[ad_1]

In a flash, almost $200 billion in worth was worn out of the cryptocurrency market at the moment in a bigger selloff pushed by rumors that pending Bitcoin ETF approvals may find yourself denied by the SEC. Regardless of the carnage throughout crypto at the moment, this may very well be the second dip consumers have been ready for.

Recapping The Crypto Market Flash Crash

At round 6AM this morning, Bitcoin worth started falling, inflicting a cascade of liquidations in altcoins. Bitcoin dropped almost 10% whereas altcoins fell anyplace between 20 and 30% from native highs.

The transfer has seemingly induced quite a lot of worry, uncertainty, and doubt. And when doubtful, you’re imagined to zoom out. Shifting away from the every day timeframe and into greater timeframes just like the month-to-month can present comforting view in distinction to the nasty wick left behind on the every day chart.

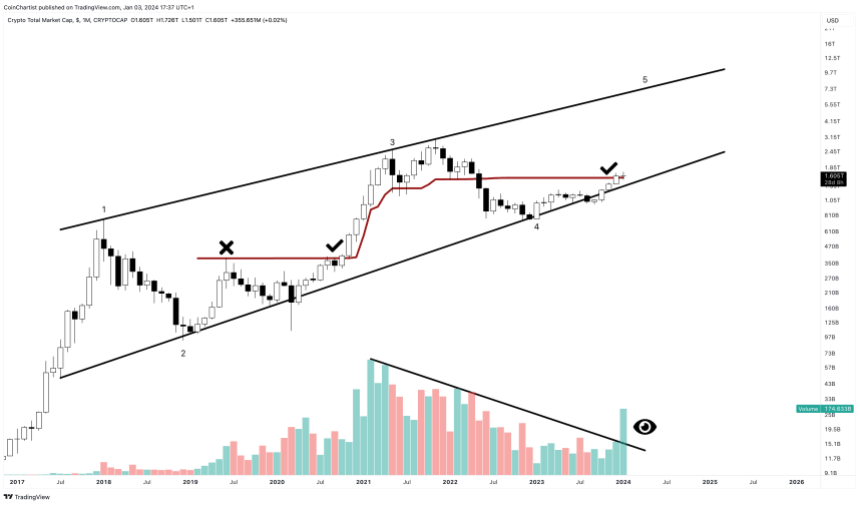

As a substitute, the excessive timeframe view reveals that there’s a breakout confirmed by excessive quantity. The market has the remainder of January to shut with a achieve, turning the quantity bar inexperienced. If it does, this might show to be the perfect purchase the dip second.

Quantity precedes worth | TOTAL on TradingView.com

Why A Breakout Might Be Confirmed By The Finish Of January

A excessive quantity breakout after three years of declining quantity is undeniably important and will trace at a cryptocurrency market bull run within the coming months. Quantity tends to substantiate worth breakouts when paired with technical indicators and/or chart patterns.

Within the instance above, 1M BTCUSD closed above the Ichimoku’s Kijun-sen. This didn’t occur in 2019, however did in 2020 into 2021. Not pictured, Bitcoin additionally closed above the higher Bollinger Band – one other state of affairs that solely occurred in 2020.

A detailed above the Bollinger Band is a purchase sign, particularly when confirmed with excessive quantity. Quantity being excessive represents extra BTC being traded on the present worth.

The extra buying and selling quantity, the extra orders being crammed which frequently is because of both huge gamers or widespread market participation. Each eventualities are doubtlessly bullish, however the month-to-month should shut with a inexperienced quantity bar.

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site totally at your personal danger.

[ad_2]

Source link