of UTXOracle, I encourage you to affix the dialogue on Telegram and Twitter.

It is a visitor submit by Daniel Hinton and Steve Jeffress. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

[ad_2]

Source link