[ad_1]

Disclaimer: Any opinions expressed under belong solely to the creator.

Over the previous few months, a brand new concern has been surfacing amongst high executives at MAS- a query of whether or not laws that they put out could have the impact of legitimising cryptocurrency corporations.

MAS Chairman Tharman Shanmugaratnam’s feedback at January’s Davos Summit sum up their major concern- that in regulating crypto, they could be inadvertently offering a stamp of approval and giving the incorrect impression that crypto has lastly handed MAS’ assessments.

It’s not troublesome to see the place Chairman Shanmugaratnam is coming from- the fame that MAS has on the earth stage is one among a accountable regulator that’s none too eager to permit crypto in with out correct safeguards.

And MAS can be cognizant of the truth that through the crypto winter, a number of of the biggest crypto crashes have been of corporations based mostly in Singapore- albeit largely unregulated ones. Not solely that, however some in Singapore have additionally been vocal in questioning MAS’ selections at each turn- from suggesting that its strict necessities turned main corporations like Binance away, to questioning MAS’ competency when FTX crashed.

Certainly, MAS’ each transfer appears to attract scrutiny from all directions- and never at all times of the great kind.

However this scrutiny is not any excuse for inaction- and for an {industry} as massive and vital as crypto, it’s all the extra vital that MAS forges forward with plans for regulation.

Regulation is a thankless task- however it’s needed all the identical

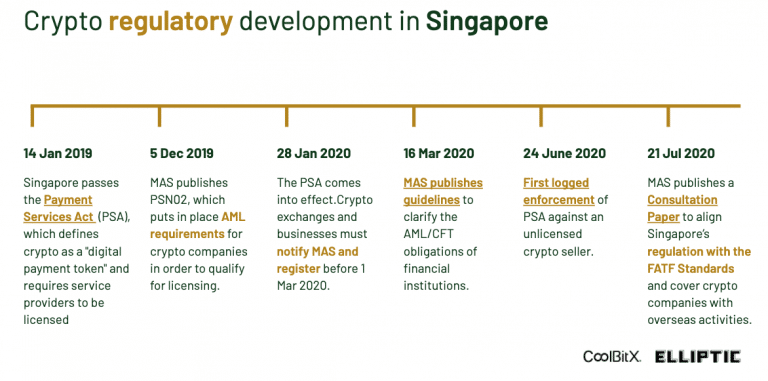

Singapore has consistently been forward of the curve with regards to crypto regulation- whereas different international locations have welcomed the funding and charged headlong into attracting funding, MAS has as a substitute taken a step again and questioned if crypto is de facto one thing that we welcome.

And crypto fanatics haven’t been happy with MAS’ conclusions, to say the least. Many have accused MAS’ strict necessities of stifling innovation- however are its insurance policies actually that dangerous?

Regulators are within the enterprise of protection- requiring corporations to place in place ample safeguards earlier than partaking clients, and conserving out corporations which are unsound or fraudulent.

Different international locations have additionally been following our lead with regards to crypto regulation. About two weeks after Tharman’s feedback that Singapore might regulate crypto corporations that supply companies much like these present in conventional finance, the UK additionally opened session on new guidelines for the crypto sector. The proposals into account included pointers to manage crypto asset actions underneath the identical regime as conventional monetary companies.

This may occasionally not, in itself show that MAS is perfect- however it’s maybe proof that there’s worth to be present in MAS’ concepts about how regulation needs to be carried out and the way regulators ought to formulate insurance policies and derive conclusions.

And the choice can be to disregard the crypto {industry}, and both implement a blanket ban on the {industry}, or enable any and all corporations to enter.

Letting all corporations enter is evidently a nasty idea- the {industry} nonetheless has a protracted method to go with regards to self-regulation and removing unhealthy actors from inside its midst. This a lot has been made clear by the previous yr, with outstanding corporations collapsing and their founders falling from grace.

However a blanket ban too can be not the perfect policy- there are corporations with a real curiosity in offering crypto companies and options that might enhance the lives of Singaporeans and corporations in Singapore.

Definitely some corporations shouldn’t be allowed to arrange store here- however we must always not throw the infant out with the bathwater and cease good corporations from coming too.

So actually, regulation of crypto is the very best, and sure solely means for Singapore to operate- it permits us to draw good corporations, whereas conserving out the unhealthy.

Will regulation actually legitimise crypto?

There is a vital distinction between legitimacy and authority- the place authority is imposed from above, legitimacy is given from under.

MAS isn’t ready to offer crypto legitimacy- regardless of what number of warnings that it points, it stays as much as particular person traders to supply it the legitimacy by shopping for into the token.

