[ad_1]

My RWM colleagues Josh Brown and Michael Batnick do a bang-up job every week diving into the specifics of the newsflow in What Are Your Ideas?

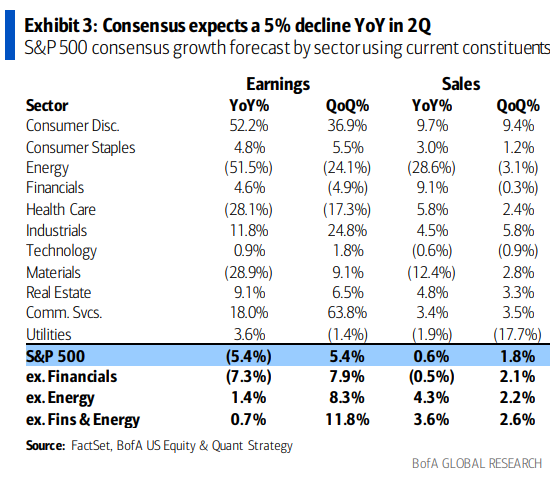

Don’t miss my favourite chart from this week’s dialogue 46 minutes deep into the episode; its from Financial institution of America by means of Batnick (above).

All the fall-off surrounding the 8% pullback in S&P 500 income — actually, greater than 100% of it — is because of the enormous drop in vitality income. Recall 2022, vitality was one of many few vivid spots as oil costs rallied largely because of the Russian invasion of Ukraine. This yr, with decrease oil costs, vitality firm income dropped in half

Again out the 51.5% drop in Power income 12 months-over-12 months, and SPX income are up 1.4%. Q/Q its +8.3%. The flip aspect of that is the sectors that obtained shellacked in 2022 at the moment are exhibiting large revenue recoveries. Client Discretionary 12 months-over-12 months is +52.2%, Communication + 18%, and Industrials 11.8%.

When taking a look at any information collection, the Base Impact issues. We are going to see one thing comparable within the subsequent few CPI studies, as the most well liked year-ago numbers drop off from the 12-month collection.

I’m usually skittish about exhibiting issues “Ex” something — recall my mid-2000s fisking on Inflation Ex Inflation — however on this case, the framing reveals relatively than hides what’s going on.

Beforehand:

Earnings

Ex-Inflation, There’s No Inflation (September 26, 2005)

Inflation Ex-Deflation (this time, INCLUDING vitality) (June 22, 2012)

CPI: Imperfect However Helpful (Might 24, 2022)

[ad_2]

Source link