[ad_1]

The federal authorities introduced the launch of a N200 billion Presidential Intervention Funds (PIF) for Micro, Small and Medium Enterprises (MSMEs) and producers within the nation.

The Minister of Business, Commerce and Funding, Doris Uzoka-Anite, made this announcement on Monday, 22 of April 2024, in Abuja.

Based on the Minister, N75 billion can be allotted to MSMEs whereas N75 billion can be allotted to producers below the Presidential Intervention Fund Programme.

Under is the whole lot it’s essential know to use for the Intervention Fund Programme:

1. To use, candidates ought to go to the official software portal at www.fedgrantandloan.gov.ng

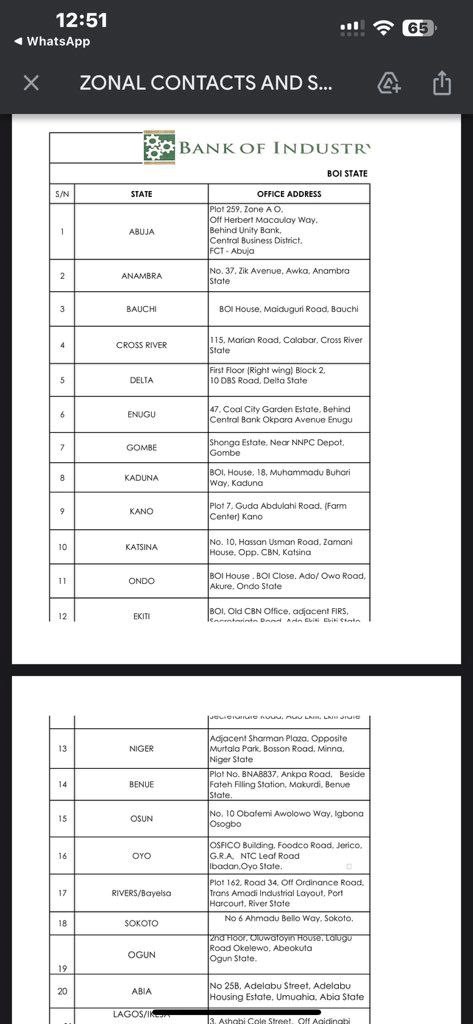

- Moreover, candidates searching for extra detailed info ought to go to the native state Financial institution of Business department.

2. Eligibility Standards:

- Candidates should be in an present enterprise in operation for not less than one yr, or a registered start-up.

- Candidates should present CAC enterprise registration paperwork.

- Candidates should current a Firm’s Financial institution Assertion for present companies or Chief Promoter’s Financial institution Assertion for start-ups.

- Candidates should fulfil the required month-to-month turnover and adjust to different necessities as specified by the financial institution.

3. Safety:

- Candidates should present a Private Assure from the promoter.

- Candidates should comply with BVN Covenant.

- Candidates should adhere to International Standing Instruction (GSI) and different securities as required by the financial institution.

4. Compensation Frequency:

- Month-to-month equal instalments with no moratorium, spanning a 3-year time period.

5. For Producers (For Loans as much as N1 Billion):

- Candidates should select between Working Capital or Asset Financing.

- Candidates should preserve not less than a 6-month enterprise/company banking relationship.

- Candidates should Present extra documentation as required by the financial institution.

- Asset Financing comes with a 5-year reimbursement interval, and Working Capital Financing features a 6-month moratorium on principal and curiosity, adopted by a 12-month equal instalment reimbursement plan.

Native Banks of Business in States (Pictures Under):

[ad_2]

Source link