If there may be anybody responsible for the gradual legitimation of crypto over the previous few years, it isn’t the regulators who’ve sought to civilise it, however the lots who’ve recklessly embraced it.

Regulation has at all times been about one goal- safety. Ever since crypto started to realize mainstream consideration, MAS has been warning the general public concerning the dangers that investing in crypto may entail- although such recommendation typically falls on deaf ears.

Is it proper, then, to recommend that the regulators are responsible for making an attempt their utmost to guard folks, after seeing the debacles at Terraform Labs, Celsius, and Three Arrows Capital?

Crypto regulation has turn into a necessity exactly due to the failure of self-governance within the industry- and governmental oversight has now turn into needed so as to include the injury.

To recommend that the implementation of pointers for crypto corporations can be to legitimise crypto can be to disregard the huge publicity and hype generated by coin holders who’ve voted with their {dollars}.

As a substitute, regulation and regulators are coming in as a result of the dangers of such investments are too nice to disregard.

Crypto has not but expanded to the purpose the place fiat currencies in developed international locations like Singapore are threatened with substitute. Nor have they solved the issue of scalability inherent inside cryptocurrencies.

The rationale why crypto requires regulation is as a result of they include the specter of misuse and malinvestment- and till the {industry} proves itself able to coping with these points, there may be not more likely to be case for the authorities legitimising crypto by their actions.

Is crypto legitimation actually that regarding?

There may be definitely some purpose to method crypto regulation with warning. The {industry} has nonetheless not shed its picture of being one which criminals flock to for illicit actions.

On high of this, the volatility of crypto costs and behavior from former {industry} leaders like Arthur Hayes, Do Kwon, and others haven’t precisely been profitable followers with regulators.

If MAS now steps in and provides the inexperienced mild to crypto, will it not ship the incorrect message to shoppers in Singapore?

Will it then encourage extra Singaporeans to leap aboard the crypto hype practice, and park extra of their hard-earned cash into tokens that might probably crash at any second?

Definitely this final result is a chance, and one that’s removed from superb. However the various would probably be far worse.

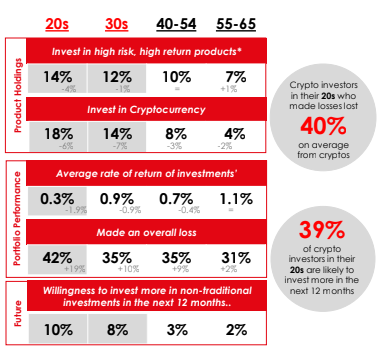

Singaporeans are already investing in cryptocurrency-regulated or not. And plenty of are nonetheless eager to maintain on investing regardless of the latest downturns and excessive profile crashes.

Is it the case that customers are investing as a result of they have no idea of the dangers that crypto brings? Most likely not. MAS has harassed so many instances that retail funding in crypto is extraordinarily dangerous.

Any shopper who stays invested however doesn’t but respect the dangers of such investments in all probability mustn’t even be allowed to take a position at all- not to mention in a area as complicated as crypto.

As a substitute, it’s much more probably that they’re investing, understanding the dangers of such actions, and accepting them.

However how far they can perform their due diligence when investing their hard-earned cash into the area is one other difficulty.

Particular person shoppers are hardly ready to compel corporations to launch info concerning their enterprise mannequin, income streams, or monetary statements. As such, they’re investing with lower than full information- maybe lower than what would usually be deemed accountable.

That is by far the worst scenario to be in. Shoppers will make investments regardless- and they’re doing so with out doing their due diligence.

MAS and regulators, however, will not be in such a place. Since they can implement licensing necessities, they’re in a stronger place with regards to negotiating with corporations on what info these corporations might be required to reveal, and what info can stay personal.

This info can then be utilized by shoppers who want to make investments regardless of the a number of warnings of how dangerous the area is.

Admittedly, this may give the impression that MAS is giving the inexperienced mild to crypto- however at this stage, the purpose is moot.

Shoppers haven’t been postpone by MAS’ repeated warnings, although I’ve little doubt that the warnings will preserve being issued. As a substitute, it’s higher to supply some further info in order that these shoppers who’re keen to threat their cash have that little bit extra info to guard themselves.

Although unlikely, some traders may even see the brand new info and realise simply how dangerous their investments are, and resolve to exit the area earlier than the following conflagration.

Legitimising crypto, as harmful because it appears, could be the subsequent needed step in defending Singaporean shoppers from any additional injury.

Featured Picture Credit score: World Financial Discussion board

[ad_2]

Source link